Highlights:

- The price of XRP jumps 5% to $2.28, with a 65% rise in trading volume.

- The number of XRP Ledger addresses continues to increase, reflecting growing network usage and demand for XRP.

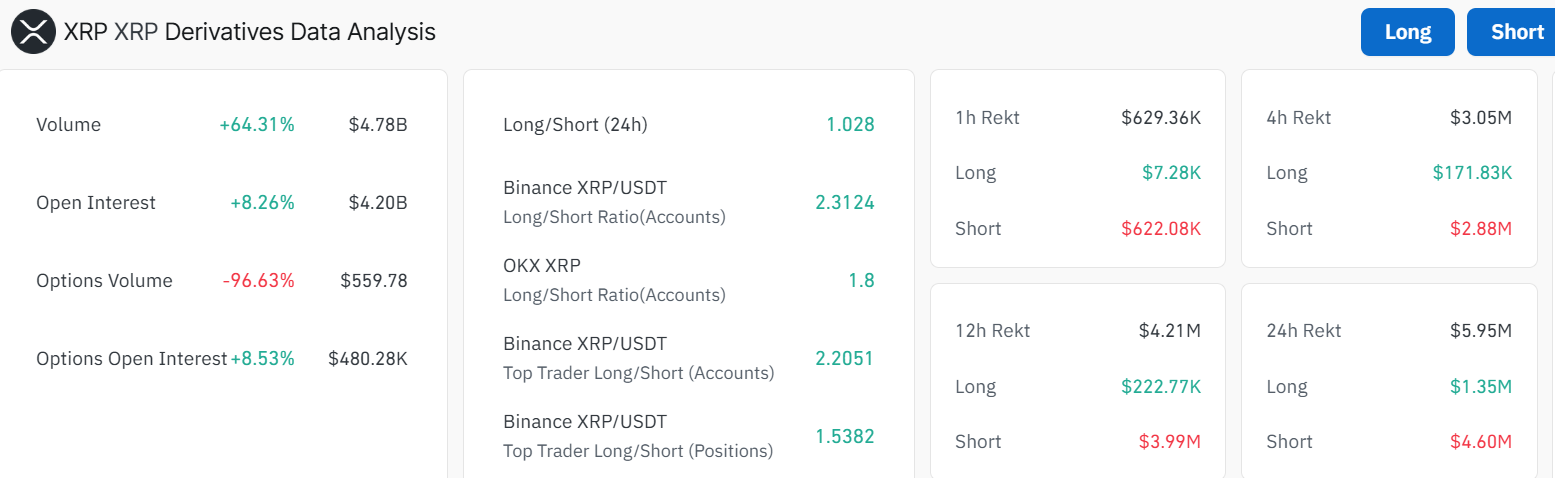

- XRP derivatives market sees a surge with a 64.31% increase in volume and a long-to-short ratio of 1.028, showing strong bullish sentiment.

The XRP price has shown signs of life, surging 5% to trade at $2.28 in the past 24 hours. Notably, there has been a 65% increase in trading volume, reflecting high market activity. This rise comes as the total number of XRP Ledger addresses has been on the upward trend. This growth plays a crucial role in the XRP ecosystem, as it signifies not only an increase in the number of active users but also a higher level of network usage.

The number of addresses on the $XRP Ledger is steadily increasing.

The $XRP ecosystem is growing.

The growth of the ecosystem means increased demand. This will be reflected in the increase in price. pic.twitter.com/GsiASThxgQ

— CW (@CW8900) June 16, 2025

XRP Price Technical Outlook

XRP is now fluctuating within the ranges of 2.27 and 2.38, as shown on the daily price chart. At this time, the bulls have built formidable support around the $2.27 level, which coincides with the 50-day MA, and face immediate resistance at the $2.38 mark.

The Relative Strength Index (RSI) is 53.59, indicating that XRP is neither overbought nor oversold. Moreover, there is more room for the upside before it is considered overbought. The Moving Average Convergence Divergence (MACD), which has crossed the orange signal, has suggested that traders should buy more XRP. This can trigger a powerful rally, and the bulls may surge to reach the resistance level of $2.38 in the short term.

XRP Derivatives Market: Increased Activity and Growing Market Sentiment

The Ripple derivatives market is not left behind, as it exhibits signs of progressive growth, characterized by high volume and open interest. The XRP volume over the past 24 hours has grown by 64.31% to $4.78 billion. On the other hand, the open interest has risen by 8.26%, standing at $4.20 billion. These figures portray some growing demand for XRP, particularly among institutional traders. This is evident as the open interest represents the sum of each contract transaction on the derivatives market.

Another interesting indicator is the long-to-short ratio of XRP, which stands at 1.028. This indicates that long positions are being demanded at a higher level compared to short positions. This further reinforces a bullish sentiment in the market. Recent data from the past hour indicates that most liquidations involve short positions, which is another good indicator of XRP’s uptrend. The increase in long positions and the derivatives interest is a good indication that the market is active and capable of taking the XRP price up in the short term.

What’s Next with the XRP?

The XRP market is portraying signs of life as the bulls aim for higher levels. If the support at $2.27 holds, a strong rally toward $2.38 could be imminent. A break above this level may open the doors for further upside towards the $2.50, $2.66, and $2.82 mark.

On the other hand, if the bears enter the market, the altcoin may drop, with the $2.27 support level acting as a safety net. Increased selling pressure may cause a further drop towards the $2.21 and $2.17 support zones. Meanwhile, since the XRP network is becoming part of the financial world to a greater extent, the future of XRP is bright. Traders should closely monitor the key technical indicators, including support and resistance levels, to determine the next move in the XRP market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.