Highlights:

- XRP price drops 5% to $3.30 despite a 1% surge in trading volume.

- SEC approves and pauses Bitwise’s ETF conversion, causing market uncertainty.

- XRP technical indicators flash bearish as selling pressure mounts.

The XRP price has slipped 5.83% to $3.30, despite the trading volume spiking 1% to $9.56 billion. Recently, the altcoin reached a high of around $3.68 before dropping to its current level. Despite the drop, XRP still upholds positive momentum, rallying 11% over the past week and 65% over the past month.

The recent drop in XRP price follows the SEC’s initial approval, then quick pause, of Bitwise’s plan to convert its crypto index fund into a spot ETF. According to SEC Assistant Secretary Sherry Haywood, the “order is stayed until the Commission orders otherwise.” Further, the “Commission will review the delegated action.”

🚨 UPDATE: SEC approves Bitwise’s crypto ETF conversion, then immediately pauses it. pic.twitter.com/sLHQzevB9l

— CW (@CW8900) July 23, 2025

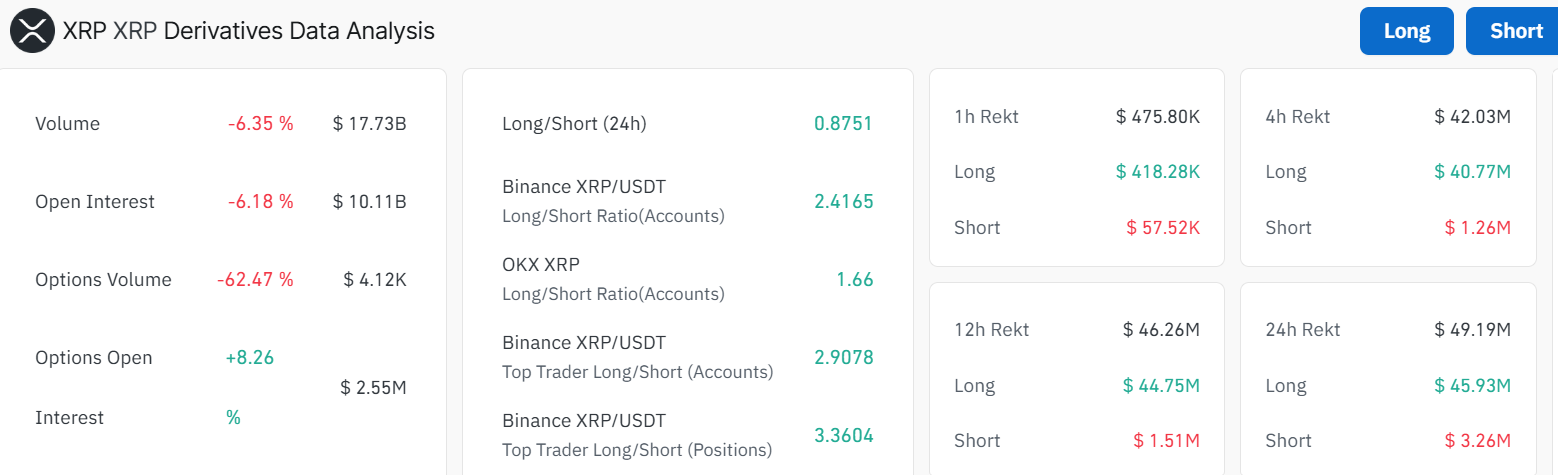

Meanwhile, the daily trade volume of XRP on the derivatives market is quite high, amounting to $17.73 billion, but it has fallen by 6.35% in the past day. The open interest in the token has also reduced by 6.18% to reach $10.11 billion. Nevertheless, XRP has considerable potential, as demonstrated by the 8.26% growth in options open interest.

Regarding market sentiment, the long-to-short ratio stands at 0.8751. This suggests that the market is modest. However, the sentiment does not heavily lean towards the long side.

XRP Price Moves Remain in Consolidation as the Bears Show Strength

On the 4-hour chart of the XRP price, the new development shows a consolidation process following a previous rally. The price action on XRP has hit a flattening resistance level around $3.35 (50-day SMA). The bears are showing strength, as they have established immediate resistance around $3.35. A continued downtrend may lead to further downside, giving sellers the upper hand.

The Relative Strength Index (RSI) sits at 38.46. This indicates a dwindling buying momentum, as a deeper correction may cause XRP to move towards the oversold region. However, if the bulls regain momentum, the RSI could reclaim the 50-mean level, invalidating the bearish signal. The Moving Average Convergence Divergence (MACD) indicator also upholds a sell signal. This is evident as the orange signal line (0.0445) has crossed above the blue MACD line (0.0106), indicating a sell signal.

Will XRP Rally to $4 By August?

The market is hanging in limbo following the current SEC’s approval and pause of the Bitwise ETF Conversion. The approval would further legitimize the XRP price and fuel FOMO among the institutions, causing a spike in prices. In such a case, a rally towards $4 could be clear or even beyond to $5.30.

However, the recent pause triggers weak holds, more so at the $3.26 support zone. A breach below this level may trigger panic selling, causing the XRP price to drop to the support zones at around $3.05-$2.80. In a highly bearish scenario, the XRP price could plummet to around $2.36. In the short term, there will be volatility among the traders. Meanwhile, if the pause is resolved by August 2025, XRP could rally to $4- $5.32 area. However, traders will want to watch the RSI, as the overbought levels could signal a potential breather.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.