Highlights:

- STP price has rebounded about 180% from April lows, currently at $0.075.

- Crypto analysts are optimistic about further upside, as they target the $0.1 mark soon.

- STP technical indicators show overbought conditions, which may cause a slight retracement.

The STP price has formed a rounded bottom pattern, as the bulls show immense strength. As of this writing, the token has spiked about 6%, with its daily trading volume surging 49%. Meanwhile, various analysts are still optimistic about further gains, potentially hitting $0.1.

$STPT

Gradually but effectively growing in accordance with our prediction.

87% Spot Profit so far😎 with good signs of Rising towards our ultimate target✍#STPT https://t.co/Y5mCakmGzu pic.twitter.com/iDifh7SpOP— Globe Of Crypto (@GlobeOfcrypto1) May 4, 2025

Despite the crypto market wobbling, led by Bitcoin, which has dropped to the $94K mark, the STP price flaunts a bullish outlook. The token has rebounded about 186% from the April lows of about $0.03 to $0.075.

On May 5, the STP token rallied to $0.08 in the day, before slightly retracing to the current price levels at $0.075. However, the bulls still uphold a bullish outlook, dominating the market. This is manifested as the STP price has flipped above the 50-day and 200-day MAs, tilting the odds towards the buyers.

STP Price Targets $0.08 Amid Bullish Momentum but Faces Overbought Risks

With the STP support levels established at $0.06 and $0.04, the STP price could have further upside. In such a case, the bulls could reclaim the $0.08 level. The bulls could hit the $0.086 mark in a highly bullish scenario.

A closer look at the STP Relative Strength Index shows it has surged towards the 70-overbought position at 79.46. This indicates that the buyers are grabbing the STP tokens immensely. However, with the token overbought, traders and investors should be careful of possible profit booking. This may cause a slight retracement or consolidation in the STP market. To evade the bull trap, they should cautiously monitor the RSI, as the bulls may sweep through liquidity.

On the other hand, if investors commence early profiteering, the STP price could drop. In such a case, the first safety net would be around the $0.067 support area. If this region gives way, further downside would be plausible towards the $0.060, which coincides with the 200-day MA. A breach below this mark will call for a deeper correction, threatening the bullish sentiment in the market.

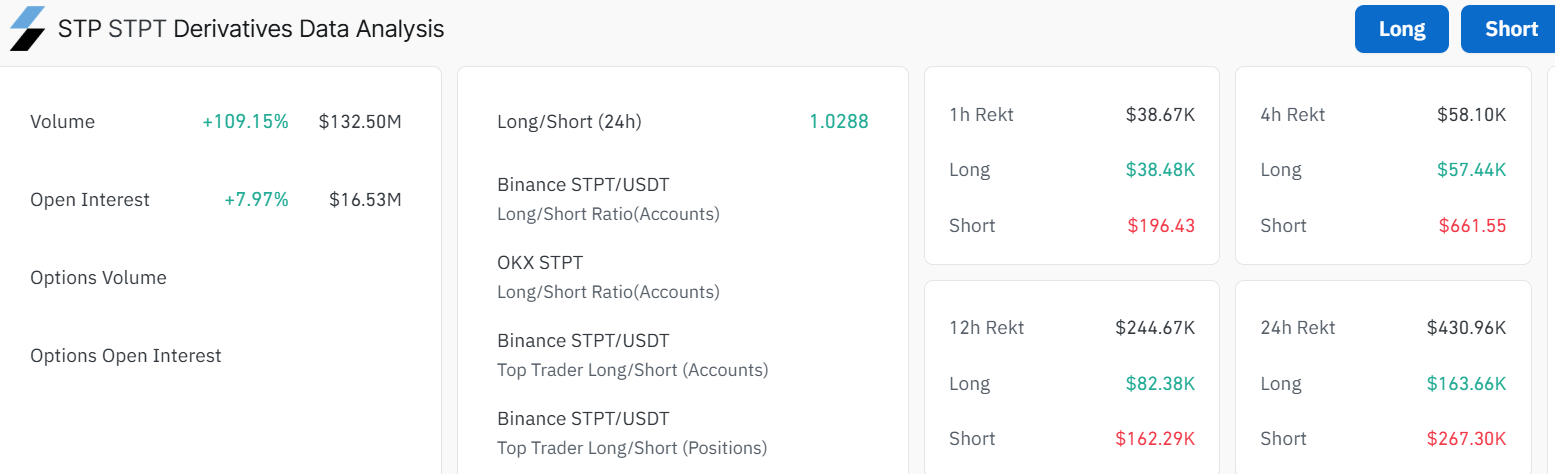

STP Derivatives Data

The on-chain metrics data, CoinGlass, shows a positive outlook, as analyzed on the derivatives data. This is evident as the open interest has increased by 7.97% to $16.53M, while the volume has soared about 109% to $132.50M. The rise in both volume and open interest shows that investor confidence is growing in the STP market, as new money keeps flowing in. This could soon cause a price rally in STP, potentially to $0.086.

However, a zoomed-out outlook at the daily liquidations accumulates to $430.96K. The big share is accounted for by the short liquidations, which have garnered $267.30K, with the longs taking the rest.

As the short liquidations surpass the longs, it is a clear indication that the bullish traders are forcefully closing positions due to pressure from the bears. In such a case, the traders and investors should be vigilant, as this may lead to a slight retracement in the STP price. Meanwhile, the overbought conditions in the market also call for more caution.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.