Highlights:

- TRON’s market cap grew 24% in Q3, driven by a deflationary model and SunPump’s success.

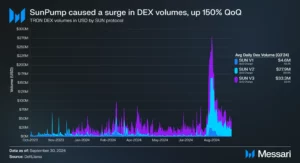

- SunPump boosted TRON’s DeFi activity, with daily DEX volumes up 150% in Q3.

- TRON’s staking ratio declined, but USD value staked rose 14% due to higher TRX prices.

TRON has experienced growth in Q3 driven mainly by activity on SunPump. TRX climbed up in rankings, going from 10th to 9th place among large-cap cryptocurrencies due to this gain. The growth was largely influenced by the deflationary token model, according to a report by Messari. TRX burns decreased the amount of tokens in circulation, leading to a higher increase in its value.

State of TRON Q3 2024: #TRON has achieved seven straight quarters of growth in on-chain activity, driving protocol revenue to an all-time high, fueled by increased transaction volumes and a rapidly growing user base.

Read the full report from @MessariCrypto 👇… pic.twitter.com/aRgAxKvfTZ

— TRON DAO (@trondao) October 17, 2024

SunPump Drives DeFi Activity Surge

SunPump had a major impact on TRON’s DeFi sector. The memecoin platform caused a significant increase in network activity. Between August 16 to 31, almost 270.3 million TRX was burned. During Q3, these burns generated a total of $42 million, or 27% of TRON’s Q3 revenue.

The highest single-day burn for TRON occurred on August 21, burn 34.7 million TRX. With this surge, the volume of DeFi transactions skyrocketed by 487% over the prior quarter. At the same time, SunPump attracted more activity and liquidity, increasing average DEX volume by 150% QoQ.

Record Revenue and Staking Updates

TRON had its highest-ever revenue in US dollars during the third quarter. Revenue increased by 6 percent, reaching a total of 1.05 billion TRX. More users began moving towards Stake 2.0, which improved resource management. TRON’s staking ratio was 48%, but TRX staked decreased by 9%. Due to the rise in TRX prices, the overall amount staked in USD increased by 14%.

TRON’s Decentralization Efforts and Super Representatives

TRON relies heavily on its DPoS system and PBFT consensus model for governance. In Q3, there were a combined 419 SR candidates. Additional candidates enhance the network’s decentralization. The number of TRON nodes has expanded to 78 locations globally. This has expanded the geographic coverage. However, Europe continued to be the main location with 39% of nodes.

Although the system may seem more varied, the dangers of centralization still remain. As an example, Binance Staking garnered the most votes at 8 percent of the total votes. It stresses the significance of allocating additional votes to candidates.

Technical Developments and Other Key Metrics

During the third quarter, TRON approved multiple suggestions to enhance network efficiency. It increased the energy cap to 180 billion TRX, which increased gas fees. On average, daily transactions rose 14%, and daily active addresses rose 6%.

Wallet transfers rose by 10 percent, while stablecoin transactions decreased by 1 percent. The TVL measured in TRX fell by 17%, while the TVL measured in USD rose by 4%. This shows that the growth was driven by price rather than inflows of capital.

TRON’s security initiatives also expanded, with the T3 Financial Crime Unit (T3 FCU) freezing over $12 million in USDT linked to scams. This move highlights TRON’s proactive approach to safeguarding its network and stablecoin users.

Additionally, TRON continues its ecosystem expansion with its Bitcoin Layer-2 initiative, which connects its stablecoin capital to the Bitcoin ecosystem through cross-chain technology and strategic partnerships. As Q4 continues, activity on the Sunpump platform continues to grow and it is expected to grow more revenue for TRON.