Highlights:

- Gemini founders are eyeing a U.S. IPO this year amid early advisor talks.

- Robust trading volume and SEC-led regulatory reforms bolster Gemini’s industry prominence and IPO potential.

- Gemini accelerates European expansion, appointing three new executives after its VASP license.

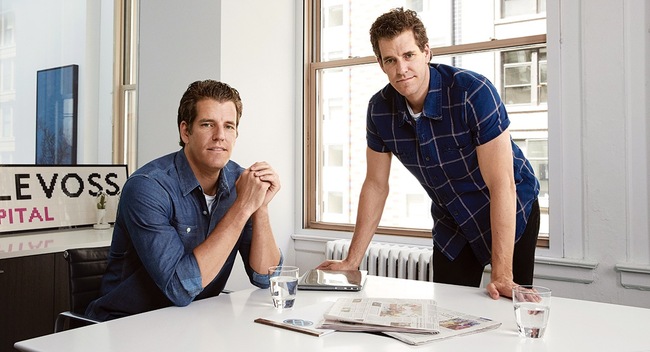

Tyler and Cameron Winklevoss, the founders of crypto exchange Gemini, are considering conducting an Initial Public Offering (IPO) in the United States that might take place this year, Bloomberg reported, citing people familiar with the matter. The firm has begun talks with multiple entities, including financial advisors, but no key IPO details have been decided yet.

Gemini, the cryptocurrency firm backed by the billionaire Winklevoss twins, is considering an IPO as soon as this year https://t.co/oqWbt5wZ5H

— Bloomberg (@business) February 6, 2025

As Gemini pursues its IPO plans, it remains committed to business expansion. Last month, the company appointed three new executives to lead its growth in the European Union. This move builds on its progress after securing a Virtual Asset Service Provider (VASP) license in France last November.

The firm ranks among the largest global exchanges by 24-hour trading volume, with approximately $173 million, according to CoinMarketCap. It also manages around $8.20 billion in assets under custody. Gemini’s IPO plans come as Bitwise predicts five “crypto unicorns” may go public this year. In December, Bitwise listed Circle, Figure, and Kraken as possible candidates.

Despite its growth, Gemini has faced regulatory challenges. On January 7, the co-founders paid a $5 million fine to settle a CFTC lawsuit. The lawsuit accused the exchange of misleading regulators when trying to launch the first US-regulated Bitcoin futures contract. It has also refunded $1.1 billion to Gemini Earn customers and paid a $37 million fine for compliance failures.

Gemini’s IPO and SEC’s Efforts to Shape U.S. Crypto Leadership

The crypto exchange plans align with Donald Trump’s promise to establish the U.S. as a global hub and crypto. Moreover, Crypto-friendly SEC Commissioners Hester Peirce and Mark Uyeda are working to create clearer regulatory frameworks for the industry. Gemini first considered going public in 2021 but later postponed the plan.

In January 2021, the Winklevoss brothers reportedly stated:

“We are watching the market and we are also having internal discussions on whether it makes sense for us at this point in time. We are certainly open to it.”

Bloomberg ETF analyst James Seyffart stated that more crypto firms are expected to pursue IPOs in the coming years, driven by the pro-crypto agenda signaled by Trump’s administration.

There's likely gonna be a lot of crypto-related IPOs in the next couple years. https://t.co/QenFZUIeim

— James Seyffart (@JSeyff) February 6, 2025

Crypto Giants Eye Public Listings

Gemini joins major crypto firms eyeing public listings amid regulatory shifts. Meanwhile, Bullish Global, backed by Peter Thiel, is collaborating with Jefferies Financial Group and JPMorgan on a possible IPO this year.

Social trading platform eToro has secretly submitted its US IPO filing, seeking a valuation exceeding $5 billion. The company plans to go public in New York by Q2, with Goldman Sachs, Jefferies, and UBS overseeing the process.

Circle, the company behind the USD Coin (USDC) stablecoin, has also submitted confidential IPO paperwork to the Securities and Exchange Commission and awaits regulatory approval. Ripple, the firm associated with XRP, also plans to go public, but ongoing SEC legal issues make a 2025 listing unlikely.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.