Highlights:

- The price of XRP drops 3% to $2.09, while trading volume surges 28%, indicating heightened market activity.

- Ripple launches Permissioned DEX, allowing regulated institutions to trade on the XRP Ledger with KYC-compliant transactions.

- XRP remains in a consolidation channel between $1.99 and $2.36, with technical indicators pointing to mixed market sentiment.

As of 27 June, the XRP price is down 3% to $2.09, as the daily trading volume increases 28%. Despite the drop, the trading activities are heightened, indicating intense market activity and strong investor confidence. Meanwhile, Ripple has launched its Permissioned DEX (Decentralized Exchange), which will permit regulated institutions to trade along the XRP Ledger.

NEW: Ripple launches ‘Permissioned DEX’ allowing regulated institutions to trade on $XRP Ledger using verified credentials, enabling KYC-gated FX swaps, stablecoin flows, and more. pic.twitter.com/Hsdd3QUJc7

— Whale Insider (@WhaleInsider) June 27, 2025

As this permissioned DEX launched, Ripple continues to place itself as a provider of trading environments that are compliant with KYC regulations. It allows different transactions, such as FX swaps and stablecoin flows. This is by using verified credentials with an extra layer of security and regulatory protection.

Is XRP Poised for a Breakout Above the Consolidation Channel?

Shedding some light on the recent performance of the XRP price, the daily chart depicts that the token has moved into the consolidation channel. Technically, the Ripple token has been oscillating between the $1.99 and $2.36 area for the past few weeks. However, the question remains: can the consolidation channel ignite a bullish breakout? In the meantime, the bears have squashed the bulls, as they establish immediate resistance at $2.26 and $2.36. These levels align with the 50-day and 200-day MAs in the daily chart pattern.

Besides, indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), show that the XRP remains in the neutral ground. RSI remains quite stable with a value of 43.37. Nevertheless, negative values of the MACD line indicate that there is an insignificant bearish impulse in the short term. In the meantime, traders need to be cautious as the market portrays some mixed reactions, with the odds favouring the downside.

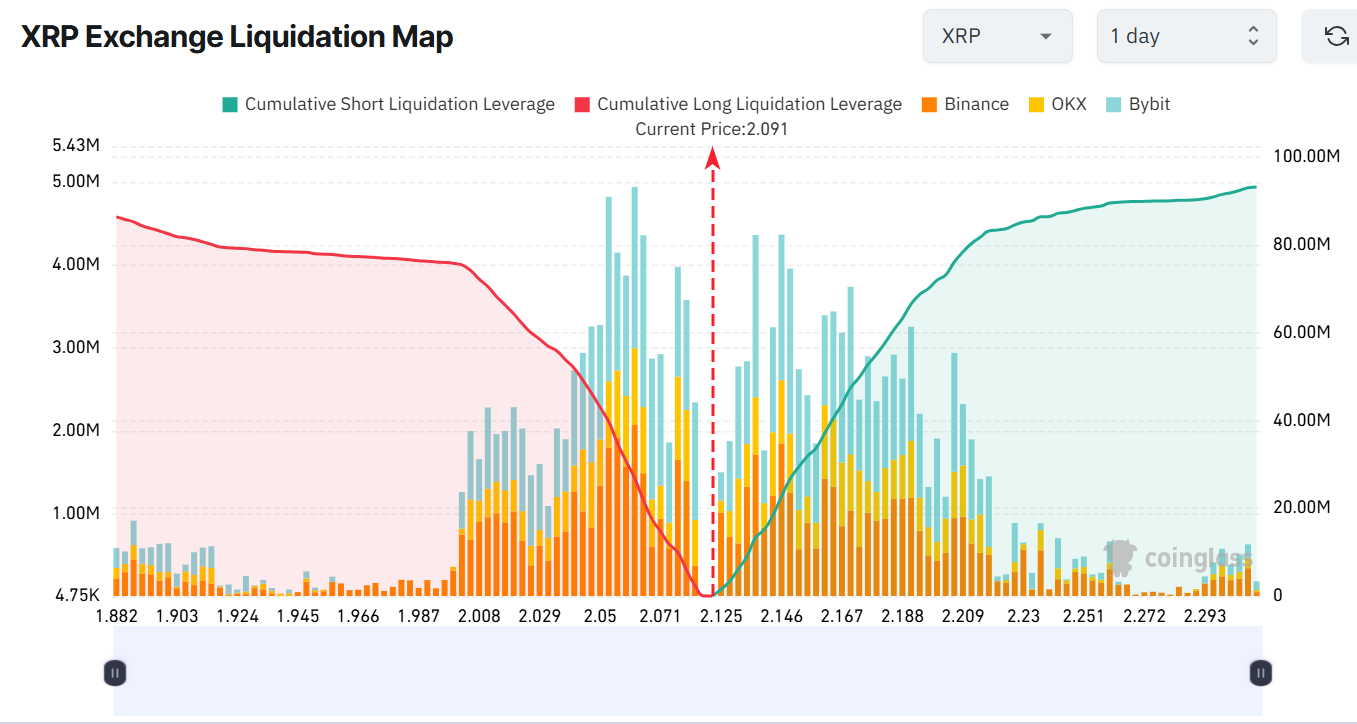

The cumulative long and short liquidations can be seen on the XRP Liquidation Map. It provides us with an idea of how traders are positioned in the market. The short positions and long positions are about to hit neutral levels. Meanwhile, the aggressive longs are facing a lot of heat with the price standing at around $2.09.

This means that there is more cumulative short liquidation leverage ($93.27 million) compared to shorts ($85.85 million) in the last 24 hours. This imbalance suggests that some bearish sentiment is building in the XRP market.

XRP Price in a Tight Tug-Of-War

A zoomed outlook from the above analysis, the market is faced with a bullish versus a bearish tug of war. However, the odds tend to lean towards the bear. If the immediate resistance at $2.26 proves too strong, the XRP price could stay in the consolidation channel. However, if the selling pressure mounts, reinforced by the sell signal from the MACD, a further drop towards $1.99- $1.98 support zone would be plausible.

On the other hand, if the bulls show strength, the XRP price could spike. However, only a close above $2.36 resistance would initiate further upside. Meanwhile, traders should keenly monitor the technical indicators and the increasing trading volume. This will help monitor the price changes of XRP to prevent being trapped in the wrong market movements.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.