Highlights:

- Tron price soars 1% to 0.36, as trading volume skyrockets 70%.

- Tron’s founder has sued Bloomberg to prevent the publication of his crypto holdings.

- Despite the legal setup, TRX is poised for growth as technical indicators flash bullish.

Tron price shows a recent uptrend, breaking past $0.35 to $0.36, marking a 1.42% rise. Its daily trading volume has also risen 70% to $2.34 billion, suggesting growing market activity. TRX is now boasting a 6% rise over the past week and 22% over the past month.

Meanwhile, TRON blockchain founder, Justine Sun, is back in the headlines, but this time in the legal setup. The billionaire is now suing Bloomberg in the Delaware federal court in order to prevent the company from publishing precise details regarding his crypto holdings. Sun alleges that Bloomberg is now intending to reveal these financial records in a way that he had previously contradicted the agreements of confidentiality.

🚨 Justin Sun is suing Bloomberg in Delaware federal court to block it from publishing a detailed breakdown of his crypto holdings—info he says was shared only for wealth verification for the Billionaires Index under explicit promises of confidentiality.

Sun claims the planned… pic.twitter.com/rRADEbnK43

— Bitcoin.com News (@BTCTN) August 14, 2025

Sun states that the suggested disclosure is not only utilitarian but also harmful. He says that publicizing his financial information would make him and his family prone to different dangers, such as robbery, cyber-attacks, and even physical violence. These crimes may be associated with physical violence in the sense of compelling the individuals to provide their judicial keys or passcodes of their crypto-funds. The legal team of Sun is in the process of requesting a ban on the publication as it has an impact on his safety and security.

Tron Price Shows Bullish Outlook Despite the Legal Setup

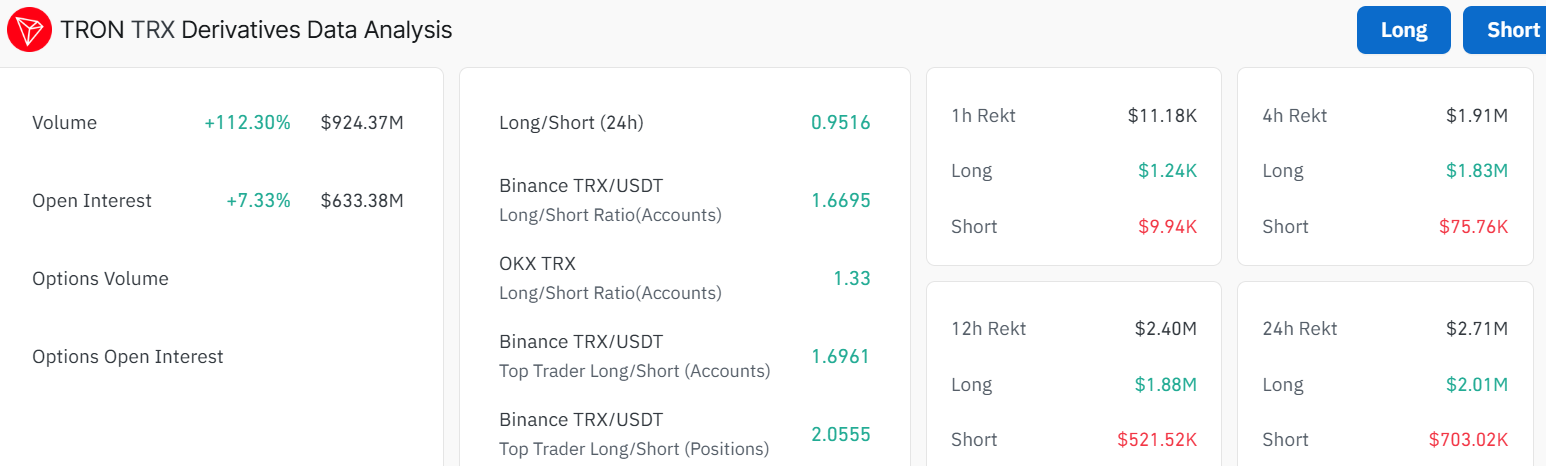

Nevertheless, the current case of the legal drama has not negatively impacted the performance of TRON in the market, especially in the derivatives market. The TRON derivatives market shows that there is a massive spike in trading volume and open interest. Total trade volume has jumped a remarkable 112.30% to $924.37 million, and open interest has also surged in number as well by 7.33% to $633.38 million.

These data indicate that despite the legal problems that its founder experiences, the interest of the investors in TRON is strong enough. Analysis of the derivatives market indicates that the number of long positions is greater than that of short positions, with the long-to-short ratio at 0.95. This fact means that traders are relatively optimistic about the future of TRON.

The 1-day timeframe for TRX/USDT shows a wild ride. The price recently dipped to a low of $0.26 on 22 June before staging a solid bounce, currently hovering around $0.36. The bulls have shown immense strength, as the token trades well within the rising channel. Moreover, the 50-day ($0.31) and the 200-day ($0.26) are offering strong support, suggesting a longer-term upward trend.

The Relative Strength Index (RSI) at 81.89 is overbought, calling for traders to be cautious. This move above the 70-overbought region suggests a potential short-term pullback, to allow the bulls to sweep through liquidity. Meanwhile, the Moving Average Convergence Divergence (MACD) shows a bullish crossover, with the MACD line (blue) slicing through the signal line (orange).

TRX Poised for a Short-Term Pullback – Then Rally

The chart shows a massive upside, tilting the odds towards the bulls. If support zones hold, the Tron price could rise further to $0.43 by the end of August. However, if the early profit taking kicks in, the TRX token may retrace towards $0.34-$0.31 safety net. In the long term, Tron price could ride the wave to $1 and beyond by year-end.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.