Highlights:

- Tron price has gained 2% to trade at $0.30 today.

- On-chain metrics show a rise in TVL, while the derivatives market shows a surge in open interest.

- The technical outlook suggests a potential breakout, with TRX bulls targeting $0.32.

The TRON (TRX) price is continuing to rise and is currently above $0.30 at the time of writing on Friday. This marks a 2% surge over the past 24 hours, despite its daily trading volume slipping by 5%. The optimistic on-chain and derivatives outlook supports the optimistic price movement. Technically, TRX bulls are targeting the $0.32 level, as the momentum for a breakout builds.

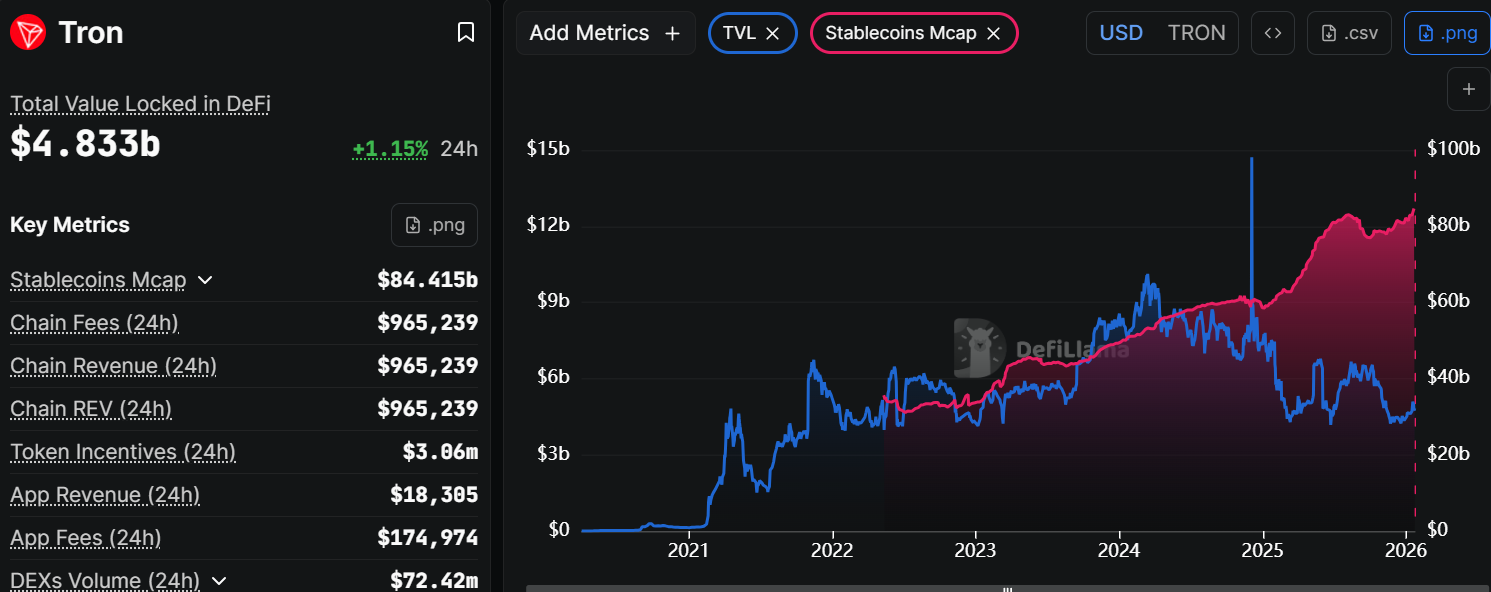

According to DefiLama data, the total supply of the TRX stablecoin has increased since the end of December. On Wednesday, it reached a new record high of $84.63 billion, and on Friday, it stood at $84.41 billion. This type of activity and value growth in the Tron project signifies a positive trend. This would promote the network’s use and encourage more individuals to join the ecosystem.

Notably, its TVL has soared 1.15% to $4.83 billion, indicating growing investor optimism in the TRX ecosystem. Recently, the Tron Network has continued to support stablecoin payments at a global scale. This comes as hundreds of billions in monthly stablecoin volume prove it as a reliable stablecoin network.

TRON continues to power stablecoin payments at a global scale. 🌐

Hundreds of billions in monthly stablecoin volume show why the network is trusted by merchants and users alike. https://t.co/By89P1zfwX

— TRON DAO (@trondao) January 22, 2026

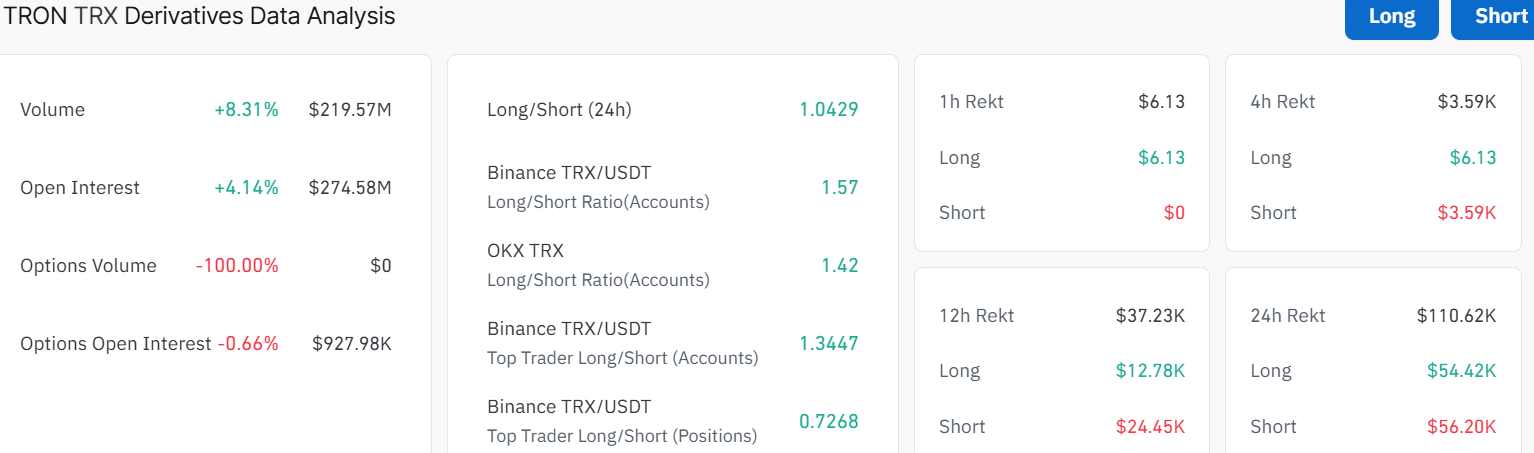

On the derivatives side, Coinglass’s long-to-short ratio for TRX sits at 1.04 on Friday, approaching the highest of the last month. The ratio is above 1, indicating that more traders are betting on Tron’s price to rise.

Notably, the open interest has surged by 4% to $274 million, indicating that new money is flowing into the market. This may also cause a surge in the TRX price towards $0.32 soon.

TRX Bulls Target $0.32 Zone as Momentum Builds

Tron is trading around $0.30 on the daily chart, and the trend looks bullish. The chart shows a rising wedge pattern, which means the price is slowly accelerating upwards.

Currently, the price found strong support around $0.29, which aligns with the 50-day SMA. This area has acted as a floor, where buyers stepped in and stopped further downside. Meanwhile, the bulls are targeting a clear breakout above the immediate resistance around $0.31, which aligns with the 200-day SMA. In the meantime, the $0.29 level is important because it is now acting as a strong support. As long as the price holds above this area, the short-term bullish structure remains intact.

The next major resistance is around $0.31. This is the level the Tron price needs to break and hold above to confirm a stronger upside move. If that happens, the price could push toward $0.32, which would likely attract more buyers.

The RSI is around 58.44, which shows the bulls are building momentum. Further, it shows that buyers have the upper hand, and the TRX token has room to run before it reaches an overbought region. The MACD has, however, made a bearish crossover, cautioning traders of a potential downside if the bears step into the market.

Structurally, Tron is still making higher highs and higher lows, which supports the bullish outlook. If TRX drops below $0.29, it could signal short-term weakness. However, as long as the price stays above $0.29, the broader bullish trend remains intact, as the TRX bulls target a breakout above $0.31.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.