Highlights:

- XRP price slips 4% to $2.98, as the trading volume explodes 115%.

- Nearly 94% of XRP’s circulating supply is now in profit as the price surged past $3.

- A break above $3.30 resistance could spark a rally towards $4 and above.

The XRP price is down 4% to $2.98, as the crypto market wobbles. Despite the drop, the trading volume has soared 115% to $7.04 billion, suggesting intense market activity. However, XRP is still swimming in the red territory, down 7% over the past week and 12% over the past month. Can the bulls regain momentum and reclaim the $3.30 resistance?

Meanwhile, the on-chain analytics Glassnode shows that almost 94% of its circulating supply is currently enjoying a profit as XRP hit past the $3 level. The milestone depicts one of the best profitability ratios in the history of XRP, making the ongoing rally ripe. This level of profitability has in the past led to further bullish rises or short-term corrections as profit-taking becomes enticing to investors.

GM CT ☀️

Happy Monday!

🚨BREAKING: Nearly 94% of $XRP’s circulating supply is now in profit as price surges past $3.

This marks one of the highest profit ratios in XRP’s history, this just shoes how strong this rally has been and it's just getting started. pic.twitter.com/eqAtTWQvjj

— ZUB!D¤RM (@zubidorm) August 18, 2025

The circulating supply of profit is a very important indicator of the confidence levels of investors. The change of mood in the market has now become bullish as the majority of the holders are experiencing profits.

XRP Derivatives Market

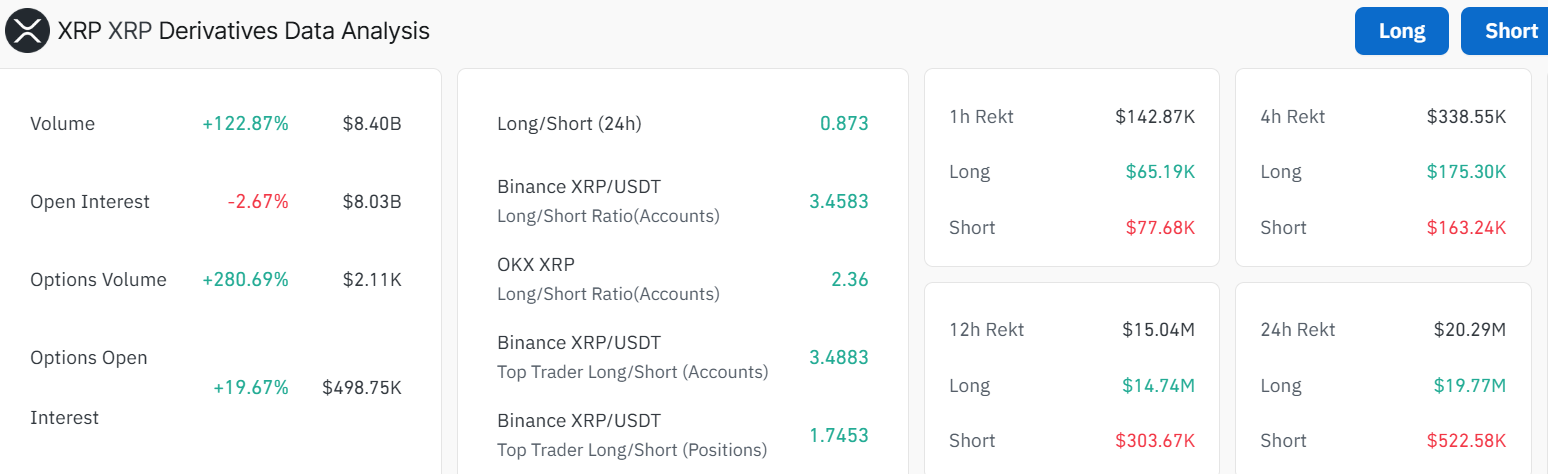

Combined with the spot market momentum, the derivatives market depicts an interesting trader positioning trend. The trading volume of XRP increased by 122.87% to $8.40 billion, showing that speculative activity was very high. Options trading volume experienced an even more dramatic 280.69% growth, highlighting the increased interest in geared exposure. Nevertheless, there is a decrease in open interest by 2.67%, indicating that although the volume of trading is high, some traders may be liquidating positions and switching strategies.

The long/short ratio sits at 0.87, signalling some bearish stance. The 24-hour liquidations stand at $20.29 million, with the larger loss of 522.58 K shorts, and 19.77 M longs. This skew implies that bearish bets are still getting squeezed if the XRP price breaks up further.

XRP Price Upholds a Bullish Stance Despite the 4% Drop

He cross-border payment token recently pulled back after failing to break above $3.30, but bounced quickly from the $2.94 support level, showing buyers are still in control. The daily chart shows XRP is trading within a falling triangle, with the bulls showing strength. This rally hit resistance near $3.30, then slipped back to $2.94 in what turned out to be a false breakout. Buyers stepped in fast, leading to a bullish reversal, as the XRP price currently sits at $2.98.

The Relative Strength Index (RSI) sits at 45.49, suggesting there’s still room for more gains if the bulls gain momentum. Its position below the 50-men level, however, tilts the odds towards the bears. The Moving Average Convergence Divergence (MACD) is also bearish as the MACD line crossed below the signal line on July 24.

A clear move above that level may open the door to the next target at $3.30. On the downside, a drop below $2.94 could pull the price back toward $2.45. For now, XRP’s price structure remains bullish. Traders are watching $3.30 as the breakout point and $2.94 as the key support. If XRP can push past resistance, it could see its biggest rally since late 2021.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.