Highlights:

- The price of XRP drops 1% to $3.49, despite the 15% spike in trading volume.

- The XRP long-to-short ratio on the Binance exchange signals strong confidence in XRP growth.

- XRP bullish technical indicators signal further upside as a crypto analyst eyes $6.

The XRP price remains bullish, despite a 1% drop over the past 24 hours to the $3.49 mark. The daily trading volume is up 15% to $10.38 billion, as its market capitalization reaches $ 207.13 billion. XRP is now 20% up over the past week and a whopping 72% over the past month, indicating growing market hype. XRP has been gathering such astounding strength, as it has surpassed giants such as Uber, Shell, and Nike. This means that XRP has entered a new era, as it continues to make significant progress in the cryptocurrency market.

🚨 $XRP just flipped Uber, Shell and Nike in market cap. pic.twitter.com/1O78Kn9Dkn

— John Squire (@TheCryptoSquire) July 21, 2025

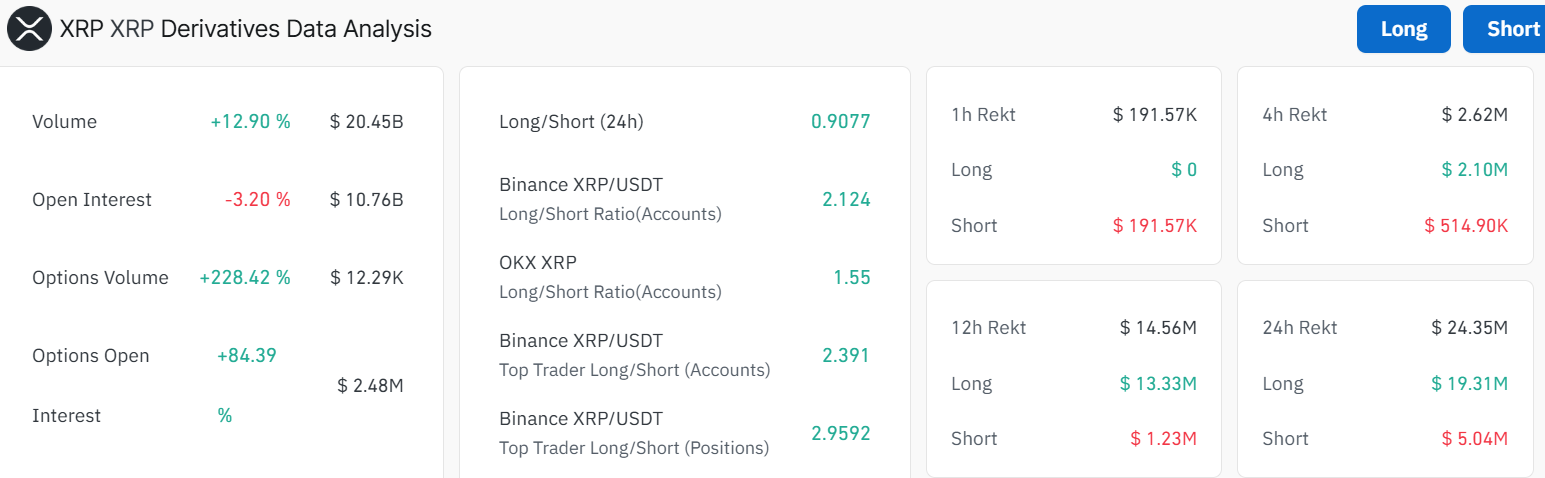

Notably, the XRP Derivatives market data also exhibits a positive outlook. The recent substantial variation of long positions further indicates that investors are confident about the future growth of XRP. The balance between long and short positions on the Binance is 2.12. This indicates that the long positions have the upper hand, resulting in a bullish grip on the XRP price.

Meanwhile, the XRP volume has spiked 12.90% to $20.45 billion, despite a 3.20% decrease in open interest to $10.76 billion. The recent imbalance indicates an increase in trading activity in the XRP market. However, the drop in OI indicates that they may be closing the existing positions, signalling early profiteering.

XRP Price Moves Into a Consolidation Channel

In the XRP 4-hour chart, the cross-border payment token (XRP) now trades within a consolidation channel, which typically precedes an explosive breakout. In recent times, XRP has experienced a significant price surge, and as the price stabilizes in a narrow range. The bulls remain in dominance, having established a strong support level around the 50-day MA ($3.27). If this support zone holds and the volume continues to surge, the XRP price could break out to the upside.

The Relative Strength Index (RSI) shows a value of 55.79, indicating that the price is neither overbought nor oversold. In other words, the market has reached a neutral point and could experience additional upside after the consolidation breaks. Moreover, the consolidation phase may act as an accumulation period before the bulls initiate a strong leg up.

However, the MACD momentum indicator is signaling a sell. This is evident as the orange signal line (0.07957) has crossed above the blue MACD line(0.05822).

Is a Breakout to $6 Plausible in XRP?

Looking ahead, if the support zone at $3.27 holds, the XRP price could spike to the upside. A close above the $3.64 level will call for further upside towards $4.00. According to a popular analyst, Ali Martinez, XRP could target $6 after breaking out of a triangle.

$XRP targets $6 after breaking out of a triangle! pic.twitter.com/8VJ5DD2eOE

— Ali (@ali_charts) July 21, 2025

However, if the bears capitalize on the sell signal from the MACD indicator, the XRP price could dip. A crack below the $3.34 support will see the altcoin drop to $3.27 safety net. In the short term, the XRP price is looking bullish, but its long-term performance will depend on volume and market sentiment.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.