Highlights:

- The Uniswap price is showing a positive outlook, currently exchanging hands at $8.11, a 34% rise in a month.

- The derivatives data show a bullish sentiment as the funding rate flips positive.

- The technical outlook shows the bulls are in control, as they eye $8.65-$9.50 in the short term.

Uniswap price is responding positively, with the price up 2.64%, currently trading at $8.11. The daily trading volume has spiked 60% to $737 million, indicating heightened trading activity. Meanwhile, the derivatives data show a rise in bullish positioning, which is a positive indication of a continuation of the upside.

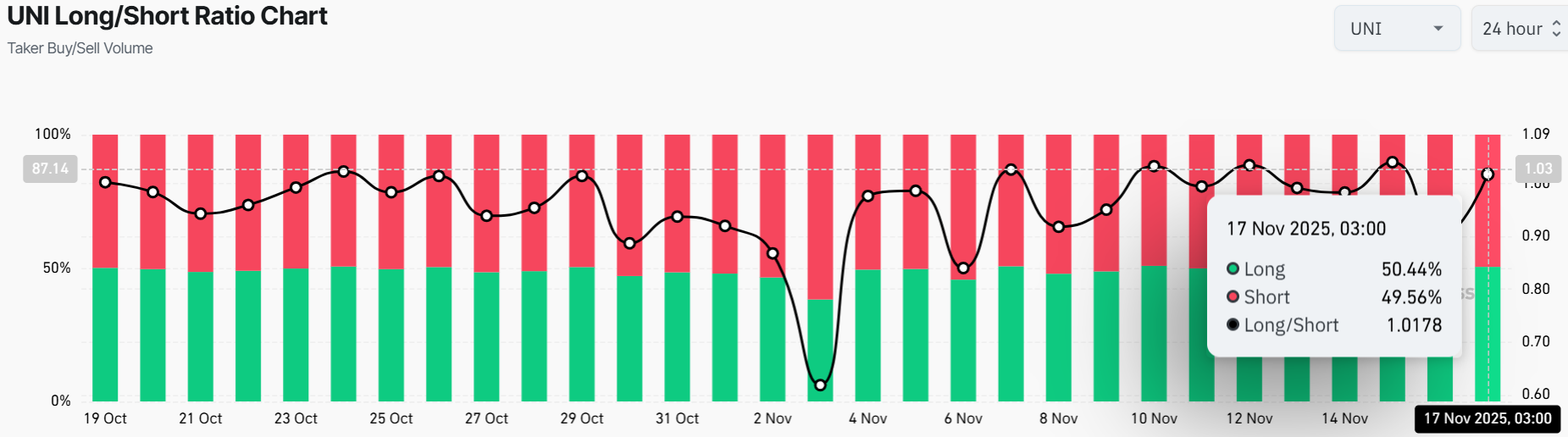

The data on derivatives stays in favor of a bullish grip. The long-to-short ratio at Coinglass reads at 1.0178, which is the highest in a month. The fact that the ratio is greater than 1 indicates that there is a higher number of traders who bet on the rise in Uniswap price.

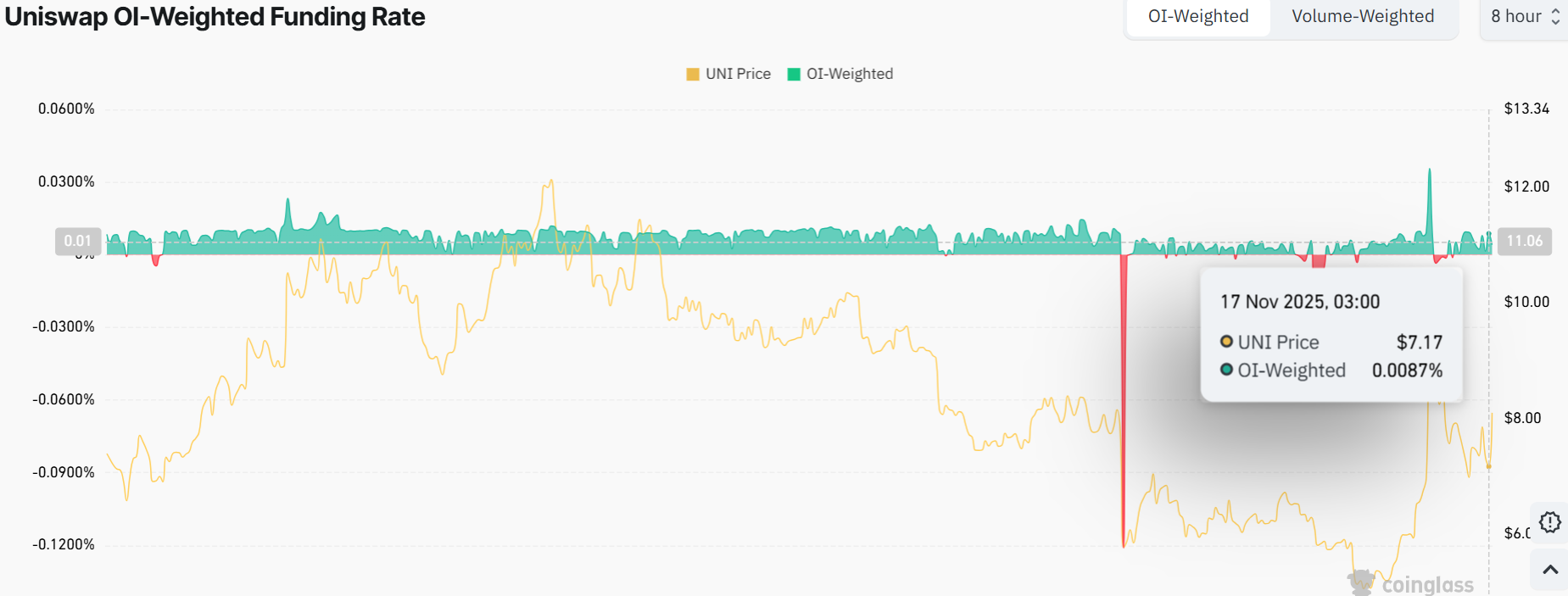

According to the OI-Weighted Funding Rate data provided by Coinglass, it has flipped positive at 0.0087%. This means that the traders who are betting that the price of UNI will fall further are fewer than the traders who believe that the price will rise.

The measure has reversed to positive, which implies that longs are paying shorts, indicating that traders have positive sentiment in UNI.

Uniswap Price Poised for Further Upside

The UNI/USD trading pair shows a price clocking in at $8.11, which represents a solid climb from its lower levels. The 50-day and 200-day Simple Moving Averages (SMA) hover around $6.79 and $7.95, respectively, and the Uniswap price is trending a good distance above them.

Meanwhile, if the moving averages hold strong as support zones, the Uniswap price is bound to rise further. If the UNI price adds to its 34% gains last month, it may soar to the previous high at $12, if the volume also holds strong. The Relative Strength Index (RSI) is sitting at 59.26, indicating intense buying pressure in the UNI market. This suggests the rally still has some gas, though traders should watch for a pullback if it hits over 70.

Zooming into the chart, the Uniswap price has recovered from its recent lows at $4.92, as the bulls are now in control. If the breakout momentum holds, the target could push toward $8.63-$9.50 in the coming days.

Crossing $12 Could Boost UNI

The lower support zone, ranging from $7.95-$6.79, has held strong, acting as a safety net for dips. Looking ahead, the 34% monthly gain shows Uniswap price is riding the current bullish wave, possibly fueled by broader market hype, as it shows signs of reversal. If it holds the current trend with conviction, the next stop could be reclaiming the ATH at $12 in the mid-term.

However, if the RSI spills into the overbought territory and profit-taking kicks in, it could trigger a dip back to the current support zones, if the bears increase pressure. In the long term, breaking above $12 would be a game-changer, putting UNI back in the spotlight.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.