Highlights:

- WV senator proposes a treasury investment bill, allowing 10% in digital assets.

- Inflation Protection Act targets investments in digital assets with market caps over $750B.

- U.S. states increasingly pursue Bitcoin reserves despite critics citing significant price volatility.

On Feb. 14, West Virginia State Senator Chris Rose introduced a bill to allow the state’s treasury to invest a portion of its holdings into digital assets or precious metals. The Inflation Protection Act of 2025 proposes allowing investments in digital assets with a market cap of over $750 billion. Currently, only Bitcoin (BTC) meets this requirement, as Ethereum (ETH) has a market cap of $328.3 billion, less than half the required threshold.

The bill limits the treasury to investing only 10% of its total funds in digital assets and precious metals. It also allows the state to hold these assets either on-chain or through exchange-traded funds (ETFs). Senator Rose’s proposal is part of a rising trend where states seek to create Bitcoin or digital asset reserves. These reserves aim to protect against inflation caused by structural deficit spending.

Moreover, the bill lets the state treasurer loan or stake digital assets if there is no added financial risk. Bitcoin cannot be staked directly because it uses a proof-of-work system. However, it can be staked in a wrapped form or through a staking pool. The bill is now with the Committee on Banking and Insurance and will later go to the Committee of Finance.

🚨NEW: West Virginia Bitcoin Reserve bill

SB 465 would allow the state to invest 10% of public funds, plus public retirement funds, into Bitcoin.

WV is the 23rd state to introduce ‘Bitcoin Reserve’ legislation. pic.twitter.com/vlr4lpXPbr

— Julian Fahrer (@Julian__Fahrer) February 14, 2025

Supporters believe this diversification can help guard against inflation and financial instability. They argue it is crucial as concerns grow over the long-term effects of deficit spending at both state and federal levels.

U.S. States Push for Digital Asset Reserves Amid Growing Interest

On Jan. 23, U.S. President Donald Trump formed a working group to assess the viability of a digital asset reserve for the federal government. After this initiative, multiple states have introduced, updated, or progressed legislation to create digital asset reserves.

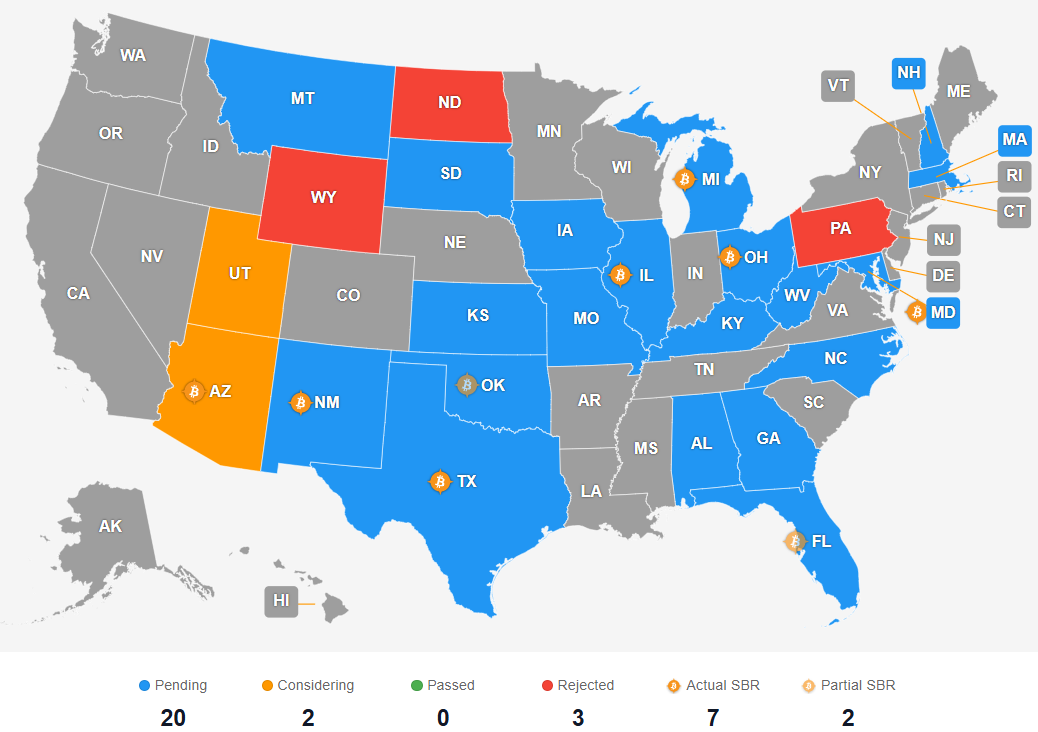

Twenty-two states have introduced crypto reserve bills, with Arizona and Utah leading the progress. Currently, 20 bills are pending, 2 are under review, none have been approved, and 3 have been rejected. Bitcoin reserve bills have faced rejection in North Dakota, Pennsylvania, and Wyoming.

More states adopting Bitcoin reserves could increase demand for digital assets. This shift may impact market prices and financial trends. VanEck, an asset management firm, estimates that such legislation could drive up to $23 billion in Bitcoin demand. This trend may also attract more institutional investors. State treasuries are beginning to recognize Bitcoin as a legitimate reserve asset, similar to gold.

However, critics argue that Bitcoin’s price volatility could create risks for public treasuries. ECB board member Piero Cipollone said that the European Central Bank might review its ties with any European national bank that adds Bitcoin to its reserves. In a Feb. 6 interview, Cipollone explained that if a national bank holds Bitcoin, it must carefully assess the risks tied to its repurchase agreements and swap lines.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.