Highlights:

- Uniswap has made history by becoming the first decentralized exchange to exceed $3T in total trading volume.

- Uniswap’s total value locked drops which reflects the DeFi market decline.

- UNI token rises 43% weekly but remains over 83% below its all-time high.

Decentralized exchange Uniswap breaks records by surpassing $3 trillion in cumulative trading volume. In a post on X, Hayden Adams, founder of the Uniswap, announced the platform’s success. He thanked users for their support and hinted that further developments are coming. The post featured an infographic from Dune Analytics which was showing Uniswap’s progress.

Uniswap is the first DEX to $3T volume 🦄

Bet its the first to 10

Grateful to everyone who swapped along the way as we decentralize the global finance system 🌐 pic.twitter.com/945Ab0Jpsl

— Hayden Adams 🦄 (@haydenzadams) May 12, 2025

Decentralized exchanges (DEXs) usually struggle with low liquidity, slow speeds, and network issues, limiting their trading volumes. That’s why it’s rare for them to surpass huge trading volumes. In contrast, centralized exchanges (CEXs) like Binance have surpassed $100 trillion in volume. However, the crypto community has shown interest in DEXs like Uniswap after the pandemic.

As per data from Dune, Uniswap currently has a daily volume of $3.3 billion. Analytics show that Uniswap dominates the DEX market, capturing 23% of daily trading volumes. Meanwhile, PancakeSwap follows closely with $2.7 billion in volume, accounting for 21% of the market share.

Uniswap launched in 2018 and has been the leader in the DEX market ever since. However, it faced regulatory challenges, including SEC investigations, and a significant drop in volumes after the crypto winter.

Uniswap Trading Volume Strong, TVL Drops

Uniswap’s trading volume remains strong, but its total value locked has fallen to $4.8 billion. This decline reflects a broader downturn in the DeFi market, with the total value locked across DeFi now at approximately $117 billion. This marks a drop from its previous peak of $174 billion, according to DeFiLlama.

Uniswap has kept a strong monthly trading volume this year. It remains above $150 billion. Although it earned approximately $150 million in fees in January, this dropped to just over $60 million by April. Several recent upgrades have helped maintain the platform’s growth.

In February, Uniswap introduced Unichain, a layer 2 network developed on the OP Stack. Unichain has already processed over $4 billion in trading volume. It offers faster, cheaper trading than Ethereum’s main network.

Unichain mainnet is live ✨

✸ Fast with low fees

✸ Built for cross-chain liquidity

✸ Prioritizes decentralization from day oneYou can now deploy DeFi apps, launch tokens, swap, provide liquidity, and more pic.twitter.com/MqJQwum4Bf

— Unichain (@unichain) February 11, 2025

UNI Token Jumps 43% Weekly, Still Below Peak

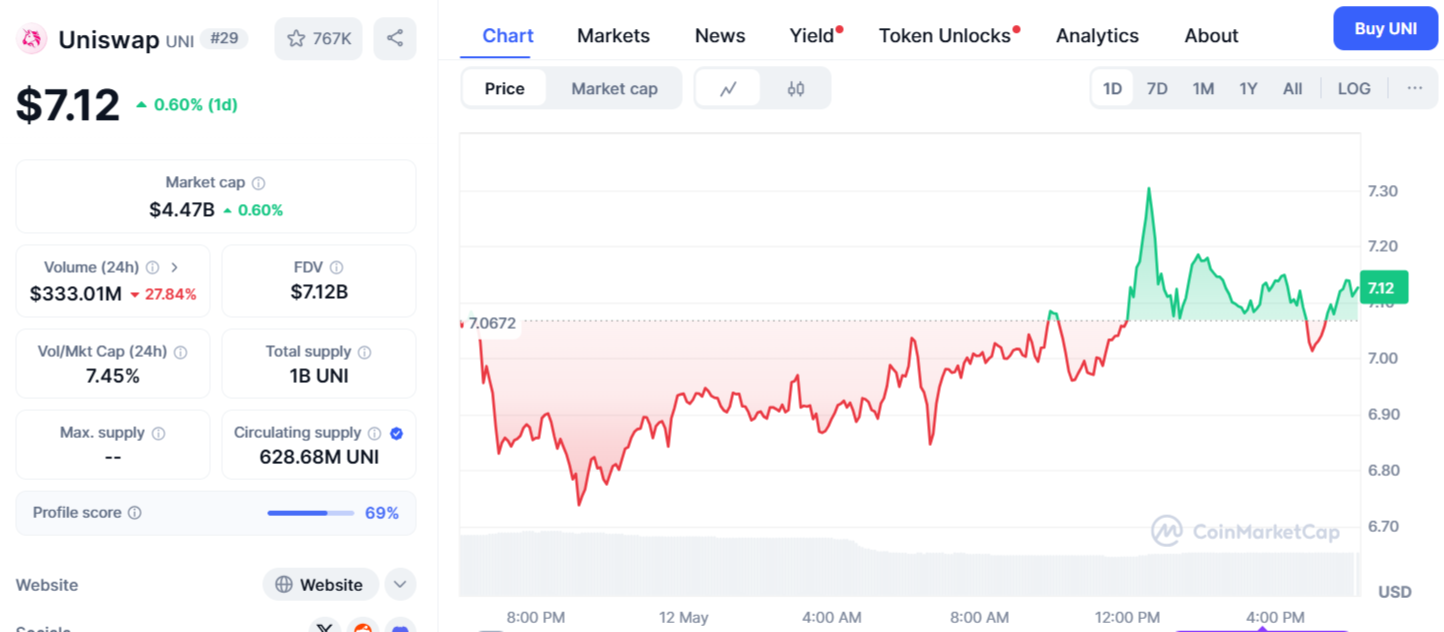

Uniswap’s token, UNI, is up 0.60% at the moment and has gained over 43% in the past week. However, it is still down more than 83% from its all-time high of $44.92. The token currently has a market cap of $4.47 billion and a 24-hour trading volume of $333.01 million.

Uniswap to Launch “7702 Wallet” for One-Click Swapping

Along with the volume milestone, Adams announced plans for Uniswap’s “7702 wallet” and support for other wallets using this standard. The aim is to enable one-click swapping for users, lowering barriers to decentralized trading.

EIP-7702 is an Ethereum update from the Pectra upgrade on May 7. Led by Vitalik Buterin, it helps Ethereum accounts resist quantum threats and lets regular accounts act as smart contracts during transactions. Trust Wallet has added smart account support, and Uniswap will follow. This update could improve the user experience and increase volume.

we're rolling out our own 7702 wallet and supporting other 7702 wallets through EIP 5792

with the goal being 1 click swapping for all users

— Hayden Adams 🦄 (@haydenzadams) May 12, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.