Highlights:

- XRP price plunges 3% to $2.46 despite rising trading volume.

- Crypto analysts predict a 14% rally in XRP price.

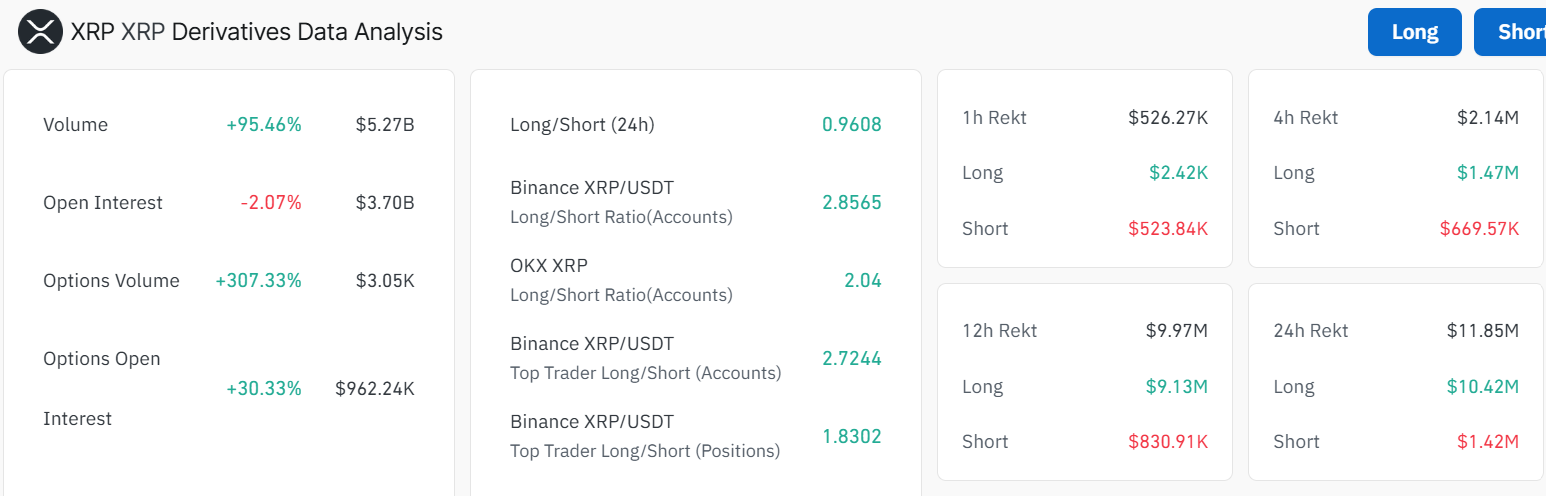

- Coinglass data shows a potential upward move in the XRP market as volume spikes 95%.

The XRP price has plummeted 3% to $2.46 despite the rising trading volume by 74% to $3.94 billion. The recent rise in trading volume indicates heightened market activity, which may soon cause a rebound in the XRP market. Meanwhile, Ali Charts, a well-known analyst, has highlighted that XRP is preparing for a 14% move soon.

$XRP is preparing for a 14% price move! pic.twitter.com/iTfGBj7Mmt

— Ali (@ali_charts) February 22, 2025

XRP Statistical Data

Based on CoinmarketCap data:

- XRP price now – $2.46

- Trading volume (24h) – $3.94 billion

- Market cap – $142.67 billion

- Total supply – 99.98B

- Circulating supply –57.88B

- XRP ranking – #3

The XRP price has pulled back from recent highs but still holds key support zones. Strong trading volume suggests active interest despite short-term price swings. The daily chart for XRP/USD shows that the price currently trades at $2.45, with a 3.78% decrease on the day.

The price is slightly above the upper boundary of a bullish flag, with the nearest resistance at $2.73 and the nearest support at $2.27. The 50-day MA (2.73) is slightly above the 200-day MA (1.48), indicating a minor bullish momentum.

Suppose the bulls sustain the price above the 50-day moving average at $2.73; there is potential for further upside. In that case, there is a strong possibility that XRP will push toward the $2.84 resistance level, where a breakout could trigger further upside potential to $3.00 in the short term.

XRP Price Poised for a Rebound Above the $2.73 Resistance Level

A closer look at the technical perspective shows that XRP trades between $2.28 and $2.82, showing signs of consolidation. On the bearish side, failure to hold above the moving $2.73 mark could see XRP retracing toward the $2.29, $2.18, and $2.05 support levels. However, the notable increase in trading volume suggests that market participants are optimistic about further price gains.

Looking ahead, the next move will depend on whether XRP can sustain momentum above the 50-moving average. A strong push toward the $2.84 resistance zone would confirm bullish control, and breaking above this level could open the door for higher price targets toward the resistance levels of $3.14, $3.35, and $3.70.

On the other hand, if $2.27 fails to hold as support, then traders should be cautious of a potential retest of $2.18, which could signal a deeper pullback. The current uptrend remains intact, but traders should watch for increased volume and momentum confirmation to determine the next major price direction.

Technical Indicators Show Potential Downside

A zoomed outlook at the Relative Strength Index (RSI) at 41.48 shows dwindling buying momentum. Its position below the 50-mean level shows intense selling pressure, tilting the odds towards the sellers. However, if the bulls initiate a buy-back campaign at this level, the RSI could hurtle above the mean level, invalidating the bearish bias.

The Moving Average Convergence Divergence (MACD) notably upholds a sell signal. This is evident as the blue MACD line (-0.0344) has crossed below the orange signal line (-0.0328). Traders are inclined to buy more XRP only when the blue MACD line flips above the signal line toward the positive territory.

On-chain data further supports a potential upward trajectory in the XRP market. Despite a slight pullback in open interest by 2% to $3.70B, the trading volume has spiked 95% to $5.27 billion. This suggests increased market activity that may trigger a rally to $3.70 in the near term.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.