Highlights:

- The SEC has revealed that it will not take immediate decisions on CoinShares’ XRP and Litecoin ETFs.

- According to a new filing, the deadline for the SEC verdict has been shifted from May 26 to August 24, 2025.

- In a separate filing, the US regulatory agency acknowledged Canary’s Capital staked Tron Proposal.

According to a May 22 filing, the United States Securities and Exchange Commission (SEC) has again postponed its final decisions on two Exchange Traded Funds (ETFs) filings. The affected ETFs were CoinShares XRP and Litecoin ETFs. For context, asset management firm CoinShares initially applied to trade and list shares of its XRP and Litecoin ETFs on Nasdaq’s exchange in February 2025.

However, the SEC has continuously delayed its decisions on the proposals. Yesterday’s announcement marked the SEC’s third postponement of CoinShares’ LTC and XRP ETF applications verdict, extending the final decision date from May 26 to August 24, 2025.

The US SEC postponed the decision on XRP and Litecoin spot ETFs, and officially accepted the application for TRX pledge ETF

Bloomberg ETF analyst @JSeyff said that the US SEC decided today to postpone the decision on Bitwise and CoinShares' XRP spot ETF, and CoinShares' Litecoin… pic.twitter.com/lOEs65Tfp4

— Mini Lab (@Minilaboratory) May 23, 2025

XRP and Litecoin ETFs Postponement Reasons

Contrary to the crypto community’s expectations, the SEC has maintained a cautious stance on ETF approvals. Citing the reasons for the latest postponement, the commission said it needed extra time to investigate potential risks in the filings.

These include assessing the possibilities of facilitating market manipulation and other fraudulent acts through these ETFs. The SEC also mentioned that the additional time will enable it to review Nasdaq’s trading rules to ensure investors’ protection.

Meanwhile, the SEC’s new filing also called for public opinions and rebuttals on the ETFs. “The commission requests that interested persons provide written submissions of their views, data, and arguments with respect to the issues identified above, as well as any other concerns they may have with the proposal,” the commission stated.

According to the SEC, the deadlines for comments and rebuttals will be 21 and 35 days after publishing the filing in the Federal Register. Earlier this week, the SEC issued similar postponement filings on several ETF filing applications. Some affected proposals include 21Shares, Bitwise, and Grayscale’s ETF applications. Moreover, market participants anticipate similar delays on WisdomTree and Canary Capital’s ETF proposals.

SEC Acknowledges Canary’s Staked TRX ETF Filing

In another May 2 filing, the SEC acknowledged Canary Capital’s staking-based Tron (TRX) ETF application. The court’s document responded to the Cboe BZX Exchange 19b-4 proposal seeking the commission’s approval to trade and list shares of the Canary Staked TRX ETF under BZX guiding principles.

The regulatory agency stated:

“The Commission is publishing this notice to solicit comments on the proposed rule change from interested persons.”

Canary Capital started applying for the staked ETF in April. The SEC’s acknowledgment of the proposal marks a landmark achievement for the investment manager, bringing the SEC’s final verdict closer. The asset manager said the ETF will help slash the Trust’s operations costs and eliminate liabilities. Notably, Canary Capital Group LLC will sponsor the ETF. In addition, the shares will be registered with the commission via the Trust’s registration statement.

SEC ACKNOWLEDGES FIRST STAKED TRON ETF — IS MAINSTREAM STAKING FINALLY HERE?

– The U.S. Securities and Exchange Commission (SEC) officially acknowledged Canary Capital’s filing for a staked $TRX ETF.

– This acknowledgment, published as a notice by the SEC, brings the proposal… pic.twitter.com/rzM3QoWSX0

— BSCN (@BSCNews) May 23, 2025

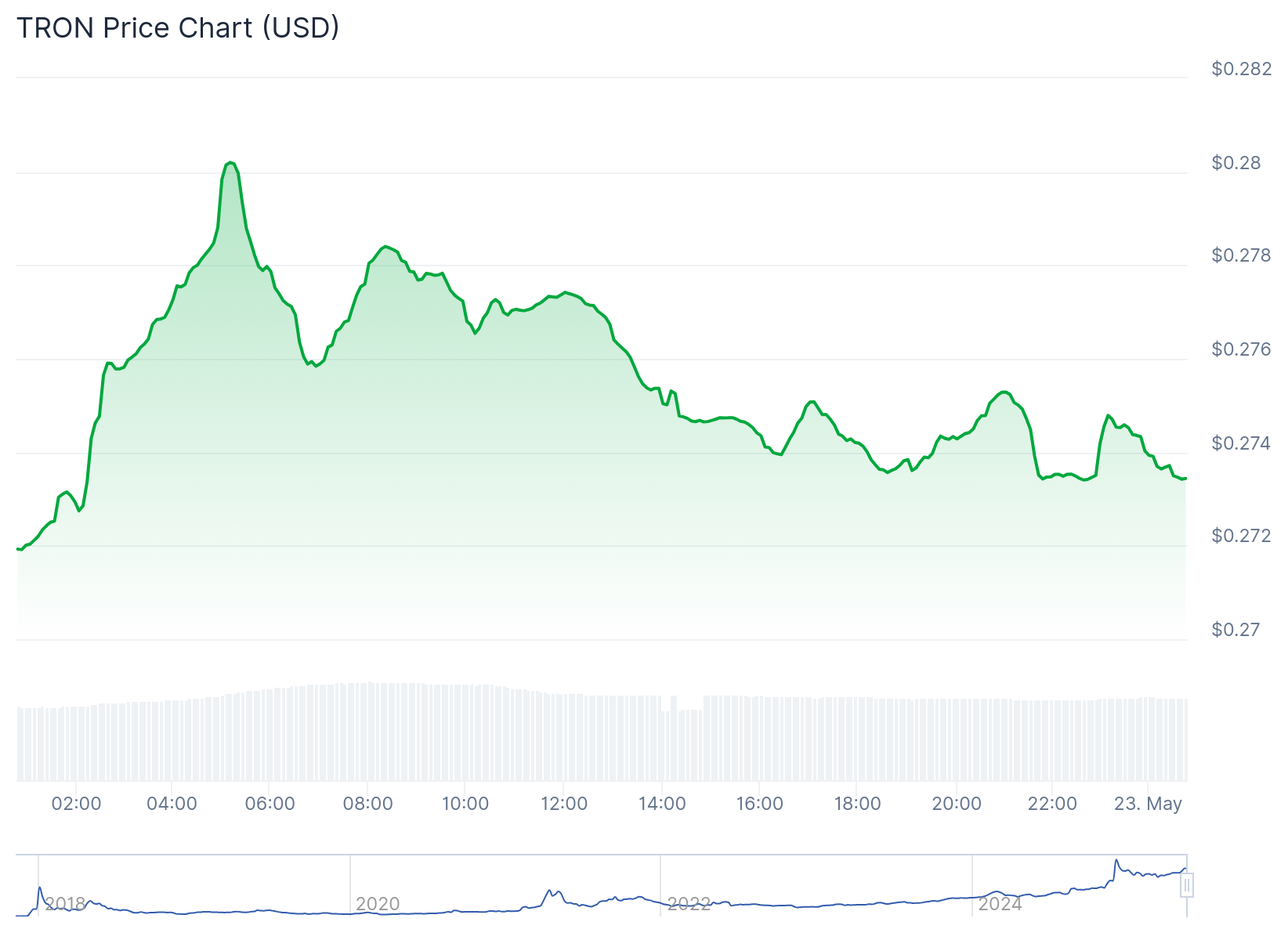

Tron Price Jumps 0.1%

After facing significant bouncebacks in the past few days, the crypto market has slightly retraced, reflecting a 1.7% decline in the past 24 hours with a $3.63 trillion valuation. In contrast, Tron is up 0.1% in the past 24 hours, trading at approximately $0.2745 and fluctuating between $0.2717 and $0.2802. The token is ranked tenth on CoinGecko with a $26.05 billion market capitalisation.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.