Highlights:

- The price of XRP has dropped 3% to $2.23 as the crypto market slumps.

- Ripple’s partnership with Circle bringing USDC stablecoin to XRP Ledger could spark bullish momentum.

- XRP technical analysis suggests consolidation at $2.23 with bullish momentum from MACD, but market sentiment remains cautious.

The XRP price has dropped 3% to $2.23 mark, as the whole crypto market faces some declines led by Bitcoin which has hit $107K. The XRP token has lost its main support, plunging towards the $2.23 zone, as bulls attempt to regain composure. However, the recent Ripple and Circle partnership could ignite some bullish momentum in the market.

Ripple and Circle Partner Bringing USDC Stablecoin to XRP Ledger

USDC, one of the largest regulated stablecoins in the world, has come to the XRPL. The integration will carry multiple benefits, in particular, to developers, institutional, and user clients that seek a regulated and mainstream adoption of stablecoin to transact on blockchain networks. The capability of RippleX to combine USDC into the XRPL environment opens up the possibility of making more effective and transparent payments, especially in global money flow and capital efficiency.

USDC is now live on the XRP Ledger (@RippleXDev)!

With the launch of native @USDC on the XRPL, developers, institutions, and users gain the support of the world’s largest regulated stablecoin.

✅ Enterprise B2B payments: Use USDC for global money movement and improve capital… pic.twitter.com/WjXr7ui2Kp

— Circle (@circle) June 12, 2025

This partnership attracts significant changes in the utility of XRP in DeFi. With the introduction of USDC, XRP can now be used to enable cross-border payments, allowing a much smoother and more efficient way of making global transactions. The addition results in increased functionality of XRP overall and provides additional utility to the blockchain, making it a leading candidate in the crypto sphere to be used in enterprises.

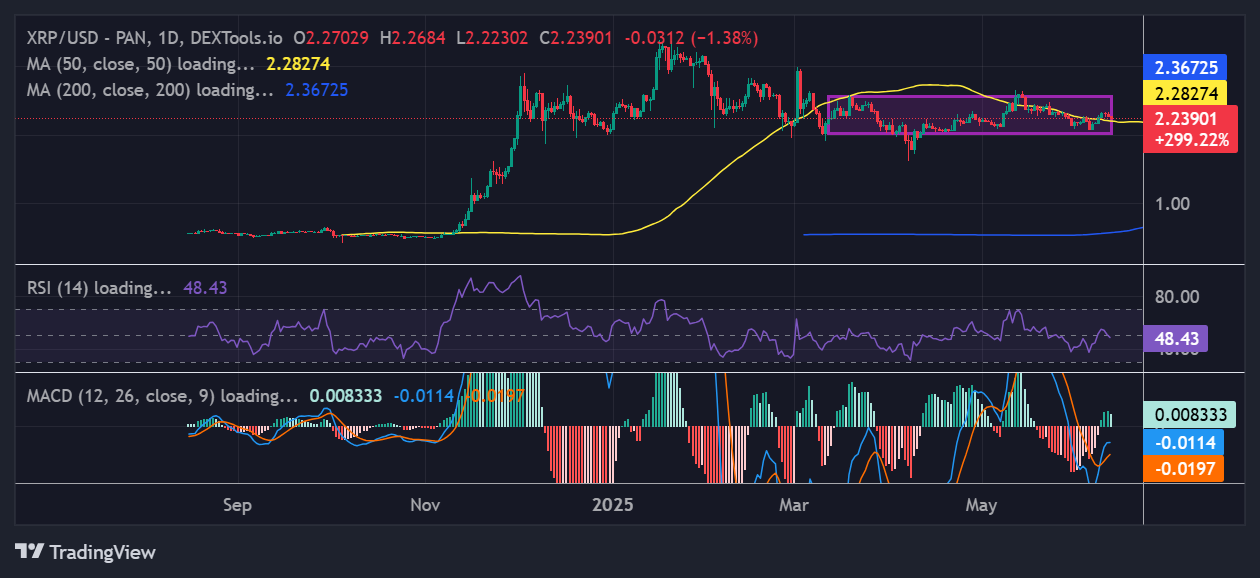

XRP Price Technical Outlook

The recent price dynamics of XRP indicate the presence of a major change in the market sentiment. As the whole crypto market has been volatile, XRP has been comparatively steady in its market performance, even in cases of minor dips. According to the recent trading chart, XRP is at a crucial support area thus trading between $2.23 and 2.28. The technical behavior indicates that XRP is consolidating and attempting to escape a multi-month channel and possibly preparing to break out.

The Relative Strength Index (RSI) is at 48.43, which shows that the market is neutral, neither overbought nor oversold. This balance indicates that XRP may experience further consolidation or overcome the existing resistance levels as long as the market conditions are positive. On the other hand, the MACD momentum indicator is calling for traders to buy more XRP, as it upholds a buy signal. The performance of XRP is under the watchful eye of traders since it is indicating a slight bullish craze.

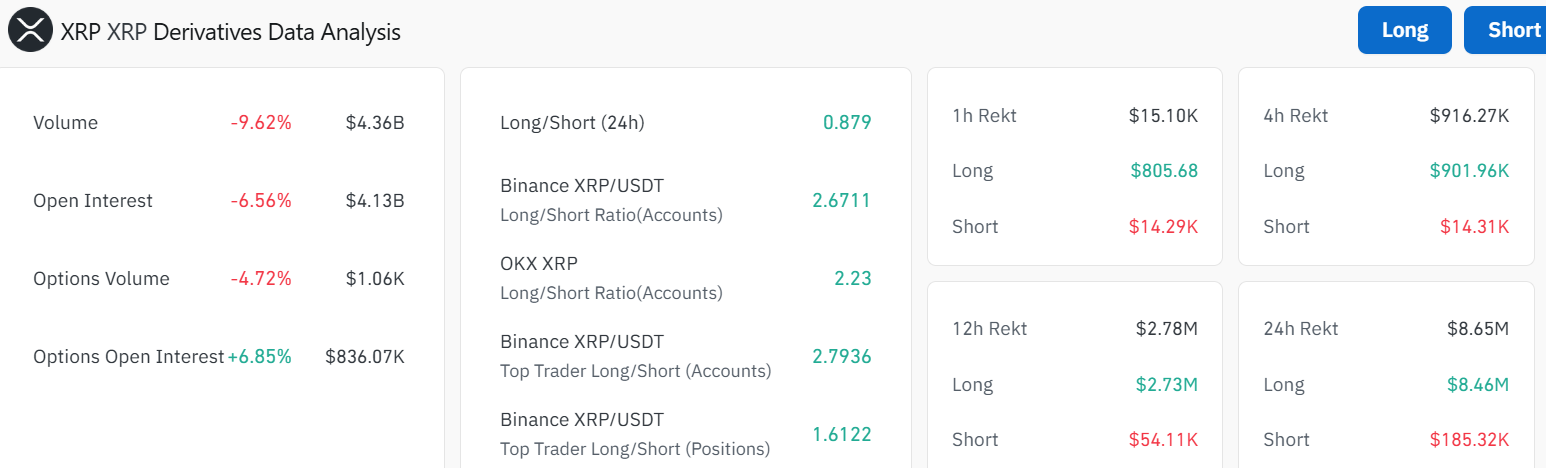

XRP Derivatives Market Outlook

Over the last day, the XRP volume reduced by around 9.62%, and open interest declined by 6.56%. Although these are minor negatives, the growth in the number of options open interest (+6.85%) indicates that traders in the market are quite bullish on the prospects of XRP.

The long/short ratio of XRP is 0.879, which indicates that traders are shorting their positions, as the ratio sits below 1. This is an indication of some bearish prospects in the XRP market. Meanwhile, if the XRP bulls capitalize on the recent partnership, the cross-border payment token could rebound. In such a case, the XRP price could flip the $2.28 resistance into support, igniting a slight rally. In a highly bullish scenario, the altcoin could surge towards $the 2.33 and $2.36 resistance mark. A break above $2.36 could open doors to $2.82.

On the downside, if the XRP price keeps dropping following the market-wide downtrend, the token may hit $2.18 support before a potential rebound. In the meantime, traders should keenly monitor the support and resistance zones in the XRP market to determine the next direction.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.