Highlights:

- The XLM price has soared 13% to $0.2864, signaling strong market momentum.

- Franklin Templeton and Circle have invested nearly $500 million in U.S. Treasuries on the Stellar network.

- XLM technical indicators suggest further upside with the bulls eyeing $0.30 and beyond.

The stellar price (XLM) has recently garnered significant attention, with a 13% rise over the last day, to $0.2864. Accompanying the price movement is its daily trading volume, which has skyrocketed 169% suggesting heightened market activity. XLM is now up 24% in a week and 9% in a month.

This rise is associated with several significant events within the Stellar ecosystem. Recently, Franklin Templeton and Circle entered the Stellar ecosystem with real U.S. Treasuries worth almost half a billion dollars is indicative of the budding institutional interest in blockchain.

$XLM holders, have you actually looked at this? 👀

Franklin Templeton and Circle aren’t playing with testnets, they’ve dropped nearly half a billion in real U.S. Treasuries on Stellar.

THIS IS BULLISH 🔥

How long before the rest of TradFi catches on and starts piling in? pic.twitter.com/1v8Z5PalcL

— X Finance Bull (@Xfinancebull) July 9, 2025

According to the reports, the relocation is an experiment that Stellar offers significant benefits for large financial operations. The Treasury bond-backed assets stored on the Stellar network signify a significant shift in how traditional finance (TradFi) leverages the power of blockchain. The news is regarded as a significant bullish move for XLM. This is evident as institutional investors are showing monumental strides towards penetrating conventional financial markets with regard to digital currency.

Bullish Indicators Signal Further Upside

The Stellar price has spiked above the descending parallel channel, indicating further upside potential. The XLM token has been on a prolonged downtrend; however, recent developments are breathing new life into XLM. Moreover, the bulls are having the upper hand, as they have flipped $0.26 into immediate support, eyeing the next resistance at $0.30.

The Relative Strength Index (RSI) is also at 68.58, which is almost in the overbought region. Meanwhile, the market remains in a healthy bull market, indicating that further gains are possible before resuming an extended period of correction.

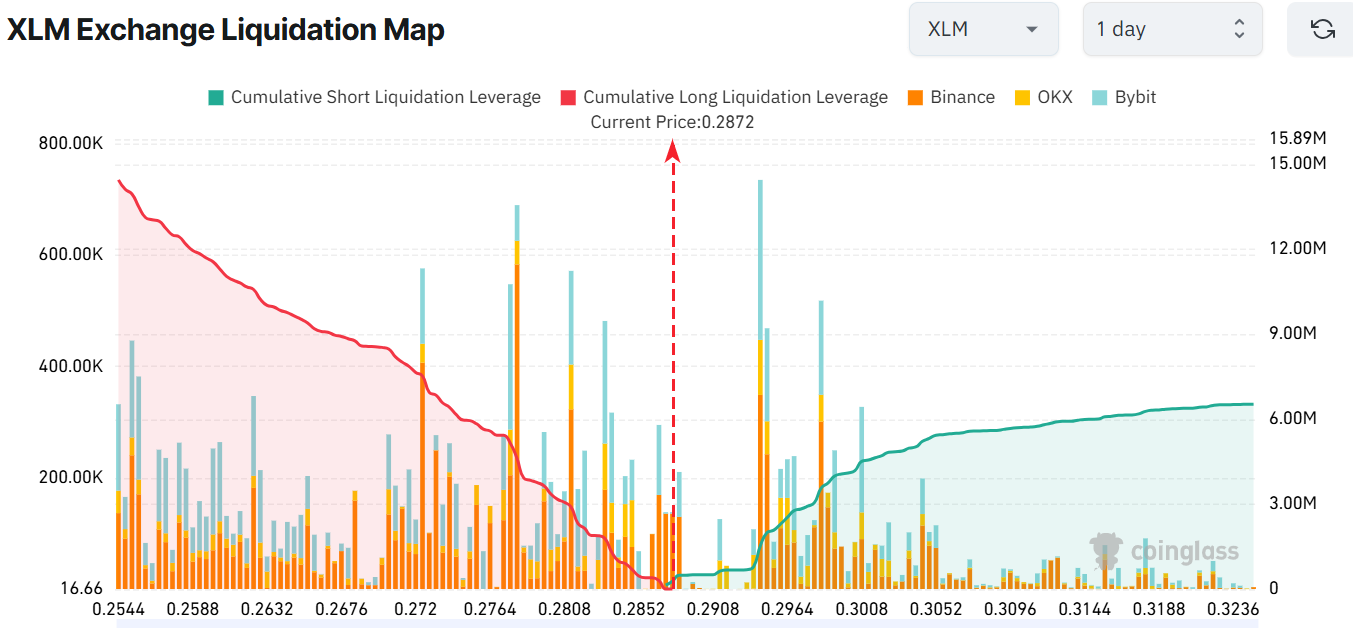

Furthermore, the bullish mood has been confirmed by the Moving Average Convergence Divergence (MACD) indicator. This is evident as the MACD line is above the signal line, indicating continued buying interest. The combination of this fact with the powerful breakout beyond key support levels makes XLM a candidate that may be poised for growth. There is also a change in the XLM market regarding liquidations. The exchange liquidation map indicates that the cumulative long liquidation ($14.45 million) has increased, whereas short liquidations($6.52 million) exhibit high volatility.

This implies that there could be a sudden surge in the price of XLM once it overcomes the present resistance. This imbalance suggests a high likelihood of a short squeeze, which could lead to an upside movement in the Stellar price.

XLM Price Could Cool Off Before Another Rally

The 24% weekly gain is a sign that the community is optimistic. However, the overextension of the RSI may lead to a slight correction before a rally. If the current conviction holds, the bulls may overcome the $0.30 resistance towards $0.38-$0.40. On the flip side, if the $0.26 support cracks, the XLM price could slide back to $0.25-$0.22 safety nets. Traders should monitor the current support and resistance zones to determine the next move in the XLM market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.