Highlights:

- The Stellar price has recovered from the lower edge of a bullish flag, currently at $0.31.

- The Make Infinite Labs has recently joined forces with the Stellar Development Foundation to bring Space and Time into the ecosystem.

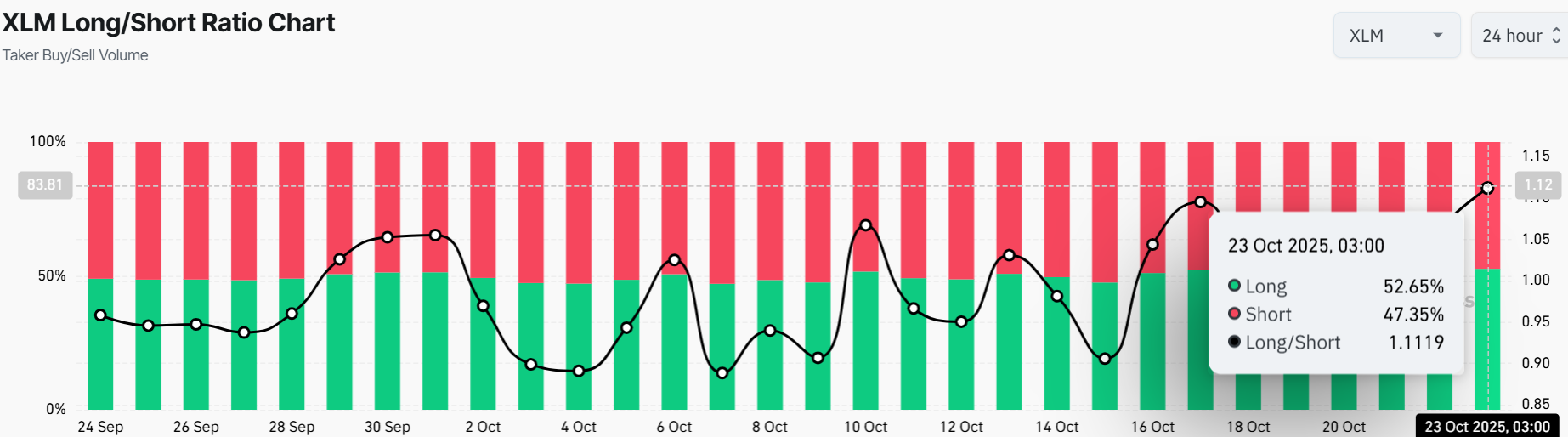

- The CoinGlass data shows improving sentiment, as the long-to-short ratio has surpassed 1.

The Stellar price is trading in green at $0.31 after recovering from support on the lower edge of a bullish flag. The derivatives information points to a turnaround in the future, as funding rates are turning positive and traders are placing increasingly bullish bets. Technically, the waning bearish momentum is an early sign of a future recovery.

Meanwhile, Make Infinite Labs has recently joined forces with the Stellar Development Foundation. It aims to bring Space and Time into the Stellar ecosystem. The partnership aims to introduce more precise and safer on-chain finance, which is essential to making blockchain technology more reliable. According to the teams at work, improved data is directly linked to more secure decentralized finance (DeFi) operations. This will enable the creation of more sophisticated financial instruments built on blockchain systems.

Excited to partner with the @StellarOrg Development Foundation to bring Space and Time to their ecosystem.

Better data = more secure finance onchain. https://t.co/cvKwwwIHLa pic.twitter.com/cVgTrsTJM9

— MakeInfinite Labs (@MakeInfiniteCo) October 22, 2025

This collaboration between Make Infinite Labs and Stellar will leverage data to enhance the security and transparency of DeFi. Stellar, a blockchain platform focused on low-cost, high-speed cross-border payments, is well-positioned to provide a more robust data infrastructure across its ecosystem by leveraging Space and Time.

Stellar Derivatives Data Outlook

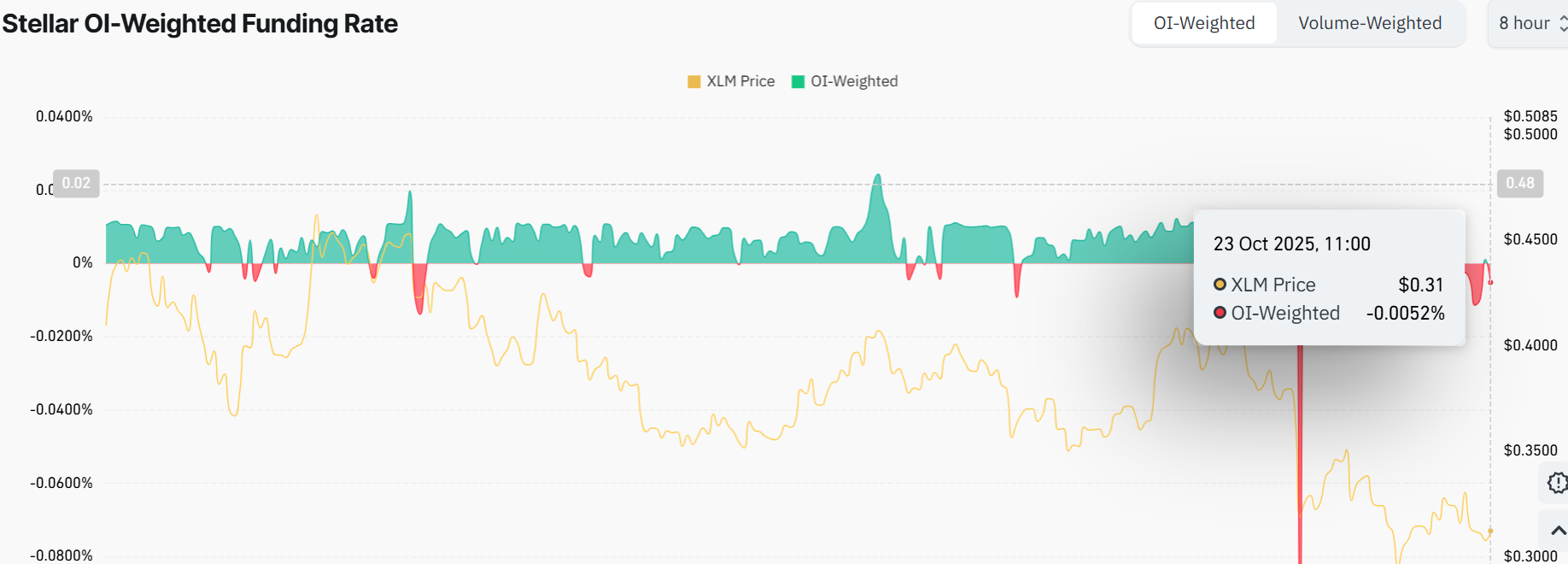

The data on the OI-Weighted Funding Rate at CoinGlass indicates that fewer traders are betting that the price of Stellar will rise than those betting it will fall. The metric is still negative, standing at -0.0052% on Thursday. This suggests that the shorts are paying off the longs. Historically, as shown in the chart below, when funding rates have turned positive, the Stellar price has rallied.

Aside from positive funding rates, bullish bets on Stellar are on the rise among traders. The long-to-short ratio for XLM on Coinglass stood at 1.1119 on Thursday, the highest in 30 days, suggesting a bullish mood.

Stellar Price Teases a Bullish Breakout Above a Bullish Flag

The daily chart shows Stellar’s price action over the past several months, and it’s been a rollercoaster ride. After a solid uptrend in mid-July, the price dipped, testing and breaking below the 200-day and 50-day Simple Moving Averages (SMAs).

This led to the formation of a bullish flag, as XLM currently trades at $0.31. The recent price action shows that the Stellat price is consolidating within the pattern, which may stir a bullish breakout. In the meantime, the bulls must overcome the $0.33 and $0.36 resistance zones to ignite a bullish rally.

The Relative Strength Index (RSI) is 38.13, indicating an oversold condition. In this case, the bulls may trigger a buyback strategy, potentially sparking a rally.

Looking ahead, if Stellar price breaks and holds above $0.33 and $0.36, it could test resistance near $0.46 in the short term. A break past this level may send it on a cruise toward reclaiming the $0.52 ATH. However, traders should watch for a pullback if the price is rejected at the 200-day or 50-day SMAs. Support lies around $0.30, and a deeper dip could test $0.28.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.