Highlights:

- Thena price jumps 33% to $0.42, with daily trading volume hitting a 5-month high, up 426%.

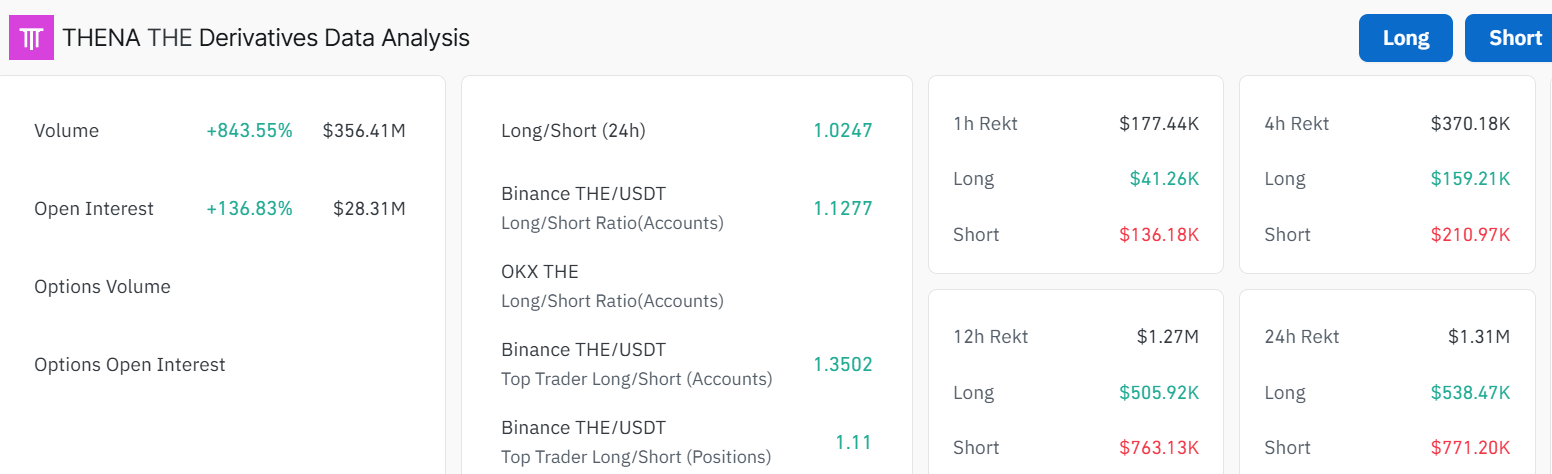

- The futures volume soars 843% to $356.41 million, and open interest rises 136% to $ 28.31 million.

- Thena breaks a downtrend as bulls eye $0.93–$1 potential if $0.48 resistance is breached.

Thena’s price has spiked by over 33% to $0.42 in the past 24 hours, as its daily trading volume reached a 5-month high, marking a 426% increase from the previous day. The recent rally comes as THENA’s V3.3 upgrade (available since 21 May) appears to be gaining adoption. It added modular liquidity pools and auto-compounding incentives. Moreover, its TVL increased by 83% after the upgrade to $22.31 million (THENA). An Italian Telegram community was also established by the protocol on 14 July, representing an attempt to expand regionally (ThenaFi_).

🇮🇹 THE official Italian community of THENA is now live on Telegram!

Il futuro si scrive in italiano, FA SENTIRE LA TUA VOCE.

🏛️ https://t.co/KTuq8TwCdB pic.twitter.com/qPXejg64q4

— THENA (@ThenaFi_) July 14, 2025

Growing Confidence Underpinned by Derivatives and Open Interest

When we take a glance at the $THE derivatives market, we can observe a significant increase in volume and open interest. The futures in $THE have increased tremendously, by more than 843%, to 356.41 million. The open interest, a measure of the number of contracts yet to be taken, has also increased by 136%, currently standing at 28.31 million. These numbers suggest longer-term stakes by market players, indicating growing confidence in the project’s future.

Its long-to-short ratio of $THE is 1.02, implying that most market participants are in long positions, indicating a bullish sentiment. Although these are bullish signs, it is worth noting that the market is not currently at a healthy level. In other words, there is a high chance that the market may reverse when profit-taking sets in.

Thena Price Breaks Out of a Descending Channel

The Thena price has been in a prolonged downtrend since November 2024, following its listing on Binance. Currently, it trades at $0.42, down about 90% from its ATH at 3.94. However, with the recent upgrades, THE is showing signs of life, as it has broken out of a descending channel, up 35% in the past day. The bulls have established immediate support at $0.25, coinciding with the 50-day MA, as they eye the immediate resistance at $0.48(200-day)MA.

The Relative Strength Index (RSI) is an impressive 80.46, and this means that $THE is flirting in an overbought territory. Traders should be cautious to avoid the bull trap, as a retracement is likely, to allow the bulls to sweep through liquidity. Additionally, the Moving Average Convergence Divergence (MACD) indicator generates a buy signal, as it reveals a solid positive crossover.

The positive outlook in the Thena price daily chart shows that the bulls have the upper hand. Looking ahead, the short-term forecast is bullish. If THE holds above the $0.48 resistance and volume continues to pump, the token could rally towards $0.93-$1 by late August.

In the long term, if this momentum continues, $1.87-$2 isn’t off the table by September, especially with the community hype. However, traders should be cautious, as the overbought RSI and potential profit-taking could drag it back to the $0.25 support area. Traders will want to keep an eye on that $0.48 level, because a bounce from the level could send the Thena price higher.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.