Highlights:

- The Stellar price has risen 2% to $0.24, as its daily trading volume has spiked 7%.

- XLM DeFi TVL has risen to an ATH of $167 million, indicating increased activity.

- The technical outlook indicates a potential rise towards the $0.29 resistance level as the MACD flashes a buy signal.

The Stellar (XLM) price is currently trading at $0.2478, representing a 2.24% increase in the past 24 hours. In the meantime, the Total Value Locked (TVL) of the network has reached an all-time high, indicating increased activity within the ecosystem. This further reinforces a positive outlook, as its daily trading volume has spiked 7% to $259 million. Technically, if the XLM bulls break out of the resistance zone above $0.25, a potential upside towards $0.29 would be plausible.

XLM DeFi TVL Hits Record Highs

According to statistics provided by crypto intelligence tracker DefiLlama, XLM has reached a new all-time high (ATH) of TVL, standing at $167.14 million, marking a slight 0.91% surge. This rise in TVL means that the ecosystem is becoming more active and popular. In other words, more users are allocating resources to protocols built on XLM, which can be compared to the price action of XLM.

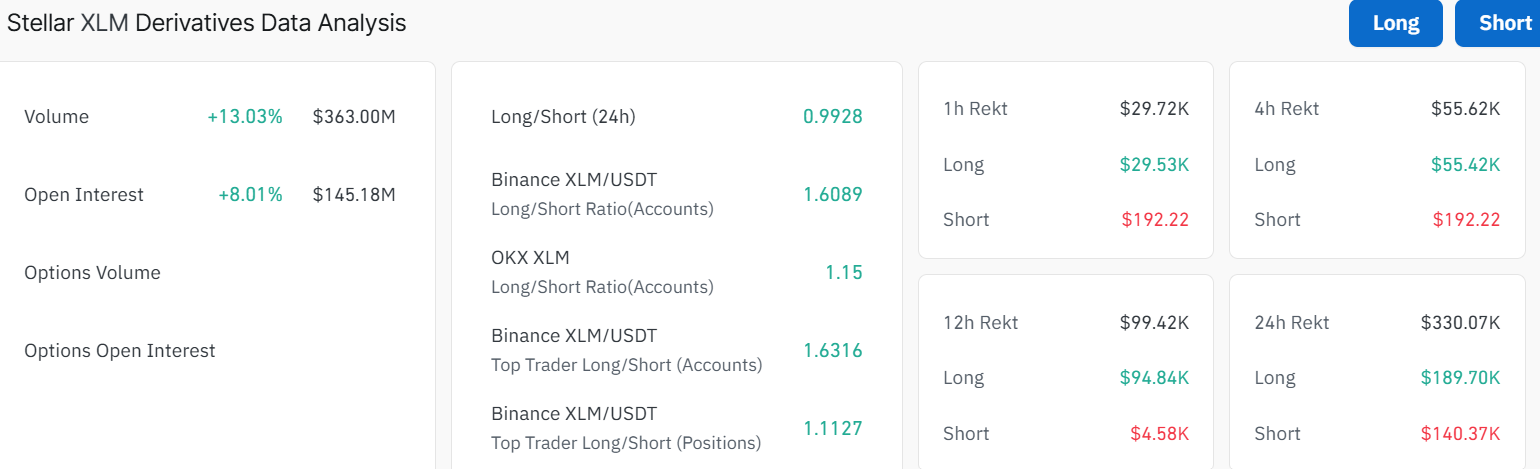

On the other hand, the trading volume and the open interest of the Stellar derivatives market have shown phenomenal growth. The price volume of XLM has surged by 13% to $363 million, and the open interest has improved by 8% to 145.18 million.

This growth is a positive sign of market sentiment and ongoing confidence in XLM assets. As the market on the derivatives side of the Stellar marketplace continues to gain momentum, the risk/reward ratio is something that investors are taking into greater consideration. The long/short ratio currently stands at 0.9928, indicating a balanced market.

Stellar Price Poised for a Rally to $0.29 Resistance

Turning to the technical analysis for XLM, the price is currently sitting just below a significant resistance level of approximately $0.29 (50-day SMA) on the daily chart. This level has acted as a hurdle in previous rallies and is a key target for bulls. Notably, the 200-SMA at $0.33 acts as the major hurdle for the bulls.

Stellar price has been trading well within a falling parallel channel, as the bulls attempt to make a recovery. The Relative Strength Index (RSI) is at 41.63, showing weak bullish momentum as it sits below 50. However, there is still room for the price to keep rising.

The MACD, however, supports a bullish view, as the MACD line is above the signal line and the histogram displays green bars. This prompts traders to buy more XLM tokens, which may soon drive the Stellar price towards the $0.29 resistance mark.

Key support levels to watch sit around $0.23 in case the bears take control. On the upside, the next resistance lies near $0.29, coinciding with the 50-day SMA, with a further hurdle around $0.33, where traders may take profits. Overall, Stellar’s price appears to be on a strong upward path, driven by growing DeFi TVL and a positive outlook for the derivatives market. If the Stellar price rises above $0.29, it could open the way toward gains of around $0.33.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.