Highlights:

- A market expert has spotlighted the $2,800 Ethereum mark as a missed investment opportunity.

- Ethereum is recovering from its decline. It is changing hands around the $3,000 region and has converted $2,849.2 to support.

- Holders making profits at ETH’s current price hit 73% as exchange outflows exceed inflows.

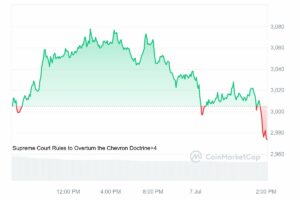

After what seemed like a nightmare, Ethereum (ETH) is finally recovering the losses that saw it drop below $3,000. Like Bitcoin (BTC), the Ether-based token elicited fear among investors when it plunged suddenly, touching a $2,847.02 weekly price low. Interestingly, within the same time frame, Ethereum traded at a peak of $3,512, underscoring a marked slump in price.

Market Staging Recovery After Exceeding the $2,800 Ethereum Mark

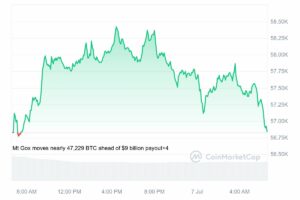

Fortunately, the declines presented as a short-lived scenario, as the market has since begun staging a gradual recovery. The major market trends determinant, Bitcoin, surged from about $54,000 to its current $57,500 valuation, touching $58,000 at some point.

Similarly, Ethereum has also recovered from its lows after spiking by about 2.2% in 24 hours and trading for approximately $3,030. Considering its 24-hour minimum and maximum prices, ranging between $2,971.85 and $3,076.26, ETH seems to stabilize around the $3,000 region.

The $2,800 Ethereum Mark – A Lost Opportunity?

In a tweet making rounds, McKenna, a renowned analyst, has called his 89.6K followers’ attention to a missed opportunity. Per the expert, the $2,800 Ethereum mark was a goldmine for investors willing to accumulate ETH at discounted prices.

Additionally, McKenna noted that amassing ETH in anticipation of the con’s Exchange Traded Fund (ETF) sales would have constituted an ideal strategy. Part of his tweet read, “The absorption at $2800 for ETH was smart money scooping Ethereum on the cheap in anticipation for the ETH ETFs starting to trade this month.”

The expert further advised investors to get greedy during market slumps. “Every single cycle bears, get too greedy. Mark my words, you are not going to see $2800 again,” McKenna asserted, reiterating that the $2,800 Ethereum mark is unlikely to repeat.

Fuck going dark returning back to Twitter that was a bottom if I've ever seen one.

The absorption at $2800 for $ETH was smart money scooping Ethereum on the cheap in anticipation for the ETH ETFs starting to trade this month.

Every single cycle bears get too greedy. Mark my…

— McKenna (@Crypto_McKenna) July 6, 2024

Technical Analysis Revealed $3,200 as ETH’s Next Stop

Hopping on to Ethereum’s technical analysis review, we deduced that the Ether-based token had converted $2,849.2 to potent support. Currently, Ethereum is heading towards the next resistance at $3,261. If the bull outweighs the bear, a break above $3,261 will ensue, setting the stage for a rally toward $3,520.

Revisiting $3,520 and possibly exceeding the level could set the stage for ETH’s and other altcoins’ unprecedented rally. Meanwhile, contrary to McKenna’s claims, ETH could drop to its newly formed $2,849.2 support if the bear outweighs the bull again.

ETH Holders Making Gains Hits 73%

Following the broader market recovery, IntoTheBlock’s Ethereum statistical summary has revealed positive figures, underscoring ETH’s marked bounce back. Notably, Ethereum’s “Holders Making Money at Current Price” data disclosed that 73% are in profits. 4% are neither gaining nor losing, while 23% are losing.

In addition, whale holders’ concentration remains at a reasonable range of 51%. Meanwhile, “Holders Composition by Time Held” statistics revealed that 74% had owned ETH for over a year. 23% have held on to ETH for 1 to 12 months, while 3% have owned Ethereum for less than a month.

Another significant positive finding in ETH’s statistical summary was its total exchange outflows relative to inflows. Notedly, Ethereum’s total exchange outflows amounted to $10.94 billion, slightly higher than the inflows at $10.73 billion. The inflows and outflows data above underscore faith in Ethereum’s bounce-back prospect, as it implies more token accumulations relative to dumps.

Learn More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Crypto Exchanges in 2024

- Toncoin Price Prediction: TON Eyes $8 as it Trades in a Bullish Channel

- Notcoin Price Prediction As Market Recovers: Will NOT Hit $1 By End of July