Highlights:

- Ethereum co-founder Vitalik Buterin has dismissed claims of selling Ethereum for profits.

- The co-founder asserted that every proceeds from Ethereum sales went into the Ethereum ecosystem expansion and other charity deeds.

- Ethereum’s price remained relatively stable, evidenced by minimal changes in its 24-hour variables.

Ethereum (ETH) co-founder Vitalik Buterin has refuted allegations claiming he cashed out profits from Ethereum sales. Writing on his verified X handle, the co-founder noted that he has never kept proceeds from Ethereum sales since 2018. In addition, Buterin asserted, “All sales have been to support various projects that I think are valuable, either within the Ethereum ecosystem or broader charity.”

I haven't sold and kept the proceeds since 2018. All sales have been to support various projects that I think are valuable, either within the ethereum ecosystem or broader charity (eg. biomedical R&D)

— vitalik.eth (@VitalikButerin) August 31, 2024

Aside from clarifying claims about selling his ETH stores for profits, the above statement was Buterin’s response to an X user’s post that supported cryptocurrency founders selling their tokens for profits. For context, the tweet that attracted Buterin’s attention was from a verified X user with the pseudonym “Ansem.”

Writing on X, Ansem argued, “What is crypto people’s obsession with founders never selling coins? Bro, he created the second most important project in crypto’s history, and I think it is ok for him to take some profit.”

Initial Ethereum Sales Claims

Before now, news about the Ethereum co-founder’s trading escapade involving Ethereum broke out. Surprisingly to most ETH enthusiasts, the stories conveyed that Buterin has been selling off his ETH holdings for profit.

Adding to market participants’ amusement was that Buterin remained highly bullish on ETH’s appreciation potential. Hence, it is unsurprising that they are against the Ethereum co-founder for selling his ETH stores.

For context, in a tweet dated August 30, 2024, Lookonchain reported that the Ethereum co-founder transferred 800 ETH worth approximately $2.01 million to a multi-sig wallet. A few minutes after the transfer, the multi-sig wallet exchanged the 190 ETH for 477K USDC, painting a potential scenario of earning profits, as earlier asserted.

Aside from the transfer reported on August 30, Lookonchain captured another transaction involving 3,000 ETH worth $8.04 million. The second transaction occurred on August 9, involving a transfer from Buterin to the same multi-sig wallet.

vitalik.eth(@VitalikButerin) transferred 800 $ETH($2.01M) to a multisig wallet again 40 minutes ago.

The multisig wallet swapped 190 $ETH for 477K $USDC later.

On Aug 9, #Vitalik also transferred 3,000 $ETH($8.04M) to this multisig wallet.https://t.co/81Vf39bvbL pic.twitter.com/6IlwtcqvPg

— Lookonchain (@lookonchain) August 30, 2024

Buterin’s Response to Centralization Claims

Interestingly, the events that played out in this insight are not the first the Ethereum co-founder debunked false claims. In previous news, Buterin refuted claims discrediting Ethereum’s decentralization goals.

To clarify, Péter Szilágyi is a member of Ethereum’s development team. Hence, his statement raised eyebrows about Ethereum’s decentralization attainment project from enthusiasts. Reacting to Szilágyi’s question, Buterin reiterated Ethereum’s commitment towards decentralization, highlighting feasible steps to actualize the target.

According to the co-founder, some measures include proposals for several protocol positions, enhancing fork selection procedures to prioritize transaction inclusiveness, and modifying inclusion lists. Another significant step involved Orbit mechanism implementation. It proposes lowering the minimum deposit size for staking. By doing so, the mechanism is increasing access to network participation.

How Has Ethereum’s Price Reacted to the Co-Founder’s Claims?

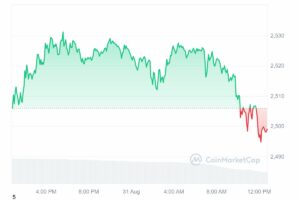

At the time of press, Ethereum is changing hands at approximately $2,500, mirroring a slight 0.4% decline in the past 24 hours. Within the same timeframe, ETH recorded minimum and maximum prices, ranging between $2,494.85 – $2,531.17.

The above price extremes underscore minimal activities in the past 24 hours. Other relevant statistics revealed that Ethereum boasts a market capitalization of over $300 billion. Its 24-hour trading volume is down by 54.22% with a $7.33 billion valuation.