Highlights:

- Toncoin price drops 4.67%, trading at $2.78, as trading volume drops by 27%.

- This comes as the UAE authorities deny the Golden Visa claim linked to staking 100,000 TON.

- Technical indicators signal a mixed sentiment, with the bears holding the upper hand.

As of July 7, the Toncoin price had decreased by 4.67% to $2.78, with its daily trading volume down 27%. This recent drop follows Toncoin’s recent Dubai golden visa giveaway to citizens who can stake 100,000-TON for three years as part of a partnership with the UAE. The government fee to acquire the visa will amount to $35,000.

BREAKING:

🇦🇪 TON HAS JUST PARTNERED WITH UAE TO OFFER 10 YEAR GOLDEN VISA TO TON STAKERS.

– STAKE $100,000 $TON FOR 3 YEARS

– 10 YEARS DUBAI GOLDEN VISA

– SPOUSE / FAMILY INCLUDED

– $35,000 GOVT FEESMASSIVE FOR CRYPTO ADOPTION 🚀 pic.twitter.com/UC7ywfV5HF

— Ash Crypto (@Ashcryptoreal) July 6, 2025

The news comes after Toncoin has been expanding its areas of usage consecutively. However, the Federal Authority for Identity, Citizenship, Customs and Port Security, the Securities and Commodities Authority, and the Virtual Assets Regulatory Authority have stated that holders of digital assets do not receive golden visas.

Here we go, $TON is the next $LUNA

Fucking send this shitcoin to zeroSource – https://t.co/HVFtvpoxQy https://t.co/wLotSDqUQr pic.twitter.com/YbFH2zbeGF

— Nadine (@CryptoNadine) July 7, 2025

Toncoin Price Outlook

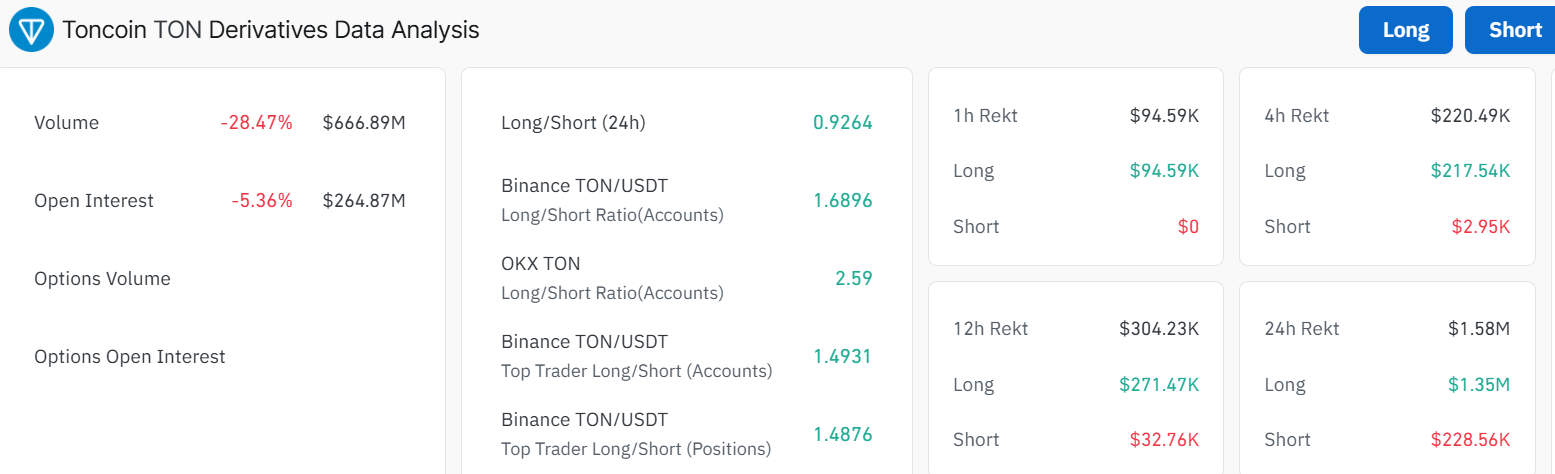

At the time of writing on 7 July, Toncoin (TON) is down by 4.67% to trade at $2.78. The volume of trading has also decreased by 26.9%, indicating a decline in short-term market interest. The open interest has also decreased by 5.36% to 264.87 million, indicating that few traders are entering positions at this point.

The volume has decreased drastically, but the Long to Short ratio is quite healthy at 0.92, with more long positions than short positions. This indicates an overall bullish note in the market. With the main resistance level at 3.00 and the main support level at 2.50, the asset is currently in a tight range. This could be a decisive point that traders should consider when making strategic decisions.

Although the recent crash caused a slowdown in Toncoin, it remains an appealing investment for long-term investors. This is because its market share and the number of users worldwide continue to rise. The current shape of the falling wedge on the TON/USD chart suggests a potential price recovery in the next few months. This could be plausible if the market mood improves towards a more positive one.

The Relative Strength Index (RSI) of 42.58. This indicates that the market is currently in a neutral position, which is expected to shift towards an oversold position with further pressure.

Moreover, the Moving Average Convergence Divergence (MACD) value of -0.0650 indicates that the asset is facing mild buying pressure. If the bulls show strength and capitalize on the buy signal, the toncoin price could break out to the upside. Meanwhile, as long as Toncoin continues to advance in strategic partnerships, such as the one with the UAE, the price is likely to bounce back in the long run.

What’s Next for TON?

A zoomed-out view of the TON market shows mixed signals, but the odds tend to lean toward the bears. If the recent downtrend continues and the resistance levels prove too strong, the safety nets at $2.70-$2.57 will absorb the dips. On the upside, with the MACD upholding a buying signal, only a breach above the $3.00 resistance area will trigger a short-term rally. In a highly bullish case, if the bulls overcome the $3.70 area, they could eye a potential surge towards $4.40 in Q4.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.