Highlights:

- Strategy has purchased an additional 1,229 BTC, increasing its holdings to 672,497 tokens, worth $50.44 billion.

- The company spent $108.8 million in its latest purchase, with each BTC token valued at an average cost of $88,568.

- Strategy raised the capital for its most recent purchase by selling 663,450 shares of its MSTR stock.

Michael Saylor’s Strategy, formerly known as MicroStrategy, has expanded its Bitcoin holdings with a fresh investment worth $108.8 million. The purchase comes amid broader declines in the crypto market, highlighting consistent faith in Bitcoin. According to a filing with the U.S. Securities and Exchange Commission (SEC), the company bought 1,229 BTC at an average cost of $88,568. The purchase brings the company’s year-to-date (YTD) returns on its BTC holdings to 23.2%.

Strategy now holds 672,497 BTC, valued at approximately $50.44 billion, with an average purchase price of $74,997 per Bitcoin. The filing also disclosed how the latest purchase was funded. Strategy sold 663,450 shares of its MSTR stock to raise the exact amount used for the purchase.

Strategy has acquired 1,229 BTC for ~$108.8 million at ~$88,568 per bitcoin and has achieved BTC Yield of 23.2% YTD 2025. As of 12/28/2025, we hodl 672,497 $BTC acquired for ~$50.44 billion at ~$74,997 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/UGvjHj5WPg

— Strategy (@Strategy) December 29, 2025

Strategy Resumes Purchase After Halting BTC Acquisition in Mid-December

Today’s purchase comes after a brief pause. For context, Strategy did not announce any new purchase in the week ending December 21. Rather, the company reported that it had raised its cash reserves to $2.19 billion to fund future Bitcoin accumulations. Earlier in December, Strategy completed some of its largest BTC purchases of the year.

In the week ending December 14, the company spent $980 million on Bitcoin, marking its largest purchase since July 2025. A week earlier, Strategy purchased 10,624 Bitcoin for $962.7 million. While both Bitcoin and MSTR stock have forfeited gains accumulated earlier this year, Strategy continues to stick with its long-term approach of adding more Bitcoin during market declines.

Strategy announced it purchased 1,229 BTC at an average price of ~$88,568, spending ~$108.8M and recording a 23.2% BTC yield YTD 2025. As of Dec 28, 2025, Strategy holds 672,497 BTC, acquired at a total cost of ~$50.44B with an average price of ~$74,997 per BTC.…

— Wu Blockchain (@WuBlockchain) December 29, 2025

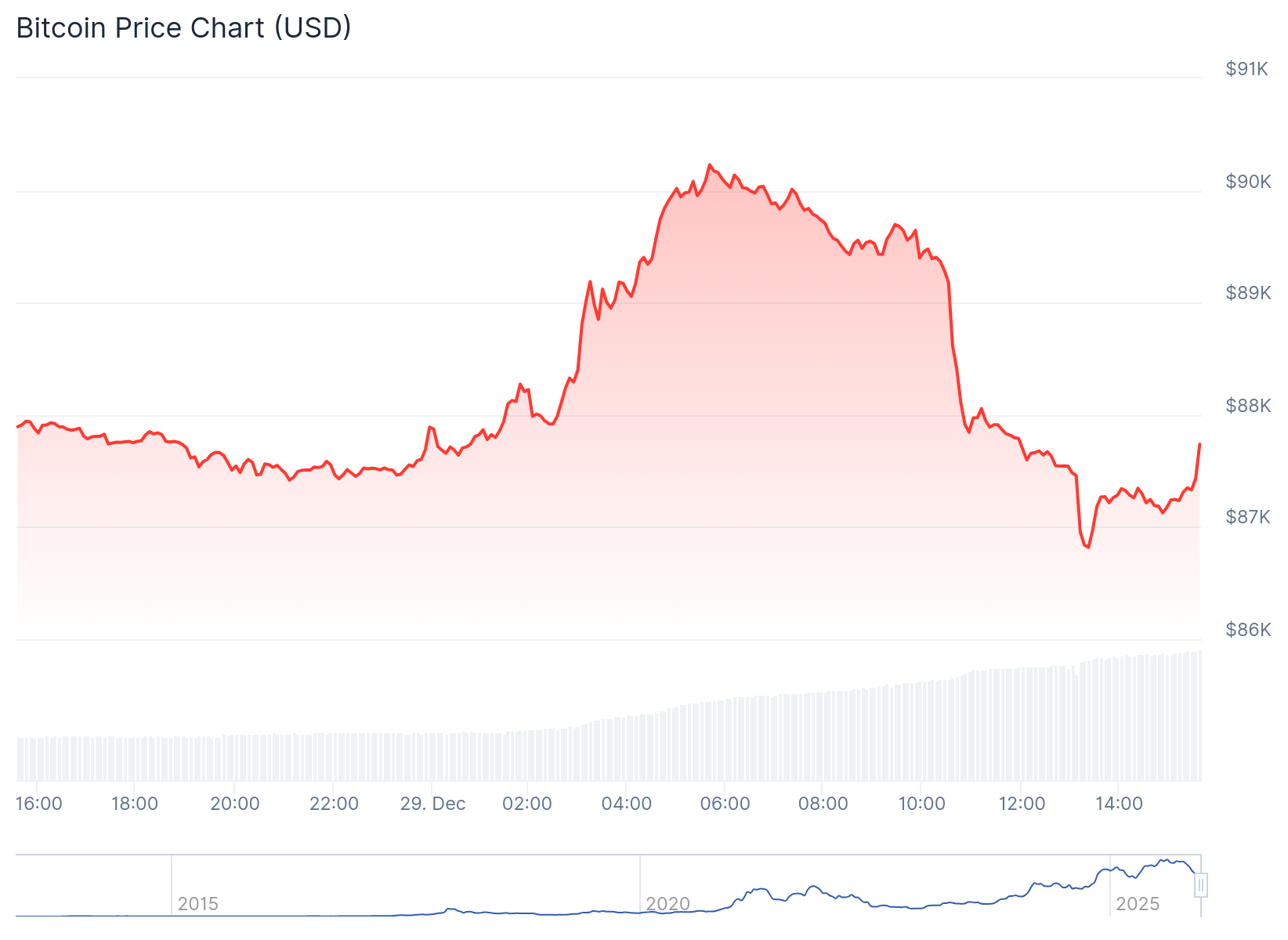

Bitcoin’s Price Remains Below $90,000 as Strategy Buys More BTC

At the time of writing, the crypto market is down 0.7% with a market cap of $3.056 trillion and a 24-hour trading volume of $113.61 billion. Similarly, Bitcoin is down 0.2%, trading at $87,966 with a market cap of $1.75 trillion, and a trading volume of $46.69 billion. In its 7-day-to-date, month-to-date, and year-to-date price change variables, BTC dropped 2.6%, 3.1%, and 7.3%, respectively.

Coincodex’s risk assessment of Bitcoin reveals that 86% of the top 100 cryptocurrencies have outperformed it in the past year. The asset is also trading below its 200-day Simple Moving Average (SMA) with medium liquidity based on its market cap and 14 profitable days in the past month. BTC’s supply inflation remains low at 0.85%, with a medium volatility of 2.15%. “Fear & Greed Index” continues to point towards “Extreme Fear” at 24 as sentiment remains bearish.

Binance founder Changpeng Zhao recently shared his strategy for purchasing Bitcoin during periods of extreme fear. He said smart investors are known for investing in BTC only when the market is clouded with many uncertainties. “Guess what, those who bought early did not buy at ATH, they bought when there was fear, uncertainty and doubt,” the Binance founder stated.

Meanwhile, Strategy’s shares (MSTR) are priced at $160.68, following a 1.18% upswing in the past 24 hours. The stock closed the previous session at $158.81, with price extremes fluctuating between $157.41 and $162.10. The company’s shares have a market value of $45.56 billion, with an average daily trading volume of 21.31 million shares.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.