Highlights:

- Smarter Web Company now owns 168.08 BTC after announcing a new purchase today.

- The company spent $4.76 million for 45.32 BTC in the latest investment at $104,935 per coin.

- SWC noted that the purchase forms part of its ten-year Bitcoin investment strategy.

UK-based web development firm Smarter Web Company (SWC) has expanded its Bitcoin (BTC) holdings with a fresh investment worth $4.76 million for 45.32 BTC. The company disclosed this latest purchase in a June 10 tweet, noting that it paid an average of $104,935 per token.

Today’s acquisition marked the company’s sixth procurement in the past 30 days, increasing its holdings to about 168.08 BTC. Smarter Web Company spent a total of £13,120,000 (roughly $17.73 million) procuring its entire BTC stores at an average price of £78,060 ($105,779) per BTC.

In the announcement, Smarter Web Company noted that the acquisition was part of the company’s long-term investment plan. The web development firm stated, “The Smarter Web Company, a London-listed technology company, announces the purchase of additional Bitcoin as part of ‘The 10 Year Plan, ‘ which includes an ongoing treasury policy of acquiring Bitcoin.”

🇬🇧 UK tech firm The Smarter Web Company has bought 45.32 $BTC worth around £3.6 million for treasury holdings now amounting to 168.08 Bitcoin, worth £13.5 million. pic.twitter.com/uGZ2nGNH96

— ALLINCRYPTO (@RealAllinCrypto) June 10, 2025

Smarter Web Company Fundraisers and Impact on Shareholders

SWC added that it raised about £13.4 million ($18.08 million) from a successful fundraiser on June 5, 2025, which impacted stakeholders in the company. “The fundraiser resulted in an 8.10% dilution for existing shareholders, including the Directors,” Smarter Web Company explained.

While none of the directors sold their stakes during the fundraising, their percentage slightly declined because the company needed to raise money by issuing new shares. For context, Andrew Webley & Family holdings, including those held by Joanna Webley, dropped from 14.6% to about 13.41%. Tyler Evans and Mario Visconti, including 123 Accounting Solutions Ltd, mirrored a similar decrement pattern from 0.51% to 0.47%. Also, Sean Wade & Family holdings, including those held as Keysford Ltd, dropped from 0.41% to 0.38%.

SWC Warns Investors About Bitcoin Investment Risks

Aside from the latest purchase, Smarter Web Company educated investors about the risks associated with Bitcoin investments. In the publication, the company admitted to storing its spare cash and extra capital in BTC. According to SWC, it adopted this approach because its board of directors envisage BTC as a sustainable store of value with considerable future reward potential.

Citing a note of warning, the web development firm mentioned that it is not registered under the UK’s Financial Conduct Authority (FCA), implying that investors will not benefit from the regulatory watchdog’s protection. SWC also stated that FCA has earmarked BTC as a highly risky investment. The web development firm emphasized that its value is strongly tied to Bitcoin’s market valuation, implying that shareholders will forfeit huge sums if Bitcoin drops significantly.

Beyond losing money due to BTC’s volatility, investors are also at an increased risk of hacks and other crypto-related fraudulent schemes. Overall, SWC encouraged intending investors to do thorough research and other appropriate assessments before investing in the company.

The Smarter Web Company (#SWC) RNS Announcement: Bitcoin Purchase.

Purchase of additional Bitcoin as part of "The 10 Year Plan" which includes an ongoing treasury policy of acquiring Bitcoin.

Please read the RNS on our website: https://t.co/z59Xf4oBRU pic.twitter.com/vmtFzjsQeY

— The Smarter Web Company (@smarterwebuk) June 10, 2025

Other companies, including Strategy, the largest corporate holder of BTC, Metaplanet, a leading Japanese Bitcoin investment firm, Semler Scientific, Blockchain Group, H100 Group AB, etc, share similar sentiments about BTC. Notably, despite growing concerns about Bitcoin’s volatility, these companies have sustained consistent BTC investments. In addition, they have also sought means to raise funds to expand their BTC portfolio.

Bitcoin Recovers Slightly After Weekly Dip

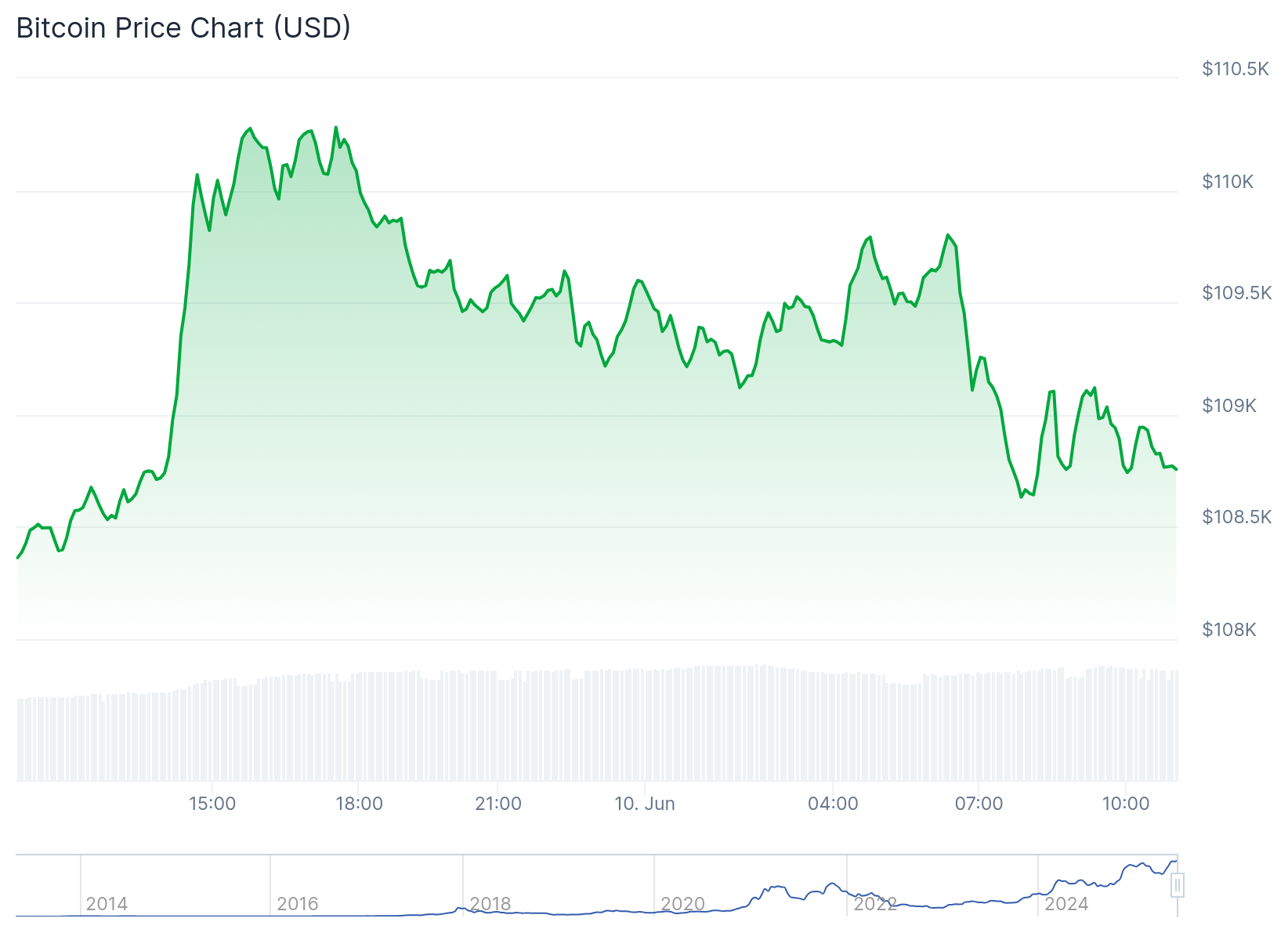

Meanwhile, Bitcoin has recovered slightly, evidenced by a 0.7% upswing in the past 24 hours, with a $108,900 selling price. Within the same timeframe, BTC oscillated between $108,148 and $110,282, highlighting a slight retracement at the time of writing. CoinGecko data showed that BTC dropped 2.6% in the past seven days, fluctuating between $100,984 and $110,266. This price range underscores marked recovery following last week’s declines.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.