Highlights:

- The price of Worldcoin has increased about 23% to $1.15, as bulls entirely take the reins.

- Bitrue crypto exchange has enabled the WLD token on its World Chain Mainnet.

- WLD technical indicators show overbought conditions calling for caution among traders.

The Worldcoin price has spiked 23% to trade at $1.15, as the bulls put their best foot forward. Accompanying the bullish outlook is its daily trading volume, which has soared 136% to $1.12B. This indicates intense reading activities among investors, which could fuel the Worldcoin price surge.

Meanwhile, the mainnet launch for Worldcoin has introduced fresh possibilities for the platform and improved its decentralized features. According to Bitrue crypto exchange, the network can now provide enhanced scalability and affordable and rapid digital access anywhere worldwide. With the launch, Worldcoin is better placed to advance and compete strongly with other cryptocurrencies.

🚀 #Bitrue now supports $WLD on the World Chain Mainnet @worldcoin

🔹 Deposits now opened via World Chain Mainnet

🌐 Worldchain is Worldcoin’s Layer 2 blockchain that verifies human identity onchain and enables fast, low-cost global digital access.

👉 More details:… pic.twitter.com/7dwDOXtZVG

— Bitrue (@BitrueOfficial) May 23, 2025

The on-chain identity verification by Worldchain Mainnet helps make the system reliable. By introducing these changes, Worldcoin hopes to develop a worldwide financial and identity network that seeks to be both accessible and efficient.

WorldCoin Price Technical Outlook

WLD technical indicator readings and market activity suggest the market is on a bullish trend. Looking at the daily chart for Worldcoin (WLD/USD), it’s obvious the token is on the rise. Lately, WorldCoin price has moved beyond the $1.54 resistance point, showing that bullish energy is building up. With a valuable RSI at 72.33, the asset is attracting lots of purchases, but one should be cautious as it sits around the overbought zone.

The MACD indicator is a confirming signal of better price movement by indicating upward momentum. It has flipped above the orange signal line, calling for more buying opportunities in WLD market.

On the other hand, the bulls have flipped the 50-day MA at 0.97 into immediate support, giving the bulls hind wings to target higher levels. Currently, the $1.63, which is in line with the 200-day MA, is the immediate resistance cushioning the bulls against further upside.

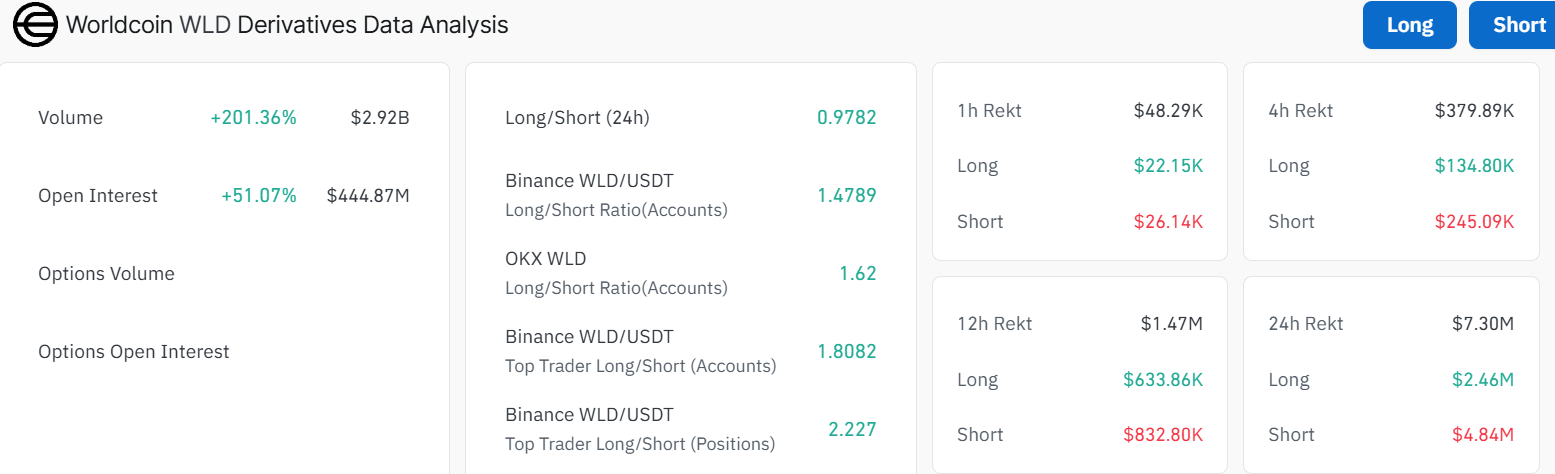

WLD Derivatives Data Analysis

Analyzing derivatives data proves how enthusiastic traders are at the moment. According to Coinglass data, WLD volume has gone up by 201%, open interest increased by 51%, and option trading is higher. This is a clear indication that the market is active and assured. Based on the long/short ratios at Binance and OKX, traders seem to think the market will keep surging, triggering a rally in WorldCoin price.

However, the bulls need to build more strength, because only a close above the $1.63 resistance will open the doors for further upside. In such a case, the WLD price could target $1.88, $2.33, and $2.57. Moreover, the consolidation channel may act as an accumulation period before the bulls strike up, reclaiming the $2 mark.

On the other hand, traders should be cautious as the token has hit the overbought region. This may cause a little retracement to enable the bulls to sweep through liquidity before further upward. In the case of a correction, the Worldcoin price will drop to $1.36. A break below this level will cause a deeper correction to $1.21, and $1.06 support zones. Until then, traders should be cautious to evade the bull trap as the token boasts overbought conditions.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.