Highlights:

- XRP price soars 4% to $3.07, despite the trading volume plummeting 10%.

- President Trump is set to sign the crypto into a 401(k) retirement plan.

- Technical indicators show a potential surge to $4 as support zones hold strong.

The XRP price has increased 4% to $3.07, despite its daily trading volume slipping 10%. Meanwhile, XRP has recently generated interest due to promising market trends and the increase in investor interest. The good news that President Trump is soon going to sign an executive order to enable cryptocurrencies to be included in 401(k) retirement plans is one strong factor that has raised the level of optimism in the XRP market.

JUST IN: 🇺🇸 President Trump to sign executive order allowing cryptocurrencies in 401(k) retirement plans today.

— Watcher.Guru (@WatcherGuru) August 7, 2025

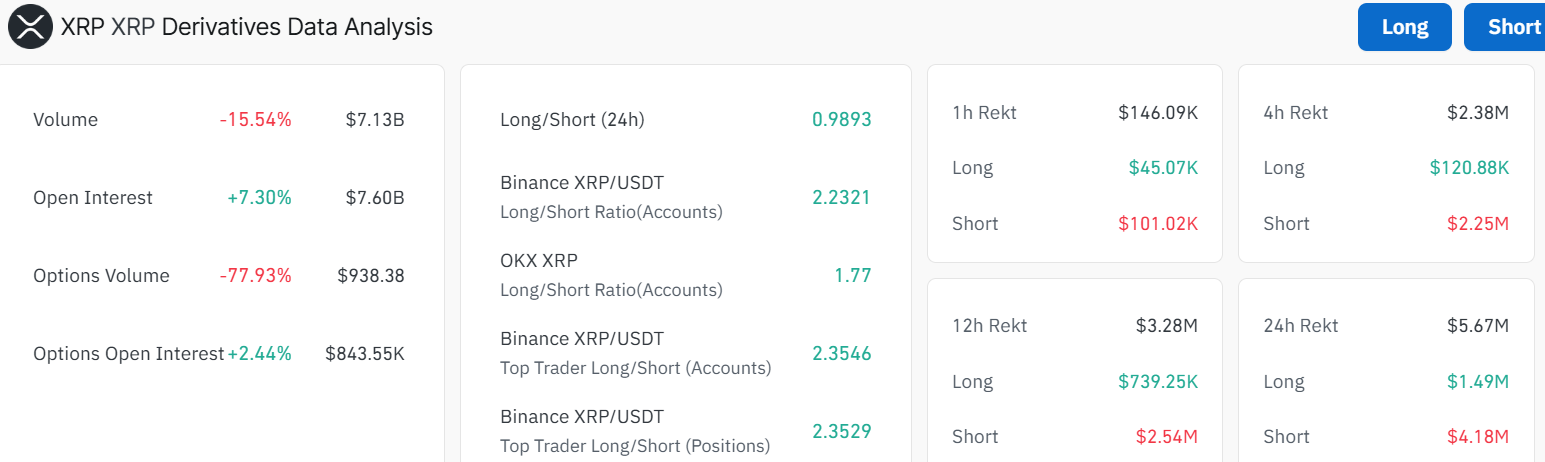

The move has created some buzz in the crypto world as more institutional investments and integration of digital assets are likely to follow. However, politics is also not the whole story about what is happening. As the derivatives data on XRP indicates, it is a market of maximum engagement despite the downward trend. To start with, its trading volume is slightly down by 15.54% to $7.13 billion. Nevertheless, the open interest has increased by 7.30% to $7.60 billion.

The surge in OI signals that the traders are becoming more active in terms of securing positions, which further confirms the positive long-term perspectives of XRP. Also, the long/short ratio has been at a balanced position with a value of 0.9893. This implies there is neutral market sentiment with more traders pricing to win on long positions.

XRP Price Poised for a Surge in the Short Term

Looking at the charts, the price of XRP has been experiencing a few signs of resilience, especially on the 4-hour timeframe. The XRP price has broken out of a falling wedge, with the bulls eyeing further upside. The cross-border payment is currently sitting above the 50-day Simple Moving Average (SMA)(2.99) and the 200-day SMA ($2.97), a classic sign that bulls are in control.

Recently, the altcoin spiked to $3.6607, but the pullback to the current $3.0019 suggests some profit-taking. The price is currently exchanging hands at $3.06, after bouncing from the $2.74 local lows.

With an RSI (Relative Strength Index) of 60.74, it can be argued that XRP is not yet in the overbought position. This signals that there is more room for the upside before XRP is considered overbought. The MACD (Moving Average Convergence Divergence) also shows a bullish scenario as it has recorded a positive divergence. This calls for more traders and investors to buy more XRP tokens unless the trend changes.

XRP Bulls Eye $4 as They Defend Key Support Zones

Looking ahead, the XRP price paints a strong bullish picture. Meanwhile, the $2.97(200-day SMA) and the $2.99(50-day SMA) serve as the ultimate technical safety net. If the bulls keep pumping the price, resistance at $3.30 could flip to support, opening the door to $3.66 or even higher to $4. Conversely, if bears start to sell, a drop below $2.99 could lead to a test of the $2.97 mark. XRP trading volume has dropped 10%, which is a good sign as it shows traders are choosing to remain on the sidelines amid the mixed signs. In the short term, XRP’s 4% climb and chart action suggest a bullish trend, especially with that breakout above the falling wedge.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.