Highlights:

- Strategy posts $4.2B loss after BTC fall and new accounting rules.

- Bitcoin surge boosts Strategy’s position, expects $8B gain in second quarter.

- Strategy plans a $21 billion stock offering to fund continued Bitcoin purchases.

Michael Saylor’s Bitcoin-focused company, Strategy — previously known as MicroStrategy — reported a $4.2 billion net loss in Q1 2025. The company’s loss came after it adopted new accounting rules. These rules now require companies to include changes in Bitcoin value—even if not sold—in their earnings. Before this, Bitcoin was treated as an intangible asset. That meant losses were recorded when prices dropped, but gains weren’t counted unless Bitcoin was sold. Now, with Bitcoin priced at $82,445 at the end of the quarter, Strategy had to report a big unrealized loss.

The company said its position has improved since then. With Bitcoin now trading around $97,300, Strategy anticipates an $8 billion fair value gain in the second quarter so far. This change shows how the new accounting rules can cause big swings for companies holding large amounts of crypto.

By late April, Strategy owned 553,555 BTC, purchased at an average price of $68,459. The company added 301,335 BTC in the first quarter alone, showing it’s still aggressively buying. So far this year, its shares are up 27%. Strategy also shared some key numbers along with its capital raise.

The firm’s BTC yield stands at 13.7% for the year, reflecting growth per diluted share. This increase equals more than 61,000 BTC in gains—valued at roughly $5.8 billion. CFO Andrew Kang stated that the company now aims to boost its annual Bitcoin yield target to 25% and raise its BTC gain goal to $15 billion.

Strategy Achieves Major Yield Milestones, Plans $21 Billion Stock Offering

Phong Le, President and Chief Executive Officer pointed out that these results account for more than 90% of the company’s 2025 yield target, achieved in just the first four months. He said this progress came from strong capital moves. He also noted that over 70 public companies worldwide have started using Bitcoin in their treasury plans. Meanwhile, the company’s stock has seen a nearly 3,000% increase since 2020, reflecting strong investor interest.

$MSTR is now up more than 3000% since adopting the Bitcoin Standard. pic.twitter.com/ZqBKMHG999

— Michael Saylor (@saylor) May 1, 2025

Strategy disclosed plans for a new $21 billion stock offering. Michael Saylor posted on X that the money will be used to acquire more Bitcoin. Strategy started a plan to sell shares and boost its Bitcoin holdings. The company has sold about $20.9 billion in shares through this program and still has $128 million in shares available to sell.

$MSTR announces BTC Yield of 13.7% and BTC $ Gain of $5.8B year-to-date, doubles capital plan to $42B equity and $42B fixed income to purchase bitcoin, and increases BTC Yield target from 15% to 25% and BTC $ Gain target from $10B to $15B for 2025. https://t.co/LgeMEd6Dr5

— Michael Saylor (@saylor) May 1, 2025

Strategy Stock Rises as Bitcoin Sees Gains

Shares of Strategy (MSTR) closed at $381.60 on May 1, marking a 0.39% increase during regular trading. After market hours, the stock dropped to $378.50, based on data from Google Finance. Despite rising more than 31.5% year-to-date, MSTR still trades below its November high of over $470 per share.

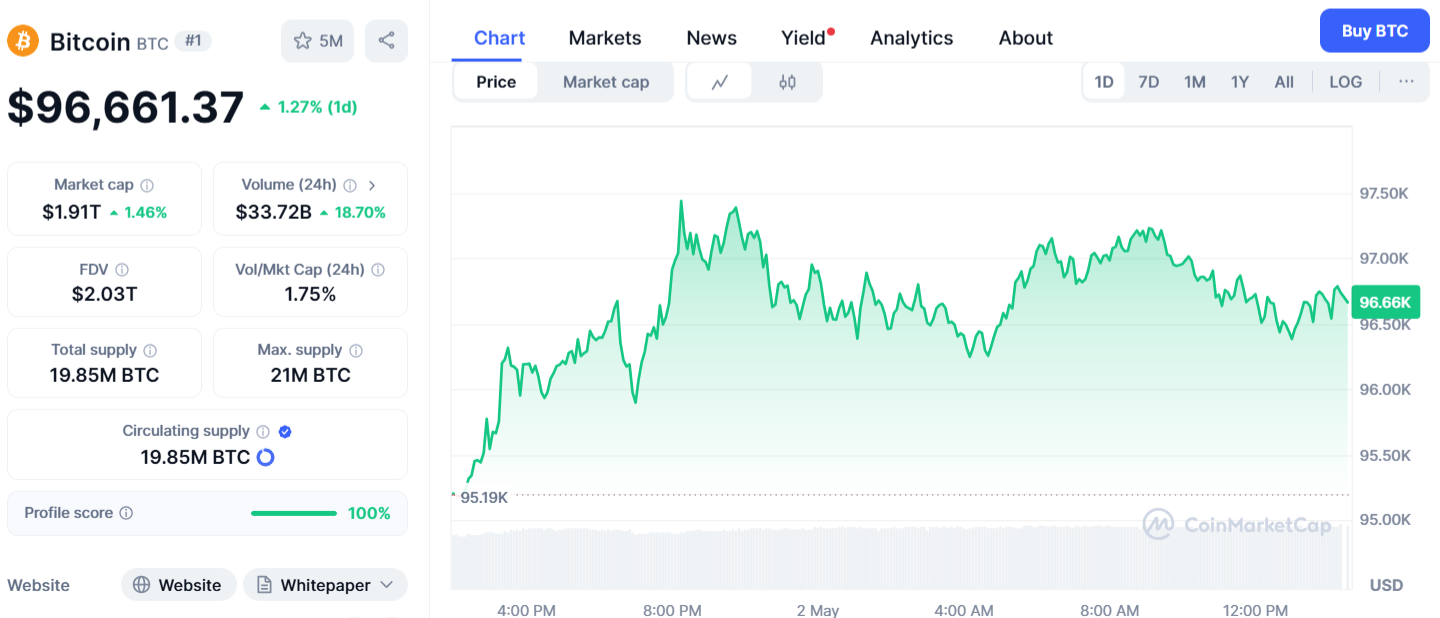

Bitcoin was trading around $96,661, marking a 1.27% increase in the last 24 hours, according to CoinMarketCap. The top digital asset has climbed 14% over the past month, bouncing back from a decline seen between late January and early April.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.