Highlights:

- Telegram to raise capital in bonds from leading companies with a 9% yield.

- Telegram plans to use the funds to buy back debt from its previous bond issue.

- Toncoin has gained after the news, while the TON Foundation has appointed Nikola Plecas to lead its global payments strategy.

Telegram, a popular messaging app, is set to raise at least $1.5 billion through a bond sale, according to The Wall Street Journal. The five-year bonds come with a 9% yield, drawing strong interest from investors. Both existing and new backers, including BlackRock, Abu Dhabi’s Mubadala, and Citadel, are participating in the offering. Telegram plans to use the proceeds to repurchase bonds it issued in 2021, which mature in March 2026.

🐶🦊🐃

😎Telegram to raise $1.5B in bond sale with 9% yield, BlackRock, Citadel & Mubadala expected to invest.

❤️#crypto pic.twitter.com/Xi5h9ZXCwB

— CryptOpus (@ImCryptOpus) May 28, 2025

So far, the company has already bought back around $400 million of that earlier debt using its cash reserves. The remaining funds from this round will help retire the rest. Investors can convert their bonds into Telegram shares, with a discount applied, if the company decides to issue shares publicly.

Although an IPO remains uncertain in the near term, this provision follows the same model as previous offerings. Bloomberg previously noted that Telegram was talking with investors about raising $2 billion, showing the market’s strong interest.

CEO Durov Returns to Dubai Amid Ongoing Legal Challenges

Telegram’s CEO and founder, Pavel Durov, is still dealing with legal problems in France. Authorities have looked into whether he cooperated with inquiries about possible illegal activity on the platform. He was detained by French authorities in August. A judge in March issued a decision permitting him to leave France for the time being, making it possible for him to return to Dubai.

After arriving in Dubai, where Telegram is headquartered, Durov made a public statement defending the company’s practices. He said Telegram has fulfilled all legal expectations in content moderation and crime prevention. Durov posted on X today that he would be in Dubai during the first week of June and added that “good news” was on the way.

🇦🇪 I’ll be in Dubai the first week of June — good news ahead.

— Pavel Durov (@durov) May 28, 2025

Telegram has yet to comment on the bond deal. Nevertheless, the presence of many investors means investor confidence in the platform has not been shaken by Durov’s legal woes. In a related event, the TON Foundation has named Nikola Plecas, a former Visa executive, as its new vice president of payments. He will lead global payment strategy and oversee platform compliance efforts.

⚡️ NEW: TON Foundation hires ex-Visa exec Nikola Plecas to lead global payments strategy as it scales for 1B+ Telegram users. pic.twitter.com/V1x9JI6KD3

— crypto magazine (@CryptoMagazine9) May 28, 2025

User Growth and Revenue Surge Amid Bond Sale

Telegram’s revenue in 2024 grew greatly compared to the previous year. The firm saw a profit rise from a loss of $173 million in 2023 to $540 million last year. Revenue climbed to $1.4 billion, driven mainly by paid subscriptions, advertising, and activity within the TON blockchain ecosystem.

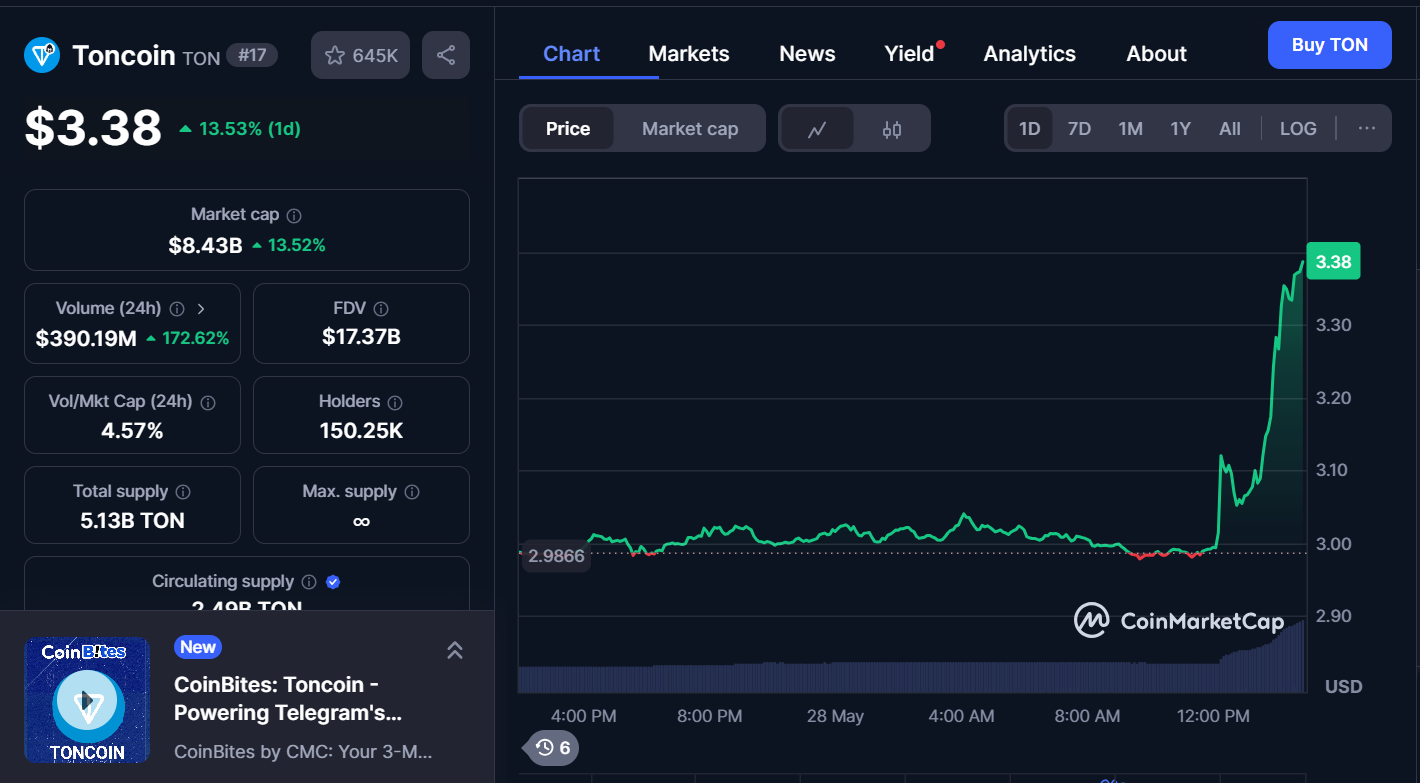

The company expects to earn more than $700 million in profit in 2025, with revenue forecasts approaching $2 billion. In just one year, Telegram Premium has seen its number of paying subscribers grow to over 15 million people. According to Telegram, more than one billion people now use the app each month, showing its growing international adoption. Following news of the bond sale, Toncoin (TON) is up 13.53% today and is trading at $3.38. Moreover, the trading volume has surged 172.62% to $390.19 million.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.