Highlights:

- The Zcash price has slipped from the $449 ATH recorded over the weekend to $392.

- The ZEC derivatives market remains strong, but the recent dip in open interest and negative finding rate could accelerate the correction.

- The technical outlook shows a tug-of-war as the MACD shows a bearish outlook.

The Zcash price is currently exchanging hands at $392, with the daily trading volume up12% indicating growing investor confidence. This is after a consistent price growth over the weekend, as ZEC rose to an All-Time High (ATH) $449 and then fell in line with the crypto giants, including Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

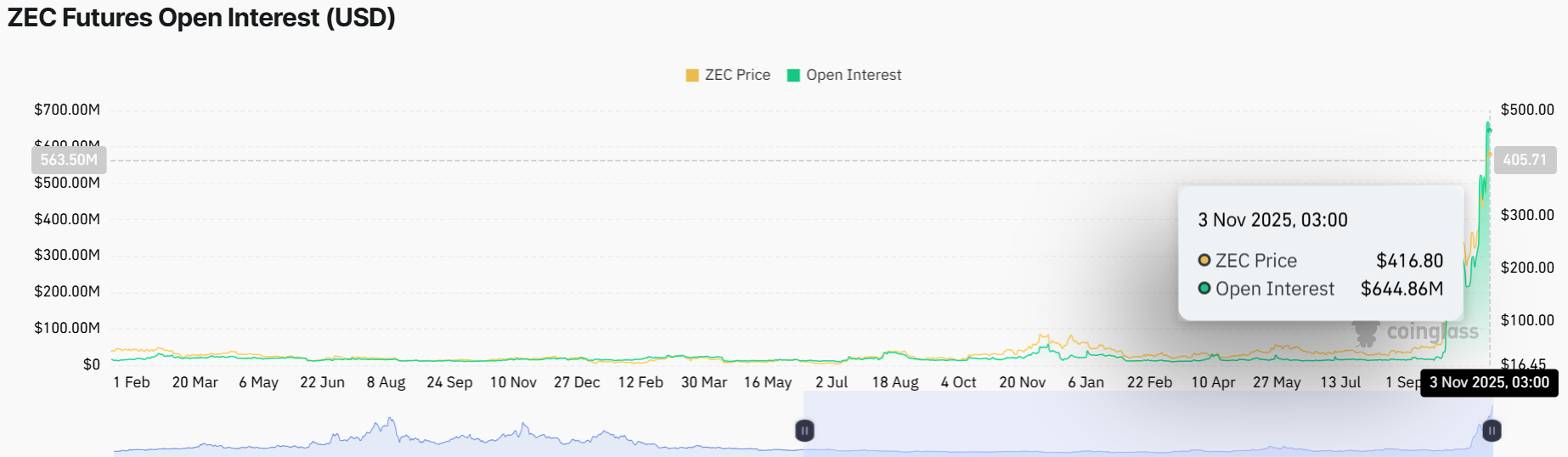

CoinGlass data, however, indicates that retail demand is trembling perhaps because of profit-taking. The Open Interest (OI) nominal value of outstanding futures contracts averages $644.86 million, compared to $669 million, its highest record ever on Sunday. The OI should be growing steadily to promote the uptrend. Otherwise, the fact that pullbacks are happening would indicate that traders are losing steam in the upward movement.

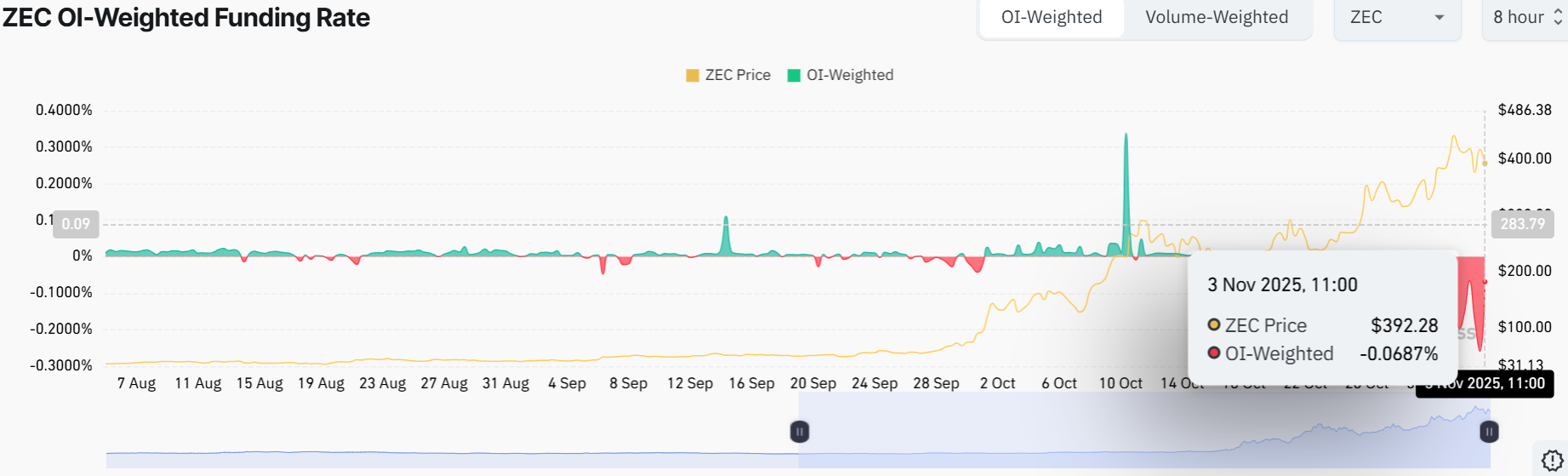

On the other hand, the OI-weighted funding rate has been negative even though the Zcash price has been trading at or close to its all-time high of $449 as of Saturday. The negative funding rates suggest traders are de-risking at the moment. Moreover, this suggests bullish exhaustion with the OI-weighted funding rate at -0.0687%. Additional shortening of position is also likely to cause additional selling pressure.

Zcash Price Targets $500 Despite the Dip

The ZEC/USD chart shows the 4-hour price action with a 50-day Simple Moving Average (SMA) at $366 and a 200-day SMA at $251. Price action’s been riding a bullish trendline, with a recent push above towards an ATH of $449, only to pull back slightly.

Zooming out, the rising channel pattern signals potential upside for the Zcash price. The upper trendline lies near $449, marking it as the next big flex point, with a measured move suggesting a possible pump towards $500 if ZEC breaks through.

The Relative Strength Index (RSI) sits at 50.80, indicating that both the bulls and the bears are in a tight tug-of-war. The MACD shows a bearish crossover, showing a sell signal in the ZEC market.

Looking at the bigger picture, the recent drop likely came from profit-taking after the Zcash price hit its ATH. ZEC has strong support at $366 (50-day SMA), and if that breaks, it could drop to around $355-$342.

In the short term, expect some ups and downs as the crypto market faces a bearish trend, following the US President’s latest comments. The recent market slump comes after the US President Donald Trump stated that Nvidia developed Blackwell AI advanced chips would not be sold to other individuals, a comment that dampened hopes of de-escalation of trade between the US and China.

On the other hand, if the bulls could establish a higher support above $400, the Zcash price could resume the uptrend. A close above the $449 ATH could open the doors for a new high level around $500.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.