Highlights:

- US Bitcoin ETFs experienced $1.2 billion in outflows in eight days, the longest streak since their launch.

- Bitcoin’s price fell 17.28% in early September, impacting market sentiment.

- Jim Bianco says Bitcoin ETFs need more time to mature fully.

US Bitcoin exchange-traded funds (ETFs) experienced the longest period of daily net outflows since their launch earlier this year. According to Bloomberg data, investors have withdrawn almost $1.2 billion from these 12 ETFs in eight days, from August 30 to September 6. The ongoing outflows from Bitcoin ETFs reflect rising investor concerns over economic instability.

US spot-Bitcoin ETFs posted their longest run of daily net outflows as $1.2 billion left the products https://t.co/SKOATIVjsS

— Bloomberg Markets (@markets) September 9, 2024

Economic Concerns Impact Bitcoin Performance

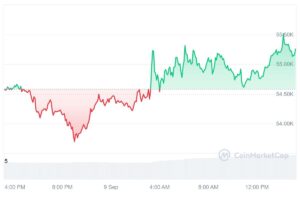

This comes as Bitcoin price fell sharply in the first week of September, dropping from $64,668 on August 26 to $53,491 by September 7—a 17.28% decline in just two weeks. Analysts note that September has historically been a weak month for BTC. Mixed US jobs data and deflationary pressures in China are impacting traders, creating uncertainty in the cryptocurrency market. This has led to an increased correlation between crypto and stock market fluctuations.

Sean McNulty, director of trading at Arbelos Markets, pointed out in a Bloomberg report that the recent small relief rally is partly due to prominent influencers closing their short positions. As an example, he pointed to a recent social media post by Arthur Hayes, co-founder of BitMEX.

McNulty noted that Donald Trump’s stronger performance in polls and prediction markets as the pro-crypto Republican presidential nominee may be boosting market sentiment. The community is bracing for potential volatility ahead of the debate between Trump and Vice President Kamala Harris, who has not yet revealed her stance on cryptocurrencies.

Outlook for Bitcoin

US Bitcoin ETFs, launched with high expectations in January, initially saw strong demand that propelled Bitcoin to a record high of $73,798 in March. Institutional interest in cryptocurrencies surged with the rise of these ETFs. However, since March, inflows have slowed, and Bitcoin’s year-to-date gain has moderated to around 30%.

Caroline Mauron, co-founder of Orbit Markets, predicted that Bitcoin would likely remain in the $53,000 to $57,000 range until the US releases its consumer price data on Wednesday. The inflation report could influence expectations for future Federal Reserve monetary easing, potentially impacting Bitcoin’s direction.

Crypto Takes Center Stage in 2024 ETF Launches

Despite the outflows, crypto remains dominant in the ETF space, even compared to the 400 new ETFs launched in 2024. Data from The ETF Store reveals that the four largest launches this year are all spot Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), Bitwise’s Bitcoin ETF Trust (BITB), and ARK 21Shares Bitcoin ETF (ARKB).

Out of the top 25 ETF launches by inflows, 13 are crypto-related. Ten of these are Bitcoin-based ETFs, while three focus on Ethereum. Notably, the iShares Ethereum Trust ETF (ETHA) ranked as the seventh-largest ETF launch in 2024, surpassing $1 billion in August.

Bitcoin ETFs Need More Time to Become ‘Instrument of Adoption’ — Bianco Research CEO

Jim Bianco, CEO of Bianco Research, commented in a September 8 X post that the Bitcoin ETFs US will require more time to evolve from a “small tourist tool” into an “instrument of adoption.” He said BTC ETFs have not met the pre-approval hype since their launch in January. Bianco suggested that recent outflows, losses by holders, and a lack of significant institutional investment indicate that the Bitcoin ETF market may need more time to mature.

1/8

Spot BTC ETFs update

tl:dr

* Inflows now outflows

* Holders have record losses

* Advisors <10% of holdings (boomers never came)

* Avg trade size now <$12k.It's not an adoption vehicle. Instead a small tourist tool and on-chain is returning to Tradfi.

See posts #4 and #8

— Jim Bianco (@biancoresearch) September 8, 2024