Highlights:

- VanEck registered the “VanEck Avalanche ETF” in Delaware, indicating a potential AVAX ETF launch.

- This marks VanEck’s fourth standalone crypto ETF registration, following Bitcoin, Ether, and Solana.

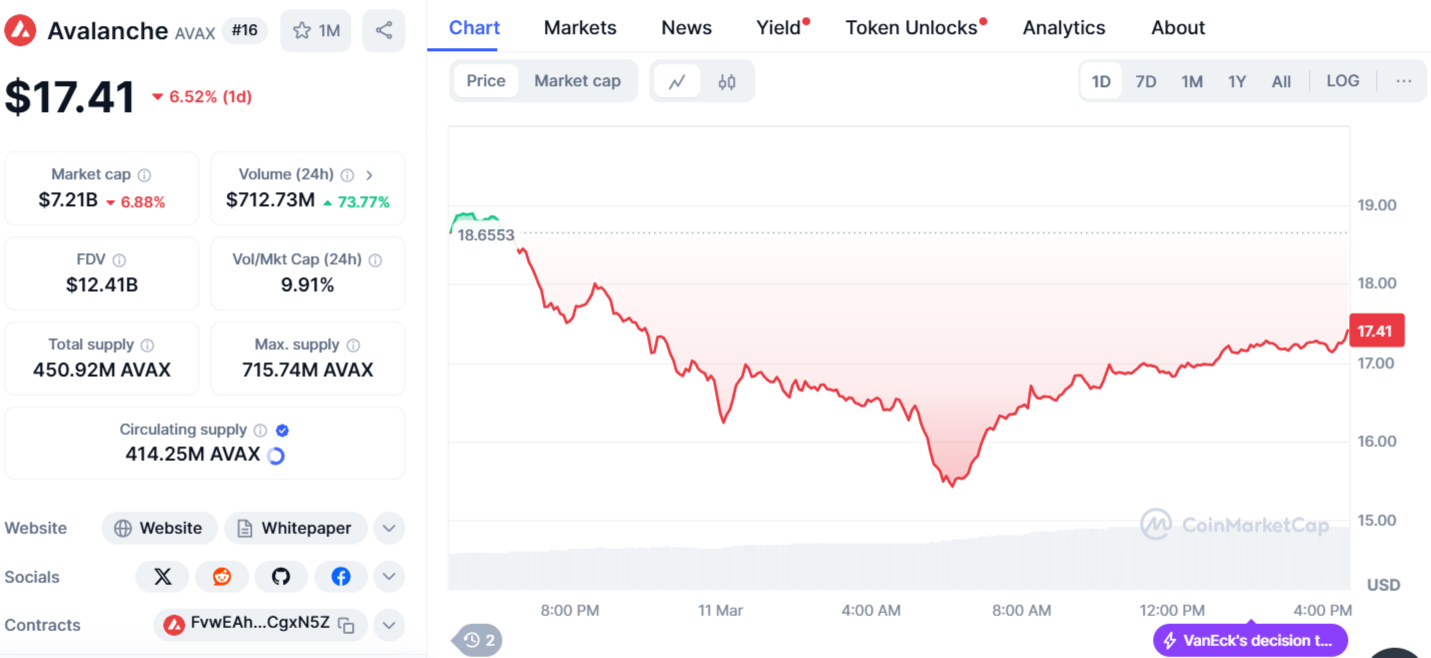

- AVAX is recovering after the recent market crash, facing resistance around the $17 level.

On March 10, global investment firm VanEck officially registered a statutory trust for an Avalanche (AVAX) exchange-traded fund (ETF) in the state of Delaware. This has raised hopes for a spot AVAX ETF filing with the U.S. Securities and Exchange Commission (SEC) soon.

BREAKING: VanEck just registered for an Avalanche ETF!

This could indicate they may soon file for a spot $AVAX ETF. 👀

Major news for team dorito! 🔺 pic.twitter.com/s4KR0qwsTd

— Kyle Willson (@KyleWillson) March 11, 2025

VanEck’s next move is expected to be filing a registration statement (S-1) with the SEC. This document will contain comprehensive details on the ETF’s structure, investment strategy, risk factors, and other regulatory aspects. Once submitted, the SEC will review the filing. It may ask for more details or changes. If approved it would enable investors to gain exposure to Avalanche without directly holding AVAX.

This registration is similar to its previous crypto ETF filings, which were also registered as trust corporate service companies in Delaware. This approach allows VanEck to benefit from Delaware’s favorable legal and regulatory environment for financial services. VanEck’s registration seems to be the first of its kind in the US. Earlier, Grayscale filed with the SEC in October last year to convert its multi-coin fund, including AVAX, into an ETF.

VanEck Expands ETF Offerings

Donald Trump’s victory led to changes at the US SEC, making asset managers more confident in filing crypto ETFs. After filing for a Solana ETF earlier this year, VanEck is now expanding its offerings with the Avalanche ETF. With this new filing, Avalanche became the fourth crypto asset to receive a standalone ETF registration from VanEck in Delaware, joining Bitcoin, Ether, and Solana.

AVAX Price Struggles Despite Strong Trading Volume and Potential Avalanche ETF Filing

As of writing, AVAX is trading at $17.41, reflecting a 6.52% drop in the past 24 hours. Over the past week, it has decreased by 12.90%. Avalanche’s underperformance stands in contrast to the global cryptocurrency market, which is down just 2.30% in the same period. Despite this, Avalanche’s trading volume has soared, rising 73.77% in the last 24 hours.

VanEck’s quick ETF filing could boost market confidence in AVAX, possibly driving its price up. However, AVAX is currently following a declining trendline, forming a bearish pattern. If AVAX holds the $17 resistance and continues rising, it could break through $20 and reach $25. However, if it fails to maintain this level, a drop to $15 is likely.

Avalanche Partners with Major Financial Players

Launched in 2020 by Emin Gün Sirer’s Ava Labs, Avalanche is a platform for smart contracts and decentralized apps. It was created to compete with Ethereum in speed and scalability. Avalanche’s token, AVAX, reached the top 10 largest crypto assets by market cap in 2021. Currently, it ranks 16th with a market cap of $7.21 billion, according to CoinMarketCap.

Avalanche is making strong progress in tokenization and already partners with major players like JPMorgan and Mastercard on projects like portfolio management. JPMorgan is connecting its Onyx platform with an Avalanche Evergreen Subnet. These subnets are custom blockchains designed for institutions.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.