Highlights:

- Bitcoin ETFs recorded another net inflow on January 24 to conclude the week with $1.76 billion in weekly gains.

- Three Bitcoin funds attracted over $100 million in cash inflows as the net profits yesterday reached $517.67 million.

- The only ETF that witnessed losses was Bitwise Bitcoin ETF (BITB).

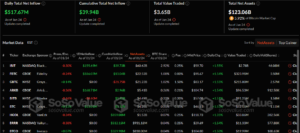

On January 24, Bitcoin ETFs marked their last outing for the week with another net inflows. The profits from yesterday’s outing became the commodities’ seventh consecutive gain since the ETF daily figure turned positive on January 15. According to the renowned on-chain ETF tracker, SosoValue, Bitcoin ETFs attracted gains of approximately $517.67 million in their most recent outing.

With the positive flow yesterday, Bitcoin ETFs concluded the week gainfully with about $1.76 billion in net inflows. Consequently, the funds extended their profitable weekly trends to a fourth consecutive week. The positive sentiments stemming from the ETF flow could be deemed crucial for helping Bitcoin sustain price levels above $100,000 in the past few days.

On January 24, the total net inflow of Bitcoin spot ETF was $518 million, with net inflow for 7 consecutive days. The inflow of Fidelity ETF FBTC was $186 million. The current total net asset value of Bitcoin spot ETF is $123.058 billion. https://t.co/59u0BnEqLG pic.twitter.com/ykhS8zZR5p

— Wu Blockchain (@WuBlockchain) January 25, 2025

Bitcoin ETFs Soar with Significant Profitable Contributions

Per SosoValue’s data, six out of twelve Bitcoin ETFs had activities yesterday, as the remaining six recorded neither inflows nor outflows. Among the active funds, only Bitwise Bitcoin ETF (BITB) registered losses with $8.06 million in outflows.

Notably, three ETFs, including Fidelity Bitcoin ETF (FBTC), ARK 21Shares Bitcoin ETF (ARKB), and BlackRock Bitcoin ETF (IBIT), attracted capital above $100 million. They gained $186.07 million, $168.71 million, and $155.69 million, respectively. Other funds that had profits were Grayscale Mini Bitcoin ETF (BTC) and WisdomTree Bitcoin ETF (BTCW). Both gained $13.01 million and $2.79 million, respectively.

As a result of the profitable outing, Bitcoin ETF cumulative net inflows near $40 billion, as it increased from $39.42 billion to $39.94 billion. Similarly, the total net assets valuation rose from $121.60 billion to $123.06 billion, while the total value traded dropped from$9.59 billion to $3.65 billion.

Bitcoin’s Price Reactions to the ETFs Profitable Outing

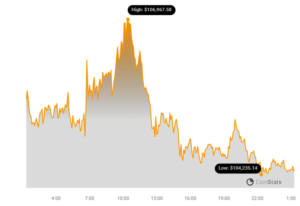

At the time of writing, Bitcoin is down about 1.1% in the past 24 hours, with minimum and maximum price levels ranging between $104,236 and $107,000. Despite the slight decline, the flagship crypto is priced at roughly $104,305. The price extreme revealed that BTC is trading at the lower price limit, which invariably implies tendencies for further declines.

Meanwhile, aside from its short-term interval price change data, other extended periods reflected increments. For context, Bitcoin’s 7-day-to-date, 14-day-to-date, and month-to-date statistics displayed increments of about 1.5%, 10.7%, and 7.9%, respectively.

Other important market details revealed that Bitcoin’s market capitalization is worth approximately $2.066 trillion. Its 24-hour trading volume has depreciated by about 55.19%, with a $44.37 billion valuation.

ETFs Filing Soars Following the Anticipate SEC Regulatory Shift

While Bitcoin and Ethereum ETTs remain the only approved funds in 2024, chances abound that more endorsements will happen this year. The odds of such happening have gotten even stronger with the appointment of Mark Uyeda as the new United States Securities and Exchange Commission’s (SEC) acting chairman.

Uyeda has already started the crypto regulatory reform with the establishment of a new Crypto Tax Force. Therefore, it is unsurprising that market participants are basking in the euphoria of an incoming regulatory shift. Notably, as part of possible responses to the anticipated regulatory reforms, new filings for several ETFs have emerged.

Grayscale and Coinshares got market observers talking after filing for crypto ETFs targeting Litecoin (LTC), Solana (SOL), and Ripple’s XRP. While how events unfold remains largely unknown, the crypto community remains highly optimistic that the SEC will look into the applications, with approvals expected in the coming months within this year.

🚨 BREAKING 🚨

6 ETF FILING HAS HAPPENED IN THE

PAST 24 HOURS 👇► COINSHARES FILED FOR A SPOT

LITECOIN ETF.► COINSHARES JUST FILED FOR A

SPOT XRP ETF► GRAYSCALE FILED TO CONVERT

THEIR LITECOIN AND SOLANA

TRUSTS INTO ETFs► GRAYSCALE FILED FOR A "BITCOIN…

— Ash Crypto (@Ashcryptoreal) January 25, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.