Highlights:

- Bitcoin ETFs got $403 million on Tuesday, showing strong investor interest.

- BlackRock’s IBIT brought in the most money, over $416 million that day.

- Ethereum ETFs also did well, adding $192 million from new investors.

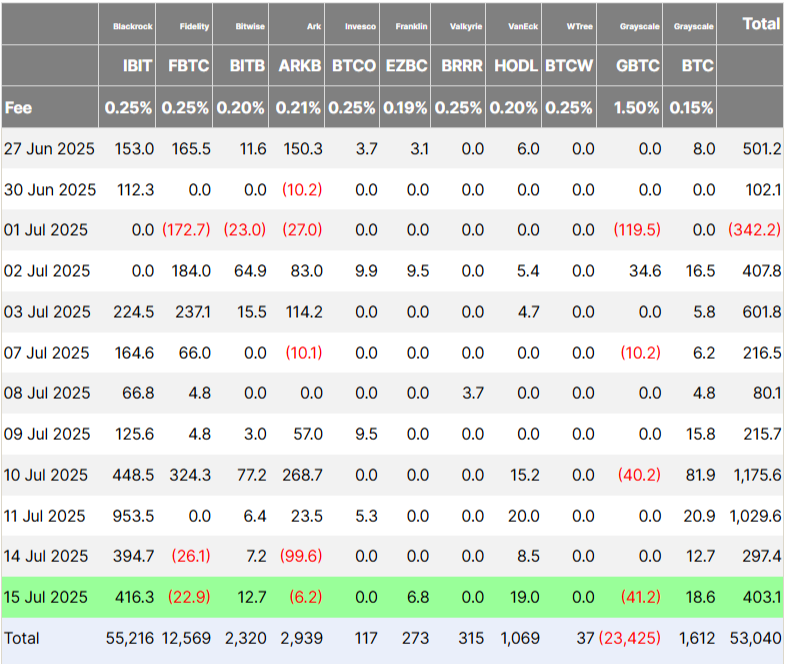

U.S. spot Bitcoin (BTC) exchange-traded funds (ETFs) extended their daily inflow streak on Tuesday, achieving nine straight days of positive gains. According to Farside data, these funds saw net inflows totaling $403 million. BlackRock’s iShares Bitcoin Trust (IBIT) recorded the highest net inflows for the day, bringing in $416.3 million. VanEck’s Bitcoin ETF (HODL) came next, recording $19 million in net inflows. Other funds also showed strength, with Grayscale’s Mini Bitcoin Trust (BTC) and Bitwise Bitcoin ETF (BITB) reporting net inflows as well.

Three Bitcoin funds saw outflows on Tuesday, partially offsetting the overall positive inflows. Grayscale Bitcoin Trust ETF (GBTC) led with $41.2 million in withdrawals, followed by Fidelity Wise Origin Bitcoin Fund (FBTC) with $22.9 million in outflows. The ARK 21Shares Bitcoin ETF (ARKB) reported net outflows totaling $6.2 million.

Altogether, spot BTC ETFs have accumulated $53.04 billion in total net inflows to date. In just the last nine trading days, they’ve added $4.4 billion, continuing a strong upward trend. Since April, this growth phase has brought in close to $17 billion, showing steady investor interest in these products.

Ethereum spot ETFs also continued their upward trend, recording net inflows for the eighth day in a row. They brought in $192.33 million in fresh investments on Tuesday alone.

Bitcoin ETFs See Strong Inflows as BTC Holds Near $117K

Bitcoin is currently trading at $117,373, staying close to a key support level. This comes after a slight drop from its recent all-time high of $123,000 set earlier this week. Nick Ruck, director at LVRG Research, explained that BTC has remained stable at around $118,000 after lower-than-expected core CPI data. This has sparked hopes of a potential interest rate cut by the Fed in September, which could drive fresh demand for Bitcoin.

Spot BTC ETFs recorded more than $1 billion in inflows on back-to-back days last week. On Friday, all 11 spot Bitcoin ETFs reported total inflows of $1.03 billion, coming right after $1.17 billion flowed in on Thursday. BlackRock recently announced that its IBIT BTC ETF is now bringing in more revenue than its popular iShares Core S&P 500 ETF.

Institutional BTC Demand Grows as Corporates Join Treasury Buying Trend

Institutional interest in Bitcoin is expanding beyond just ETFs and is now entering corporate treasuries. Japan’s Metaplanet recently made a major move by purchasing $93 million worth of Bitcoin. This investment secured its position as the fifth-largest corporate holder, now owning more than 16,300 BTC.

This growing trend continued over the past week as two more companies joined in. The UK-based Smarter Web Company added $24.3 million worth of Bitcoin to its treasury, while France’s The Blockchain Group invested $12.5 million in BTC. This steady rise in corporate Bitcoin purchases shows that more institutions now see Bitcoin as a reliable and valuable investment option.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.