Highlights:

- The Stellar price is still below the $0.160 mark, currently trading at $0.156.

- The derivatives market shows a drop in open interest, indicating a decline in investor involvement.

- The technical outlook shows XLM could drop to $0.136 lows if the bearish trend persists.

At the time of writing on Wednesday, Stellar (XLM) is below the level of $0.160, at $0.1569, as the bulls attempt a short-term rebound. The slight bullish price movement is justified by the increasing trading volume, which is up 7% to $125 million. Further, the technical analysis indicates that XLM could drop to recent lows as selling appetite surges.

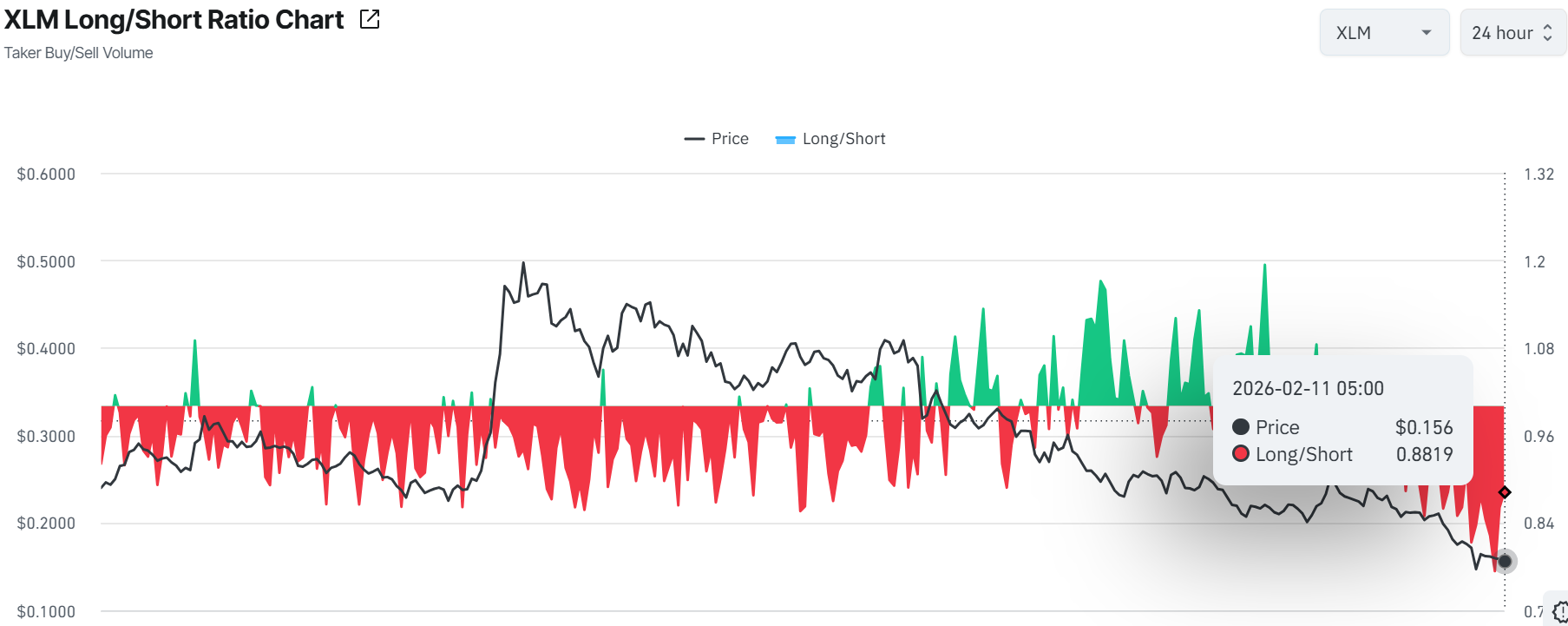

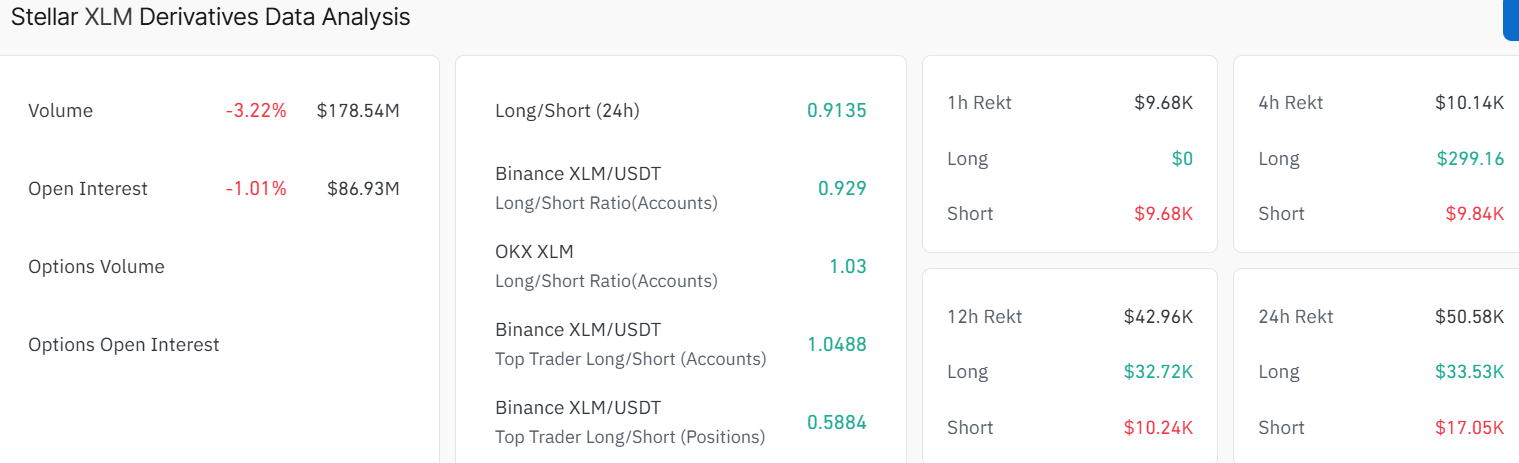

Meanwhile, the Stellar derivatives information favors the bearish position. The long-to-short ratio of XLM is at 0.88 on Wednesday, the lowest in more than a month. This ratio is less than one, which shows the bearish attitude on the market since more traders are placing their bets on the decrease of the price of XLM.

Moreover, the futures Open Interest (OI) of XLM has plummeted to $86.93 million on Wednesday. It has been gradually declining since the January 6 peak of $166.99 million. This decrease in OI demonstrates a decline in investor involvement and sends the signal of a negative perspective.

XLM Price Could Drop to $0.136 Lows as the Bearish Grip Builds

The XLM/USD 1-day chart shows Stellar is currently bearish. The 200-day Simple Moving Average (SMA) at $0.30 has turned into a resistance wall, with XLM bouncing off it several times. Meanwhile, the 50-day SMA at $0.20 is also acting as a shaky resistance level, having been breached several times.

There is also a bearish falling channel, which is a classic sign of intense selling pressure, as investors are bracing for impact. Diving into the indicators, the Relative Strength Index (RSI) at 30.92 is flirting with oversold territory, hinting that selling pressure might cool off soon. However, if it dips below 30, there could be a quick bearish surge that could send the XLM price to $0.14-$0.13 before a bounce-back rally.

In the short term, Stellar’s price may test the $0.145 support level if the bears continue their campaign. A break below the current immediate support level could drag it to the recent low of $0.136, where bargain hunters might swoop in.

However, if bulls reclaim the $0.18 resistance, reinforced by the rising trading volume, the XLM price could see a rebound toward $0.20. This is especially true if market sentiment flips, and the entire market turns green again. In such a case, the $0.20-$0.30 zone will be a key point to watch. If buyers hold it, Stellar will be back in a bullish trend.

Meanwhile, the recent dip, potentially facilitated by Bitcoin’s decline, may be a short-term correction, with the potential to recover to $0.20 if the crypto market regains momentum. For now, traders should be cautious despite the slight surge in trading volume, as the technical outlook shows intense selling appetite.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.