Highlights:

- The XRP price has dipped 4% to $2.37 as the bulls struggle across the crypto market.

- Ripple has already moved to Africa through its recent collaboration with Absa Bank.

- XRP’s open interest slips further, as XRP price may see a further drop to $2.10 support.

The XRP price has flipped below the $2.50 mark, currently trading at $2.37, marking a 4% decrease. The cross-border payment token recovery operation following the past week’s flash crash was denied at approximately $2.63 on Monday. This further confirms the bearish perspective in the short run. With the consistent bearish attitude, the chances of a continued uptrend to the psychological mark of $3.00 are weakening.

Meanwhile, the success of Ripple, the major blockchain-based payment platform, has already moved to Africa. The firm declared a strategic alliance with the Absa Bank, which is one of the best financial institutions in South Africa. The partnership is an indication of the first large-scale custody partnership between Ripple and an African unit dedicated to delivering institutional-grade digital asset custody solutions to the continent.

Last month, we announced RLUSD live on the African continent…and today so is Ripple Custody through our partnership with Absa Bank, one of South Africa’s leading financial institutions! https://t.co/0ZcrGWlZNT

— Monica Long (@MonicaLongSF) October 15, 2025

This is a big move in the development of blockchain technology, particularly in areas where the traditional banking systems are developing at a high rate. The alliance with Absa Bank would serve the increasing need for secure and efficient digital asset storage to institutional clients in Africa.

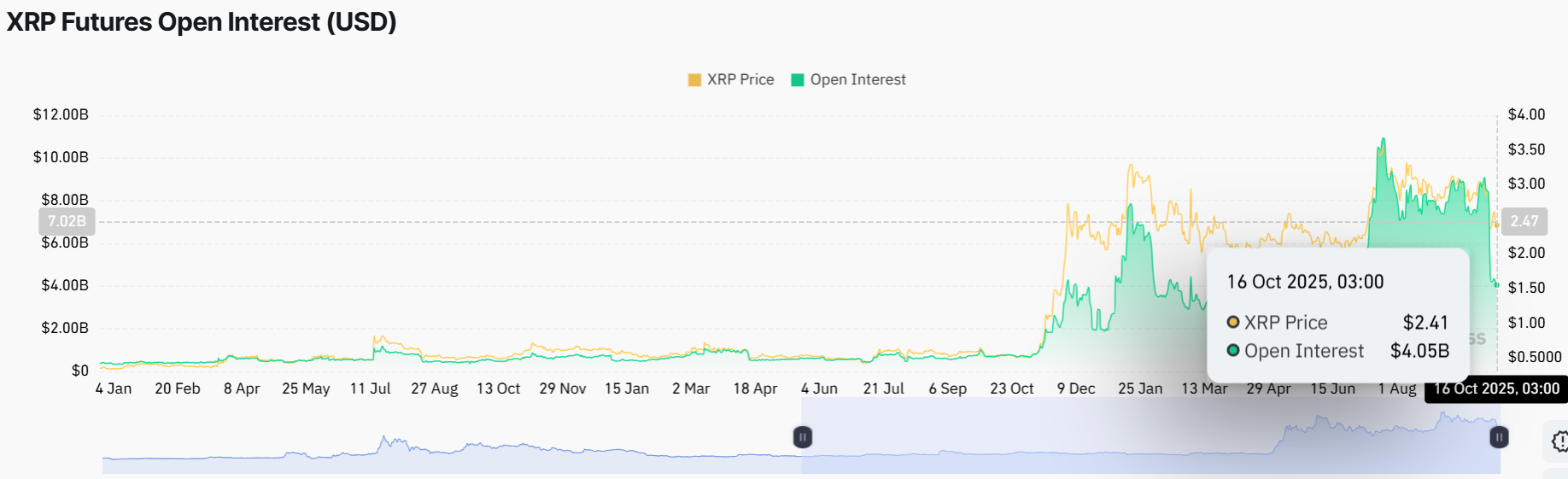

In the meantime, XRP retail interest showed a short-lived stabilization on Tuesday but went down again with an average of $4.05 billion on Thursday. As the futures Open Interest (OI) is very low compared to the levels recorded in the deleveraging event experienced last week, which caused mass liquidations, there are high chances that the XRP price decline will see a great rise.

XRP Price Shows a Bearish Grip Towards $2.10 Support

The 1-day XRP/USD chart appears bearish, as a descending triangle is forming, with the price bouncing below solid resistance around $2.38. If the XRP price breaks out and holds, the crypto could moon to $2.60 or even $2.70 soon. The 50 Simple Moving Average (SMA) ($2.85) and 200-period SMA ($2.58) are acting as immediate resistance zones, cushioning against further upside.

Zooming into the indicators, the Relative Strength Index (RSI) is at 33.62, which shows oversold conditions in the XRP market. If the bulls ignite a buy-back strategy at this level and surpass the 50-mean level, a rebound towards $2.60 is likely. Meanwhile, the Moving Average Convergence Divergence (MACD) is flatlining and showing a bearish crossover, with the signal line (orange) edging above the MACD line (blue).

Looking ahead, if XRP price breaks and holds above $2.58 and $2.85, it could end up testing resistance near $3.00 in the short term. However, traders will want to watch out for further correction, as the technical indicators show bearish sentiment. In such a case, a slip towards $2.10 support zone may be plausible.

Although the crypto market’s volatility is unpredictable, XRP’s current momentum and technicals signal that the latest dip is worth buying. For the next few weeks, XRP price may begin a steady climb, potentially hitting $2.60-$3.00.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.