Highlights:

- The Zora price soars 5% to $0.10, as trading volume increases 19%.

- Zora introduces the top 100 Trader reward program, which pushes users to wager on featured streamers.

- CoinGlass data shows a bullish bias, as bulls target $0.12 mark soon.

The Zora price has surged 5.6% to $0.10, as its daily trading volume spikes 19% to $184 million at press time. This recent rise indicates an intense trading activity among investors in the Zora market. Recently, Zora has introduced its Top 100 Trader Rewards Program, whereby the participants are allowed to win an amount of $300,000. The program pushes the users to wager on featured streamers on Zora, and those who correctly predict can enjoy the rich benefits.

This week’s Top 100 Trader Rewards is now live.

Bet on featured Zora streamers, get rewarded. pic.twitter.com/ijxTfdMxgl

— $zora (@zora) October 20, 2025

This is a new event, which shows that Zora is serious about entering its community to make trading more involving and rewarding to its users. The program has attracted great attention with the exciting graphics of the soaring graphs and the possibilities of great wins.

Zora Derivatives Data Show a Bullish Bias

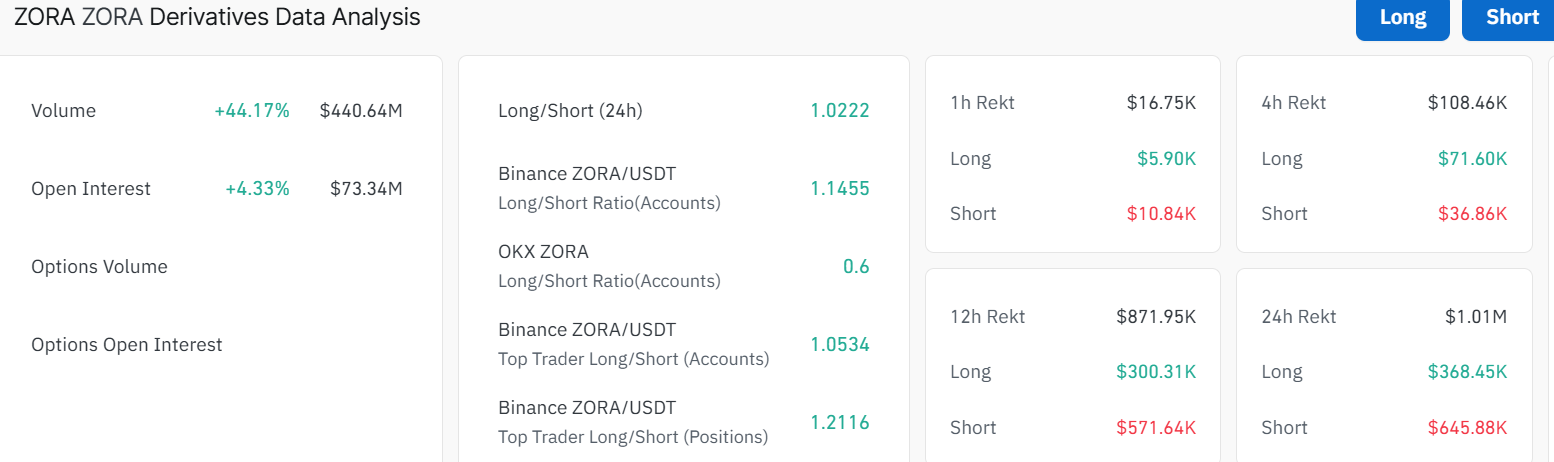

Meanwhile, Zora is causing a lot of stir in the crypto market, as its derivatives data shows a bullish bias. Recent statistics indicate a fantastic growth in its volume and open interest, with a growth of the trading volume of 44.17% to $440.64 million. Likewise, there has been an increased open interest of 4.33% to $73.34 million. This data indicates that ZORA is making huge strides among traders, and more positions are being opened in different exchanges.

The overall tendency towards long positions is one of the most outstanding factors in the ZORA market. ZORA/USDT long/short ratio sits at 1.0222, which means that a higher number of traders bet on the increase of the token instead of its underperformance. This ratio is also stable, as it portrays a relatively positive attitude towards the future price performance of ZORA.

Zora Price Targets $0.12 Mark Soon

The 4-hour candlestick chart shows that earlier in October, Zora’s price spiked to the upside, hitting $0.12 mark. However, early profiteering commenced, pushing the oken into sideways movement, in a triangle pattern. The trading volume has also exponentially increased, surging to $184 million, with a 19% spike too, signaling that big players are piling in. Meanwhile, the Relative Strength Index (RSI) is sitting at 55.44, showing that the Zora price still has room to run.

The bulls are having control in he market, as they have established strong support zones around the 50-day SMA($0.094) and the 200-day SMA at ($0.070). If these zones hold firm, a rally to reclaim the $0.12 resistance could be plausible.

The Moving Average Convergence Divergence (MACD) shows a bullish crossover on Oct.20, 2025. This calls for traders to rally behind the ZORA token unless the MACD changes. If the Zora price holds above the support levels, there could be a push toward $0.11, maybe even a test at $0.12 if the bulls keep pushing. However, if it dips, $0.094 safety net could cushion against further downside. Should ZORA fail to hold above that, there might be a slide back to $0.084.

The 5% pump indicates that Zora is gaining momentum and potential. In the short term, the Zora price could push to $0.12 within the next few days. Long-term, if this trend holds, ZORA could see $0.15 by mid-November, but it’s all about those support levels holding strong.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.