Highlights:

- The price of XRP has soared 2% to $2.30 in the past 24 hours, as trading volume soars 11%.

- Nasdaq has officially submitted an SEC Form 8-K to include XRP in the Hashdex Nasdaq Crypto Index ETF.

- XRP’s derivatives market sees a significant increase in trade volume and open interest, indicating growing investor confidence.

The XRP price has surged 2% to $2.30, as its trading volume soars 11%. This comes as Ripple sees a significant boost as Nasdaq has officially presented SEC Form 8-K, suggesting that XRP should be part of the Hashdex Nasdaq Crypto Index US ETF (NCIQ). The intention behind this move is to make the ETF cover more digital assets and offer them to investors. Should XRP receive approval, it will join other tokens with backing from institutional investors and set up for trading.

🚨BREAKING 🚨

Nasdaq submits SEC Form 8-K proposing to include $XRP in its Crypto Index, expanding the Hashdex Nasdaq Crypto Index US ETF (NCIQ) to track a broader digital asset portfolio.

SEC decision expected by Nov. 2, 2025. pic.twitter.com/50AekMhdFR

— John Squire (@TheCryptoSquire) June 10, 2025

Until the SEC gives its final approval, the proposal is waiting for review. Users in the crypto industry view this as an important step that gives more credibility to XRP for use in institutional assets. Nasdaq’s plan also indicates that financial institutions are willing to include cryptocurrencies in their main business activities.

XRP Price Technical Indicators Show Steady Ground with Bullish Potential

Although there is anticipation of new regulations, XRP’s price seems stable. Currently, XRP is worth $2.3099. The value of the price has been oscillating between its 50-day and 200-day moving averages. As the Relative Strength Index (RSI) is at 53.90, the XRP token is neither highly overbought nor too much oversold.

A slightly bullish indication shows with the MACD line remaining on the move above the signal line. As such, increased buying could make things favorable for the bulls. Right now, the market is waiting for the $2.35 resistance to be broken, since that could mean the XRP price continues in an upward swing, past the level of $2.70 seen earlier. In general, XRP is laying the groundwork for changes in macro news like the SEC’s ETF ruling, which makes it look positive both on technical analysis and on the chart.

XRP Derivatives Market Indicates Rising Confidence Among Traders

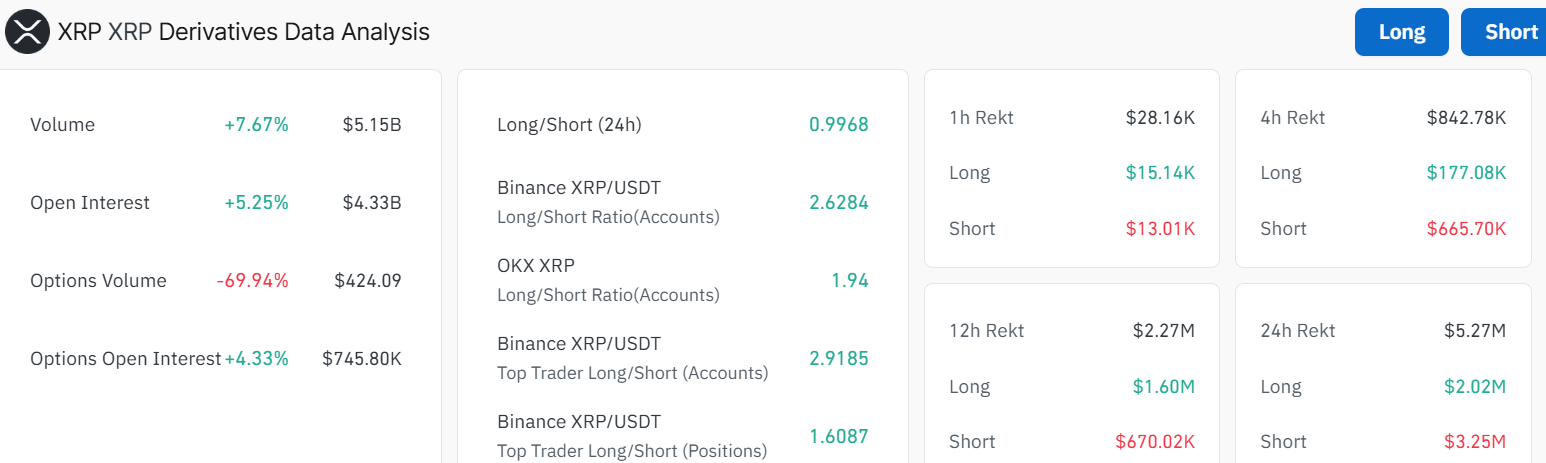

The volume of trades has gone up by nearly 7.7% to hit $5.15 billion, and open interest is up by 5.25% at $4.33 billion. This increase means that traders may expect major shifts after the SEC ruling or if certain markets breakthrough.

The ratio for the 1-day chart is almost equal at 0.9968, but Binance and similar platforms are mostly bullish. As an illustration, the number of long positions in Binance XRP/USDT user accounts is 2.6284. Since there is a clear difference between sentiments on the market and platforms, it looks like whales and institutional traders are keeping an eye out for a breakout.

Even though trading options dropped by about 69%, open interest went up slightly, showing that investors are looking for a noticeable development in the market. This means that more people have confidence in the market since XRP is becoming a more important digital asset. In the meantime, only a cross above the $2.35 resistance will confirm a bullish breakout. In such a scenario, the token will surge towards $2.45, $2.53, and $2.70. The XRP price could rally to $ 3 in a highly bullish case.

On the other hand, if the $2.35 resistance proves too strong, the token could drop toward the $2.28 support area. In a highly bearish case, a deeper correction towards $2.12 and $2.08 will be in line to absorb the potential selling pressure.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.