Highlights:

- The price of Tron has plummeted by 3% to $0.26 in the past 24 hours.

- The Cboe has submitted Form 19b-4 to the SEC, a key step toward launching a TRX ETF.

- Technical indicators uphold a bullish sentiment, as bulls target $0.32 in the short term.

The Tron price has plunged 3.19% to $0.2631, as the crypto market shows a slight shake-off. The recent drop has seen various cryptos, including Bitcoin, retest the $103K mark. However, despite the decrease, the Tron trading volume has increased by 72%, indicating heightened market activity. This rise in trading volume over the past 24 hours signals heightened investor confidence.

According to TRON founder Justin Sun, the Cboe has filed Form 19b-4 with the SEC, which is necessary for the launch of a TRX ETF. This is a big step forward for TRON in attracting larger players in the industry. A completed application suggests that exchange approvals are in place, and now the regulator can assess the project. Should this plan be approved, it could lead to a major TRX staking ETF, developing a more convenient opportunity for institutional investors.

Cboe 向SEC正式提交19B-4表格是TRX ETF通过的关键一部,代表合规交易所的审批已经通过 https://t.co/LAkvJxN0fu

— H.E. Justin Sun 🍌 (@justinsuntron) May 19, 2025

Tron Price Outlook

A quick look at the Tron price daily chart, the bulls currently have the upper hand, despite the last drop in the past 24 hours. Moreover, the TRX token has moved into consolidation, often indicating an accumulation period. The bulls are showing a splendid bullish muscle, as they have put eir best foot forward. This is evident as they have flipped the $0.23 and $0.24 aligning with the 200-day and 50-day MAs, respectively, into support zones.

If these levels hold steady, Tron price is bound to move to the upside, potentially breaking above the consolidation channel. Moreover, if the consolidation channel acts as an accumulation period, the bulls may strike out in a strong bullish move. This may see the TRX token hit the $0.32 mark.

Meanwhile, the TRX technical indicators uphold a bullish grip. The Relative Strength Index is sitted above the 50-mean level at 55.51. This shows that the buyers are having the upper hand. Moreover, the TRX token is yet to be considered overbought, buyers are at liberty to go all in for Tron.

Notably, the Moving Average Convergence Divergence (MACD) is sitting above the positive territory, upholding a bullish crossover. The blue MACD line has flipped above the orange line, calling for traders to buy more TRX tokens. However, traders should be cautious as the momentum indicator teases a sell signal. Until then, traders and investors should buy more TRX coins.

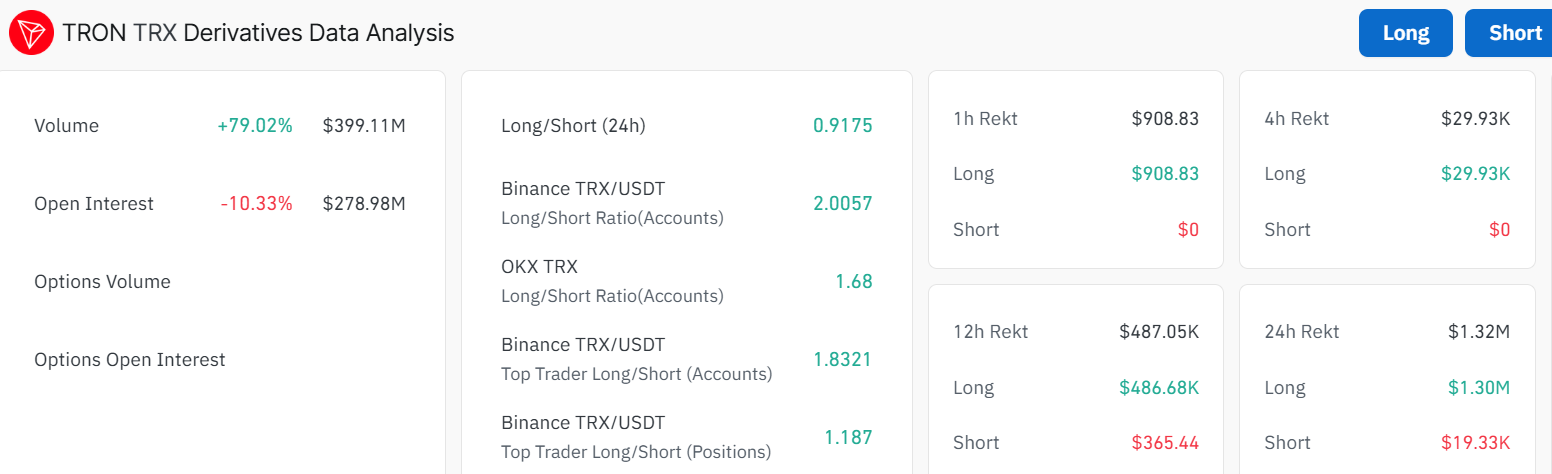

Tron Derivatives Analysis

The Tron derivatives data is showing some mixed signals. Its volume has surged about 79% to $399M. This suggests heightened market activity, bolstering increased investor confidence. On the other hand, TRX’s open interest has dropped 10% to $278M. This suggest that traders are closing their positions, which may weaken the current bullish trend in Tron market.

Meanwhile, Tron’s long-to-short ratio indicates some bearish prospects, as it flirt around 0.91, below the 1 level. This signals that the bulls should buld up momentum and rally above 1, or the bears take over in the market.

In such a case, where the bears regain dominance, the Tron price would drop. The first safety net will sit at $0.24, aligning with the 50-day MA. A breach below this level will spark some bearish sentiment. However, a decisive close below the $0.23 mark will tilt the odds towards the bears. In the meantime, traders should closely monitor the technical indicators and current support zone, to determine the next move in Tron price.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.