Highlights:

- ETH ETFs hit record 5-day outflows as Bitcoin ETFs continue to attract investors with cash inflows.

- Grayscale ETFs led the only outflows in Ethereum and Bitcoin ETFs.

- Ethereum has remained trapped below $3,000 as Bitcoin exceeds $60,000.

U.S. Ethereum (ETH) Exchange Traded Funds (ETFs) recorded another net outflow in its August 21 statistics. The latest accumulated ETH ETF losses imply that the commodities have registered fifth consecutive outflows for the first time. Conversely, Bitcoin (BTC) ETFs have maintained net inflows for five days, underscoring a marked disparity between both entities.

🚨 US #ETF 21 AUG: 🟢$40M to $BTC and 🔴$18M to $ETH

🌟 BTC ETF UPDATE (final): +$40M

• The net flow has remained positive for the past 5 trading days.

• However, yesterday’s flow volume was generally weak.

🌟 ETH ETF UPDATE (final): -$18M

• The net flow has been negative… pic.twitter.com/KLTWX4ypd6

— Spot On Chain (@spotonchain) August 22, 2024

ETH ETFs Record Outflows for Five Consecutive Days

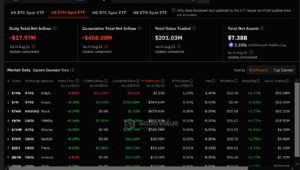

In its most recent flow data, only four Ethereum ETFs were active on August 21. Three recorded inflows, while one witnessed losses. As usual, Grayscale Ethereum ETF (ETHE) registered the only outflows at about $31.1 million. ETHE’s sustained losses imply that the commodity cumulative netflow is negative at approximately $2.5 billion. Despite its successive losses, ETHE’s net assets remained significant at roughly $4.85 billion, with $93.18 million in traded value.

For inflows, Fidelity Ethereum ETF (FETH) led the standings with $7.9 million in profits. Interestingly, Grayscale Mini Ethereum ETF (ETH) recorded the second-highest inflows at about $4.2 million. Notedly, Franklin Ethereum ETF (EZET) was third with $1 million. Despite recording inflows from three ETFs, the cumulative netflow for yesterday ended with about $18 million in losses. Consequently, cumulative netflow has remained in losses at approximately $458.08 million. The total value traded has reached $201.03 million, while total net assets were $7.38 billion, representing 2.33% of Ethereum’s market cap.

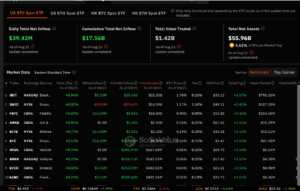

Six BTC ETFs Amassed Profits to Maintain Inflows Streak

Unlike Ethereum, Bitcoin ETFs were more active. Remarkably, six ETFs registered inflows, while only one witnessed losses. Grayscale Mini Bitcoin ETF (BTC) topped the charts in inflows with about $14.2 million. Fidelity Bitcoin ETF (FBTC), Bitwise Bitcoin ETF (BITB), and BlackRock Bitcoin ETF (IBIT) followed closely in second, third, and fourth spots, respectively. Notedly, they attracted $10.7 million, $10 million, and $8.4 million in profits.

In the fifth and sixth positions, Franklin Bitcoin ETF (EZBC) and Invesco Bitcoin ETF (BTCO) occupied the spots with $3.5 million and $2.5 million, respectively. Like Ethereum, Grayscale Bitcoin ETF (GBTC) sustained its outflow trend with approximately $9.8 million in losses. Considering the data above, BTC’s daily netflow was positive at about $39.42 million. The cumulative net inflow was also positive at roughly $17.56 billion, with $1.42 billion in total traded value. Meanwhile, total net assets keep ascending exponentially, with a current $55.96 billion valuation, representing 4.63% of BTC’s market cap.

Ethereum Remains Below $3,000 with Persistent Outflow Streak

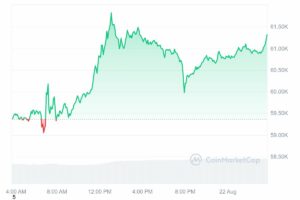

At the time of writing, Ethereum is changing hands at about $2,600, reflecting a 1.8% upswing. In the past seven days, ETH appreciated by an insignificant 0.2%, with minimum and maximum prices ranging between $2,534.63 – $2,680.70. ETH’s 7-day-to-date price range underscored the Token’s apparent struggle targeted at reclaiming $3,000.

While the general market condition has remained unfavorable, ETH ETFs hitting a record 5-day outflow streak is compounding the embattled coin’s situation. However, hope for ETH rebound potential still abounds, with the market’s cycle peak in sight.

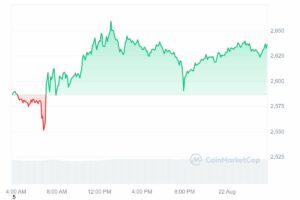

Bitcoin Stabilizing Above $60,000

On its part, Bitcoin has successfully broken above the resistance that has kept below $60,000 for some time. Notably, the flagship crypto asset is valued at approximately $61,000, mirroring a 3% upswing in the past 24 hours. In its 7-day-to-date price change variable, Bitcoin spiked by 4.5%, with minimum and maximum prices ranging between $56,765.93 – $61,524.47.l, respectively.