Highlights:

- Tom Lee says Ethereum’s long consolidation phase supports a breakout toward $10,000–$12,000 range.

- Arthur Hayes also remains confident in $10,000 ETH target despite the recent market-wide correction.

- Analysts highlight institutional accumulation and reduced liquidity supply as key bullish Ethereum signals.

BitMine Chairman Tom Lee and BitMEX co-founder Arthur Hayes are holding firm to their belief that Ethereum (ETH) still has room to soar this year. On the Bankless podcast, Lee predicted the token could climb between $10,000 and $12,000 before 2025 ends. Hayes shared the same view, saying he’s staying consistent with his $10,000 target. He dismissed the current downturn as temporary noise in a long-term bullish cycle.

Ethereum Price Set for Potential Surge

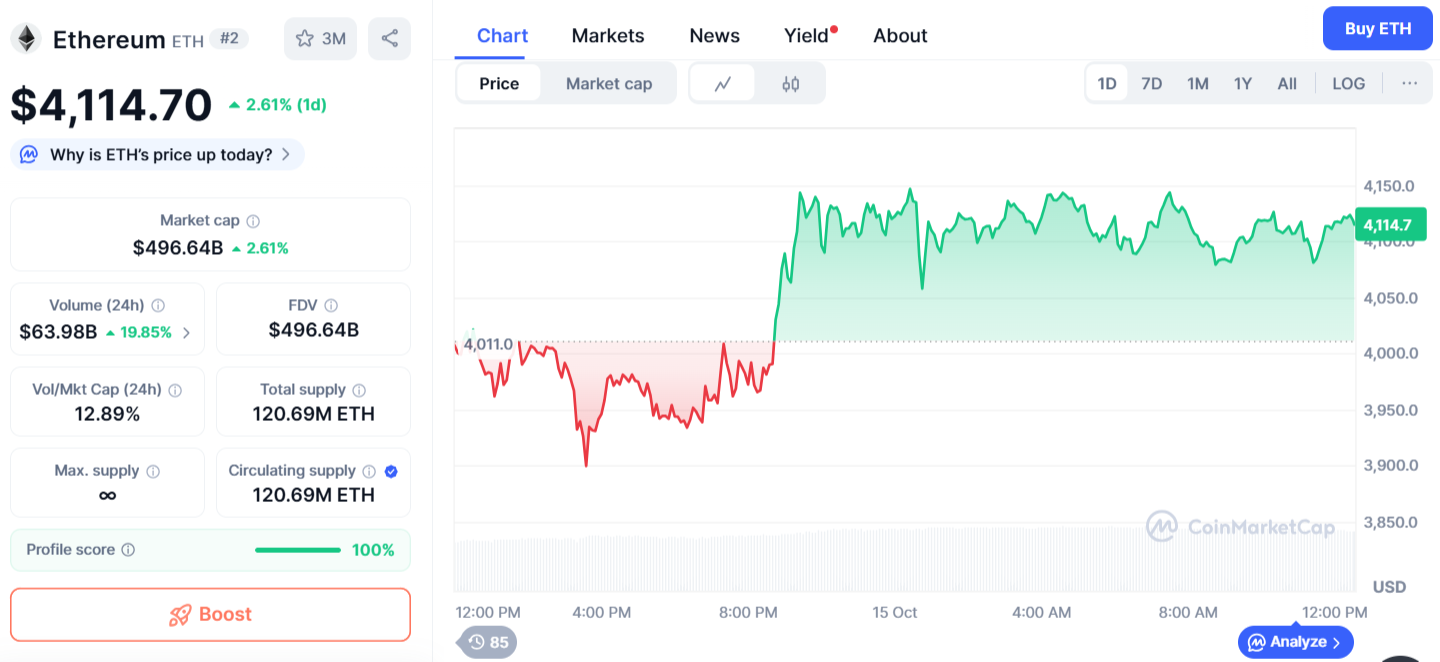

At the time of writing, Ethereum trades around $4,114, meaning a move toward $10,000 would mark an impressive over 140% rise. Both analysts argue that growing institutional demand, combined with broader crypto market recovery, could still make this ambitious target possible before the year closes. He said a big rally wouldn’t mean the market is overheated.

Lee explained that Ethereum price has mostly moved sideways since its 2021 high of $4,878. According to him, the coin has been building strength for four years and is now breaking into a new price level. Hayes agreed, saying he has no reason to change his long-standing forecast. Both analysts view the current market setup as the start of “price discovery 2.0,” where Ethereum could move past its old highs and enter a more stable growth phase.

Ethereum briefly hit its 2021 peak again in August but dropped soon after and hasn’t returned to that level since. The crypto market recently saw a sharp correction, with over $19 billion in liquidations across major assets. Ethereum’s price fell from around $4,350 to nearly $4,100 during the drop.

Despite this, Hayes and Lee remain confident, saying short-term swings don’t change their long-term view. Lee said he expects 2025 to bring stronger fundamentals for Ethereum. He believes several key developments could drive growth next year. While he sees $12,000 as an important milestone, he doesn’t think it will mark the end of the current cycle.

Ethereum Sees Strong Institutional Support and Reduced Liquid Supply

This bullish outlook aligns with recent analyses highlighting Ethereum’s strong fundamentals. Analyst “Crypto Gucci” noted that 40% of ETH is now out of circulation due to record institutional demand. Over the past months, digital asset treasuries (DATs) have accumulated around 5.9 million ETH, worth approximately $24 billion. This represents roughly 4.9% of the total supply. These holdings are expected to remain long-term and reduce the liquid supply.

As of today, US-based ETFs hold 6.84 million ETH ($28 billion), about 5.6% of the total supply, despite staking not being approved. Additionally, 35.7 million ETH, worth $146 billion, is staked. This is nearly 30% of the total supply and mostly illiquid because of a 40-day exit queue. Crypto Gucci concluded that the Ethereum price has entered this cycle with record institutional demand. He also noted it has the smallest liquid float in history.

ETH’s supply is disappearing faster than ever 🔥

Over 40% of all $ETH is currently locked out of circulation and is continues to climb rapidly

Ethereum has never experienced a market cycle with all three supply vacuums active at once:

– DATs didn’t exist last cycle

– Spot ETFs… https://t.co/Y4FtW7Rmzg— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) October 14, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.