Highlights:

- Strategy announces new fundraiser, targeting $2.1 billion to expand the company’s BTC holdings.

- The capital will also be used to find corporate fees and working capital.

- Strategy added that it will employ ATM to facilitate its proposed sales offering.

The largest Bitcoin (BTC) corporate holder, Strategy, said it is planning a $2.1 billion fundraiser to expand the company’s Bitcoin holdings. The investment firm announced the latest initiative in a May 22 press release. The publication revealed that Strategy intends to raise $2.1 billion by selling its 10% Series A Perpetual Strife Preferred Stock shares.

Strategy Announces $2.1 Billion $STRF At-The-Market Program. To view the investor presentation video and access more information, click here. $MSTRhttps://t.co/pkv0RVSyUv

— Strategy (@Strategy) May 22, 2025

Stock Trading Avenues and Guiding Principles

Strategy plans to use “at-the-market” (ATM) for the above sales. The Bitcoin investment company stated, “The perpetual strife preferred stock, subject to the terms and conditions of the sales agreement, may be sold by agents by any method that is deemed an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933.”

Unlike the conventional stock market, ATM trading permits investment firms and other companies to trade shares in the open market at prevailing market valuation. This allows companies to evade the impacts of sudden price drops. Overall, the initiative will be crucial in driving Strategy’s unrelenting Bitcoin acquisition pattern.

Moreover, Strategy noted it could sell its stocks via other lawful methods like block trades and negotiated transactions. The company added that sales will be conducted in line with a prospectus supplement approved by the Securities and Exchange Commission (SEC) on May 22, 2025. Notably, Strategy’s announcement noted that this prospectus became effective on January 27, 2025.

The investment platform also noted that the exercise will depend on market conditions like trading volume and stocks’ valuation. Beyond expanding its Bitcoin holdings with the funds realized from the proposed offering, Strategy said it will spend over $2 billion on other projects, including general corporate expenses and working capital.

Strategy’s Bitcoin Holdings Near 600,000 Tokens as Institution Interest Soars

On May 19, Michael Saylor, Strategy’s co-founder and Chief Executive Officer (CEO), announced the company’s latest Bitcoin acquisition. In an X post, the CEO revealed that Strategy bought 7,390 BTC for $764.9 million, with each token valued at an average of $103,498 per coin. “As of 5/18/2025, we hodl 576,230 BTC acquired for ~$40.18 billion at ~$69,726 per bitcoin,” Saylor added.

Strategy has acquired 7,390 BTC for ~$764.9 million at ~$103,498 per bitcoin and has achieved BTC Yield of 16.3% YTD 2025. As of 5/18/2025, we hodl 576,230 $BTC acquired for ~$40.18 billion at ~$69,726 per bitcoin. $MSTR $STRK $STRF https://t.co/QwYKgLkfPX

— Michael Saylor (@saylor) May 19, 2025

In a follow-up tweet, Saylor disclosed that Strategy’s Bitcoin holdings generated a 4.8% BTC yield after 49 days in 2025’s second quarter (Q2). The CEO added that the investment firm amassed gains worth $2.7 billion. In addition, Strategy BTC holdings surged to about $60.7 billion, with approximately $7.7 billion in year-to-date (YTD) gains.

In the first 49 days of Q2, $MSTR delivered a 4.8% BTC Yield—driving $2.7B in BTC $ Gain. We now hold $60.7B in BTC and have generated $7.7B in BTC $ Gain YTD. pic.twitter.com/6vBHNbo52M

— Michael Saylor (@saylor) May 19, 2025

On the same date, Metaplanet spent about $104 million to purchase 1,004 BTC, with each token valued at an average of $104,180. As a result of the purchase, Metaplanet’s BTC holdings rose to about 7,800, bringing the company close to achieving its long-term goal of accumulating 10,000 BTC before this year ends.

Meanwhile, Strive, another popular crypto asset management firm, announced plans to expand its Bitcoin holdings in a May 20 filing. According to the court document, Strive wants to secure BTC at discounted prices by capitalizing on claims tied to 75K from the imploded exchange, Mt. Gox.

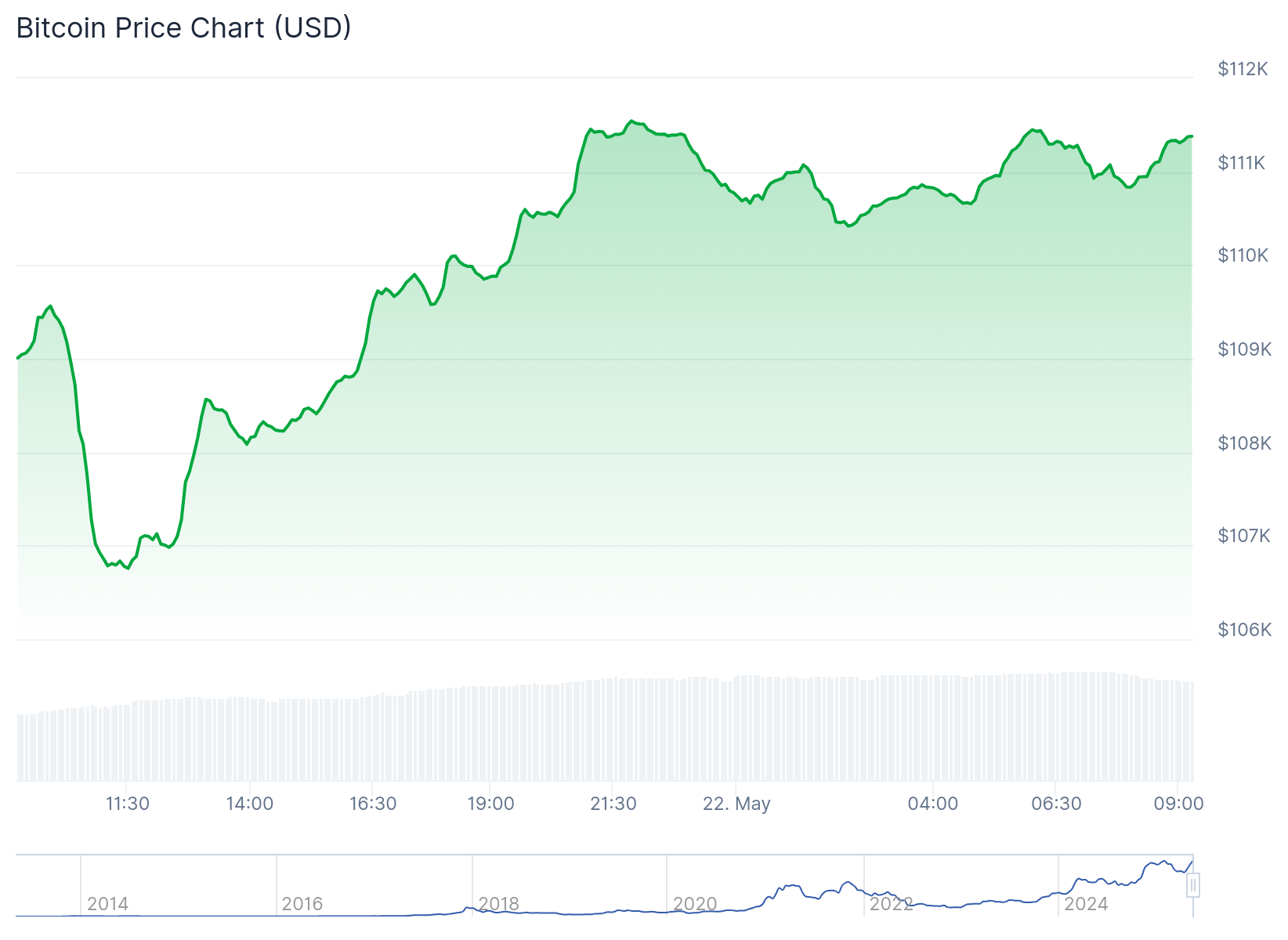

Bitcoin Breaks Above $110,000, Establishes New Peak Price

Bitcoin finally broke above $110,000 to attain a new all-time high (ATH) at $111,544. BTC is up 2.2% in the past 24 hours, trading at roughly $111,300 and fluctuating between $106,758 and $111,544. This price range highlights BTC’s significant leap in a short interval.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.