Highlights:

- Litecoin whale investors elicit market actions, resulting in over $2 billion LTC-processed transactions.

- The over $2 billion transactions imply a value greater than 50% of Litecoin’s market cap.

- Technical analysis reveals LTC’s upward trajectory with $69.656 as the next breakout point.

Decentralized crypto protocol Litecoin (LTC) is making waves, with processed transactions hitting over $2 billion. Interestingly, the transactions averaged $100,000 daily, signifying massive whale investors’ actions.

Renowned data analytical platform “IntoTheBlock” captured the tremendous spike in LTC’s processed transactions and reported it via its X handle. Consequently, it will not be surprising if market participants become concerned about the price impacts of the significant token shifts. Hence, this insight will delve into the details of the massive token transfer, with possible price Implications for LTC.

Litecoin Transactions Details

According to IntoTheBlock’s post, the exact amount of processed Litecoin transactions was about $2.85 billion. As earlier stated, these transactions are worth over $100,000 daily, with a total valuation topping 50% above LTC’s market cap.

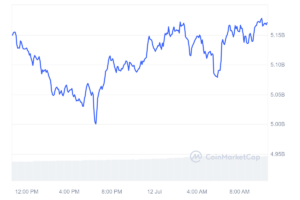

For context, Litecoin is changing hands at approximately $69, having registered a slight 0.58% upswing in the past 24 hours. The Peer-to-Peer (P2P) cryptocurrency boasts a 74.7 million circulating supply, with a market capitalization of $5.16 billion. Therefore, it supports the above assertion about $2.85 billion processed Litecoin transactions exceeding 50% of LTC’s valuation.

Litecoin Transactions Supercedes Most Layer 1s

Relative to most Layer 1s, IntoTheBlock noted that Litecoin transactions appear massive. “For example, Dogecoin sees $590 million in large transactions, despite having roughly 3x Litecoin’s market cap,” IntoTheBlock remarked.

Litecoin processes $2.85 billion in transactions over $100k daily (avg), over 50% of its market cap.

📊 This is more than most Layer 1s. For example, Dogecoin sees $590 million in large transactions, despite having roughly 3x Litecoin's market cap.

🐋 This suggests significant… pic.twitter.com/YpPKIsEMuO

— IntoTheBlock (@intotheblock) July 12, 2024

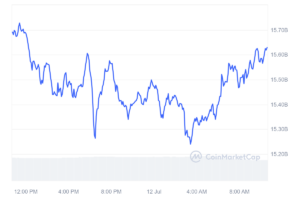

Notably, Dogecoin (DOGE) is trading at roughly $0.107, courtesy of a 1.46% decline in the past 24 hours. In addition, the Elon Musk-inspired token possesses a 145.09 billion circulating supply, amounting to a $15.6 billion market cap. Hence, it supports the above claims about DOGE, boasting a 3X LTC market cap.

Litecoin’s Breakout Seems Imminent

Per Litecoin’s technical analysis, a breakout could be on the horizon, evidenced by an upward trajectory on the chart. Notedly, LTC is changing hands in a narrow range with $69.656 as resistance and $66.205 as support. Should the bull continue to garner momentum, chances about the possibility of exceeding $69.656 abound.

If LTC eventually converts $69.656 to support, its next target will tend toward breaking above another impedance level at $70.692. Breaking above $70.692 implies a bullish momentum that would peak once Litecoin surpasses $76.237.

However, if the bear begins to outweigh the bull, a declining phase would likely set in with $57.708 as a potential target. Meanwhile, considering Litecoin attained a $412.96 all-time high (ATH) in May 2021, this cycle’s peak could see the token exceed $200. Consequently, the token could surge toward attaining a new ATH significantly higher than the current one.

Negative Netflows Value Persists

Despite a heightened transaction value, Litecoin’s netflows value remains negative at $21.5 million. Therefore, it implies that accumulating actions seem elevated relative to dumps, indicating an increased token interest. However, in comparison to other tokens, the negative value appears meager, which could imply a gradual swing in investors’ choices.

Meanwhile, at LTC’s current price, only 29% of the token holders are making profits. 9% are neither losing nor gaining, while 62% are accumulating losses. Litecoin’s whale investors appear relatively reasonable, considering they are contributing 48% of the coin holders’ pool.