Highlights:

- The price of Uniswap has surged 16% to $6.65 in the past month.

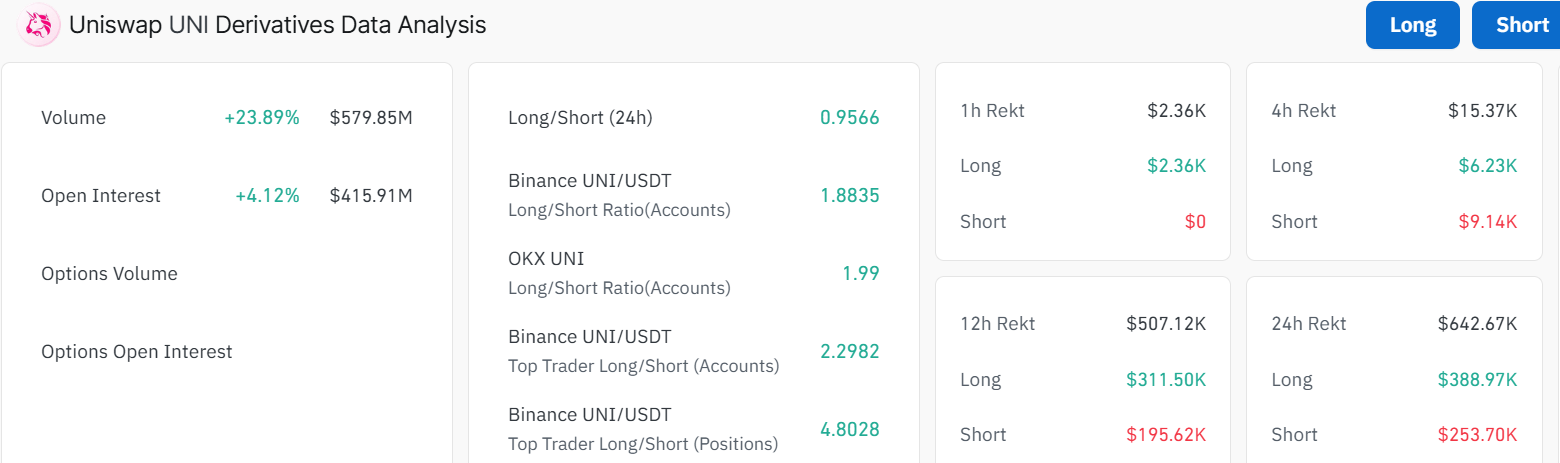

- CoinGlass data highlights growing trader confidence.

- A crypto analyst highlights a potential rally to $15.5 if $8 resistance gives way.

The Uniswap price has spiked almost 1% to $6.65, as the trading volume rises 12%. This indicates heightened trading activities, boosting investor confidence in the UNI market. UNI is now 13% up in a week and 16% in a month, showing an intense bullish thesis.

Uniswap Price Technical Analysis Points to Potential Upside

As Uniswap (UNI) approaches an important resistance level, the market is seeing signs that it might soon break out in price. Looking at indicators, derivatives, and market behavior, we can conclude that bullish energy is growing, which suggests UNI could soon reach new price levels.

The daily chart for UNI/USD points to the token closing above the 50-day line, at $5.74, yet not above the 200-day line at approximately $9.46. RSI is at 58.17 today, suggesting the market has some energy but is not overheated. Meanwhile, there is room for further upside before the token hits overbought.

Rising buying pressure is identified by the MACD’s positive crossover. It is worth noting that UNI has created a descending resistance line, and experts think a rise above $8.3 could start a big rally. If this outcome hits, UNI could trade above $15.5, almost doubling where it is now.

If $UNI breaks through the sell wall around $8.3, it can rise further to around $15.5. pic.twitter.com/XHymEJgTpO

— CW (@CW8900) May 27, 2025

Based on this chart, watchers of the market should monitor the $8.3 resistance area closely. Once this level is crossed, it could allow the price to rise much higher, due to the intense market performance.

Derivatives Data Highlights Growing Trader Confidence

In addition, derivatives data show that traders are more active and confident. The volume on Uniswap for the past 24 hours has risen by nearly 24% to just under $580 million, along with a 4% rise in open interest, showing more traders are now involved in UNI futures and options.

Binance and OKX show that more trades are happening in the long direction than in the short one, which reflects a bullish mood. According to data from Binance, traders with the most successful positions are choosing to buy more, suggesting prices might go higher. It seems traders are being extra careful by preparing for higher prices while still managing risks.

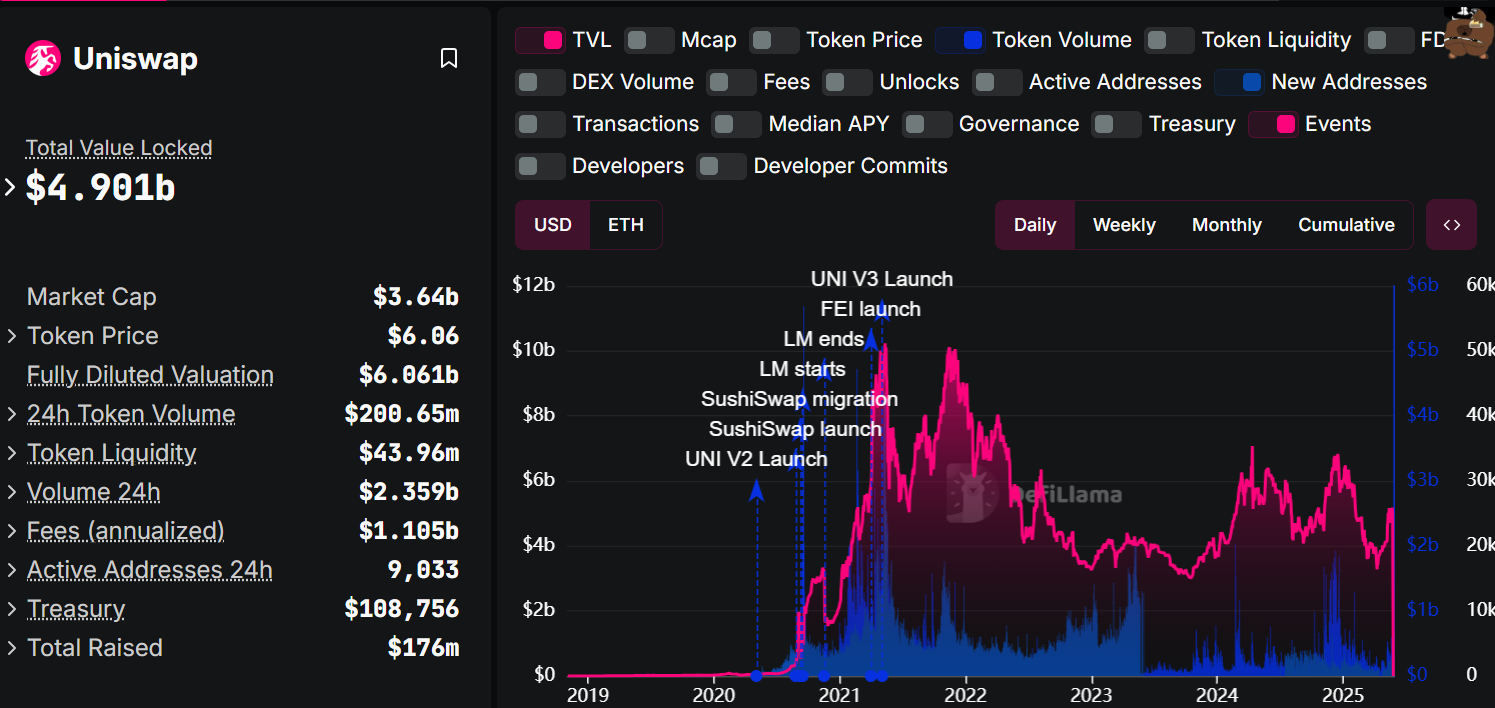

Strong Market Fundamentals Underpin UNI’s Growth

Data on ecosystem metrics for Uniswap remains strong, apart from price changes and use of derivatives. With TVL at $4.9 billion, it is evident that much liquidity and interest from users are on the protocol. The total market value of UNI tokens is $3.64 billion, while on a fully diluted basis, it reaches $6 billion.

Currently, the daily token volume is $2.36 billion, due in large part to solid liquidity with $44 million available. On top of that, the number of active addresses and new users is strong, proving that new people are adopting and supporting the network.

What’s Next for Uniswap Price?

All things considered, the indicators and statistics on Uniswap suggest a breakout could come soon. Increased buying pressure at this level will cause a rally toward the $8.3, $9.46, and $12 resistance zones. In a highly bullish case, the token could reclaim the $15 mark. On the downside, if the $9.46 resistance proves too strong, the token could drop. In such a case, the $5.97 and $5.74 support zones will act as safety nets. A break below the $5.74 mark will invalidate the bullish outlook, further causing a drop to $5.66.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.