Highlights:

- XRP price surges 43% in a month as the daily trading volume soars 12%.

- Eric Balchunas projects XRP ETF by early September amid the SEC’s standards for crypto.

- XRP technical indicators uphold a bearish look, as XRP risks a drop towards $3.02

XRP price continues to trade sideways, currently up 2% to $3.15. The trading volume has surged 12% to $6.32 billion, indicating heightened market activity. Meanwhile, the latest news highlighting the role of cryptocurrency in exchange-traded products (ETPs) has set a new benchmark for the cryptocurrency industry.

The SEC's "Listing Standards" for crypto ETPs is out via new exchange filing. BOTTOM LINE: Any coin that has futures tracking it for >6mo on Coinbase's derivatives exchange would be approved (below is list). It's about a dozen of the usual suspects, the same ones we had at 85% or… https://t.co/QlzZnta7Yv pic.twitter.com/CmBr8XxAcM

— Eric Balchunas (@EricBalchunas) July 30, 2025

Some of the listed coins include Bitcoin, XRP, and Solana, for which favorable odds of getting listed already exist. Eric Balchunas has projected XRP ETF (exchange-traded fund) approval by early September, following the US Securities and Exchange Commission’s (SEC) updated listing standards for crypto exchange-traded products (ETPs). An approval could mean that XRP gains more exposure in the cryptocurrency space, which could serve as a catalyst for the Ripple token’s price.

XRP Price Slips Below $3.16

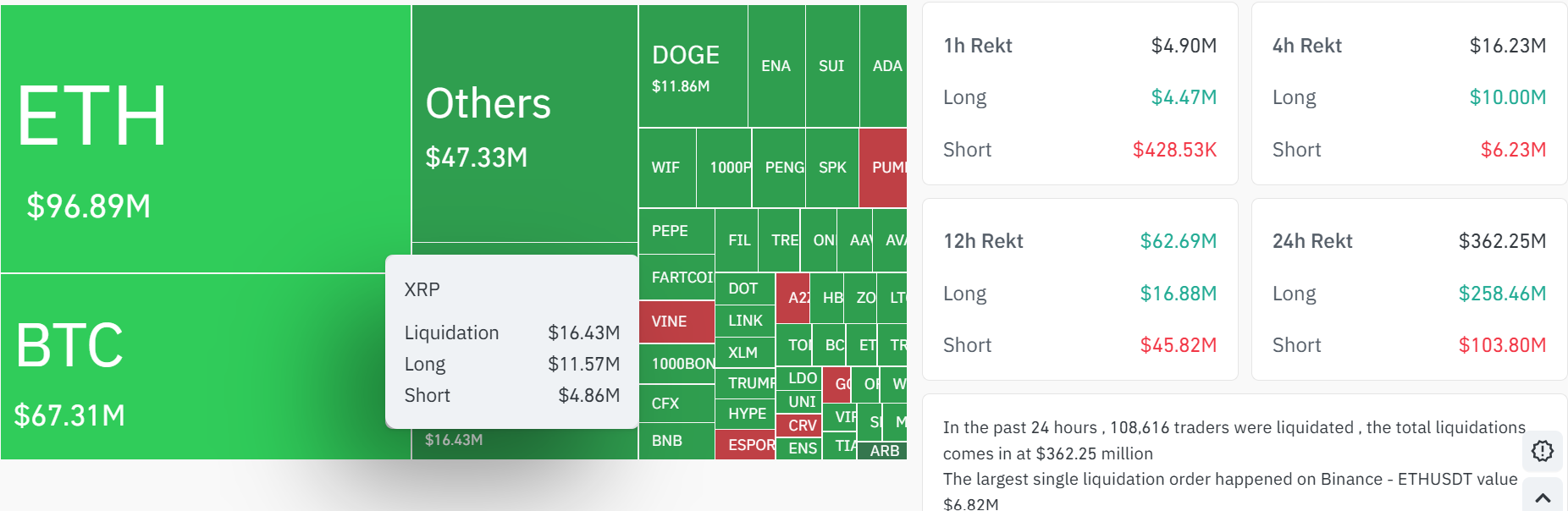

The liquidation risk is also very high, as evidenced by recent crypto liquidations, where short liquidations are particularly prominent. Over the previous 24 hours, a total of $362.25 million in cumulative liquidations occurred, with a significant portion related to the XRP market. Remarkably, a large margin of the liquidations involved short positions, indicating that many traders were caught unaware by the new price movements.

With such statistics, XRP may continue to struggle in the near term, particularly if the rest of the cryptocurrency market becomes increasingly volatile. However, if the market stabilizes and exhibits a stable upward trend, the resurgence of XRP is also likely to occur.

The current liquidation volume of XRP is at $16.43 million, according to the latest data. Examining the four-hour chart of XRP, the price is currently at $3.15. Moreover, the bulls have lost support at $3.16, which aligns with the 50-day SMA. Even in the face of the decline, the XRP price is roughly 30% higher than its 200-day SMA($2.81), which implies that the general trend remains encouraging.

However, the Relative Strength Index(RSI) currently reads at 48.76, slightly below the 50-mean level. This presents traders with a degree of caution, as further downside is likely if the bulls don’t move above the 50-mean level. There is also a small bearish crossover of the Moving Average Convergence Divergence (MACD). Moreover, the histogram is not very high, which also shows possible indecision on the market.

What’s Next for XRP?

In the short term, XRP price could test support around $3.02 (the lower end of the consolidation zone) if this dip continues. A break below that might send it toward $2.81 (the 200-day SMA), a level to watch closely. On the flip side, if the bulls push past $3.16, there could be a charge toward $3.60 or higher. The current consolidation may act as an accumulation period, but the slip below the 50-day SMA(3.16) is a red flag for caution.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.