Highlights:

- Top asset managers have submitted amended S-1 filings for spot XRP ETFs to the SEC.

- Grayscale presented a fresh XRP ETF S-1 application to the US crypto regulatory commission.

- The amended applications contained provisions for more XRP ETF flexibility

Leading asset managers, including Bitwise, Canary Capital, CoinShares, Franklin, 21Shares, and WisdomTree, have submitted updated S-1 filings for their proposed spot XRP Exchange Traded Funds (ETFs) to the United States Securities and Exchange Commission (SEC).

Grayscale also filed a new S-1 application for its XRP ETF, highlighting marked investment firms’ interest in the product. Notably, the updated filings included provisions for cash creations and in-kind redemptions. Overall, the move will drive XRP adoption as a mainstream token in the United States markets.

Asset managers Grayscale, Bitwise, Canary, CoinShares, Franklin, 21Shares, and WisdomTree filed amended S-1s for spot XRP ETFs, adjusting structures to allow XRP or cash creations and cash or in-kind redemptions. Bloomberg ETF analyst James Seyffart said the updates were “almost…

— Wu Blockchain (@WuBlockchain) August 23, 2025

ETF Analyst Reacts as Top Asset Managers Revise S-1 Filings

ETF Analyst James Seyffart attributed the moves to the SEC’s feedback on previous XRP ETF proposals. He also added that he anticipated the application amendments.

James tweeted:

“Bunch of XRP ETF filings being updated by issuers today. Almost certainly due to feedback from the SEC. Good sign, but also mostly expected.”

XRP ETFs Approval Faces Delay from the SEC

On August 18, the SEC announced that it would be extending the deadlines for approving many XRP ETFs from August to October. In its press release, the US regulatory body mentioned that it needed ample time to review public comments and other regulatory factors under the Exchange Act.

Aside from XRP, the SEC might approve many other altcoin ETFs facing similar delays. The regulatory body had earlier postponed its verdicts on Litecoin (LTC), Solana (SOL), Cardano (ADA), Dogecoin (DOGE), Hedera, PENGU, and Avalanche (AVAX) ETFs. Hence, the delays imply that all pending crypto ETFs might debut around the same time.

XRP ETFs Approval Odds Spikes with Amendments News

Popular United States betting platform, Polymarket, showed that XRP ETF approval odds before the end of this year rose by 13% to reach 84%. Earlier this month, the approval odds almost touched 60%. However, recent positive developments drove the odds surge, potentially reigniting investors’ interest in the asset.

Polymarket stated on its website:

“The delay, affecting proposals from firms like Grayscale, 21Shares, Bitwise, and others, has introduced uncertainty, though approval remains possible before this year ends.”

According to Bloomberg analyst James Seyffart, several firms have filed and received acknowledgment for spot crypto ETF applications with the U.S. SEC. Approval odds are highest for Litecoin, Solana, and crypto basket products at 90%, followed by XRP at 85%, Dogecoin at 80%, and…

— Wu Blockchain (@WuBlockchain) June 10, 2025

XRP Records Significant Price Action Boost as Top Asset Managers Revise S-1 Filings

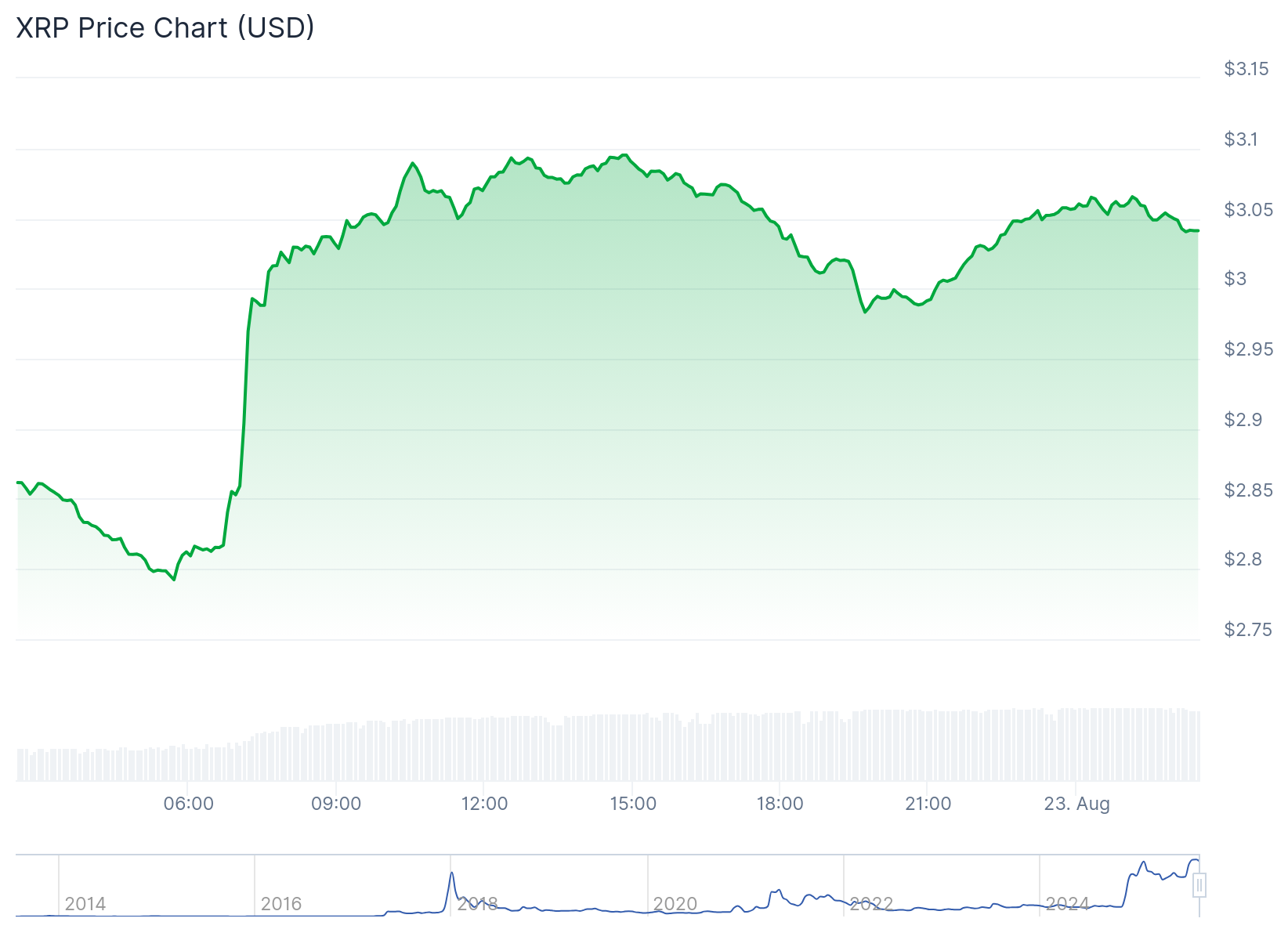

At the time of press, XRP is priced at $3.06, following a 6.5% upswing in the past 24 hours, with price extremes ranging between $2.79 and $3.10. This price range highlights the token’s significant price appreciation within a short interval. Despite the impressive price actions, XRP’s long-term variables showed declines, implying that the rally might be short-lived. For context, XRP’s 7-day-to-date and 14-day-to-date price change variables reflected declines of 1.3% and 7.7%, respectively.

Meanwhile, Coincodex showed that the volatility on XRP is medium at 3.87%. In addition, the Fear and Greed Index, which tracks investors’ attitude towards an asset, showed Greed, while sentiment reflected bullish. Risk assessment on Coincodex showed that the token possesses only a few risks, including a high yearly inflation rate of 7.3%.

Additionally, the token flashed only 13 positive trading days in the past month. Meanwhile, XRP’s positive selling points included a 411% surge in the past year. XRP also outperformed the top 100 most valuable cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH). The token is trading above the 200-day simple moving average (SMA), with high liquidity based on its market cap.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.