Highlights:

- Standard Chartered warns crypto prices may drop more due to delayed Fed rate cuts and weak demand.

- The Bank highlights that Bitcoin faces extra selling pressure as ETF holdings shrink and many investors sit on losses.

- It lowers its 2026 Bitcoin price target from $150,000 down to $100,000 amid growing uncertainty.

Bitcoin is going through a rough period, and Standard Chartered says prices could drop more soon. Geoff Kendrick, the bank’s head of digital asset research, noted that investor appetite is weakening while rising economic pressures are weighing on the market. In a note reported by Bloomberg, he highlighted slowing U.S. economic momentum and reduced expectations for Federal Reserve rate cuts, which are undermining market confidence. At the same time, declining ETF holdings are removing a key source of demand.

According to Bloomberg, Standard Chartered has lowered its 2026 Bitcoin price target to $100,000, citing heightened global macroeconomic risks and slowing demand for corporate Bitcoin treasury reserves. While the bank maintains its long-term vision of $500,000 by 2030, it…

— Wu Blockchain (@WuBlockchain) February 12, 2026

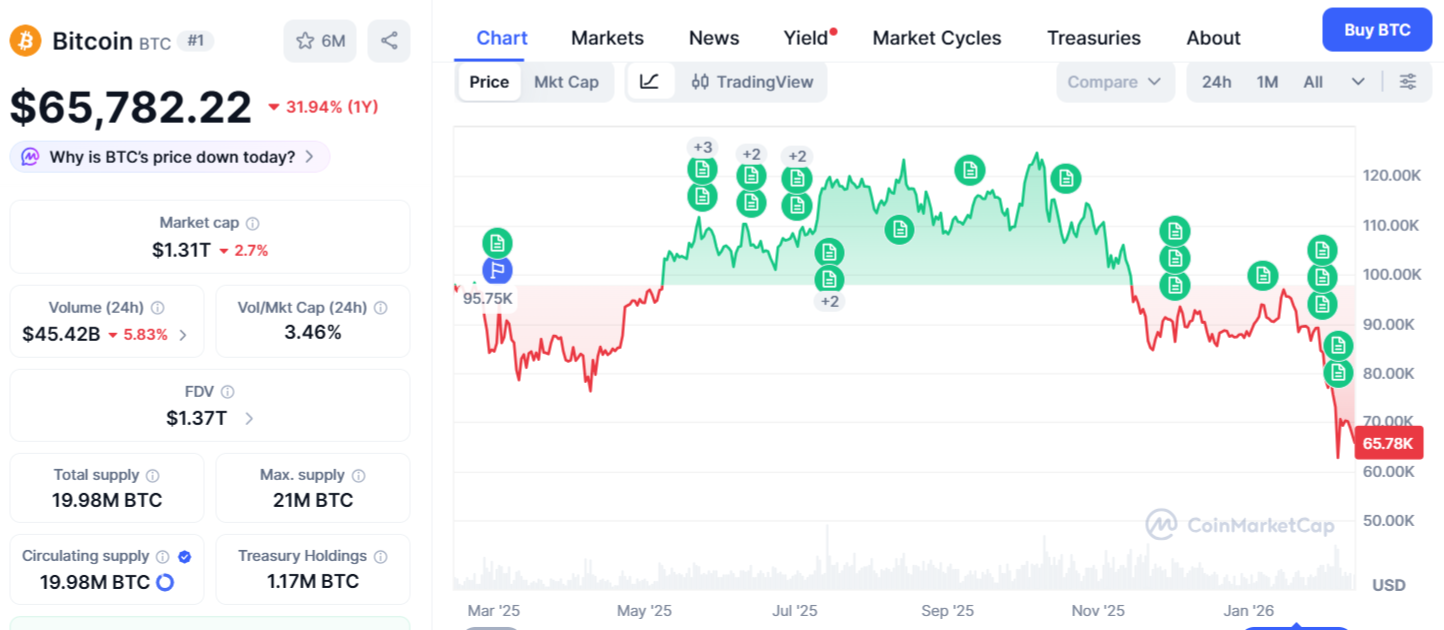

Standard Chartered has cut its year-end outlook for Bitcoin. The bank reduced its 2026 price target from $150,000 to $100,000. Kendrick also warned that Bitcoin could fall further, possibly down to about $50,000. Ethereum is also under pressure. Kendrick warned that it may drop close to $1,400 before it starts to recover later this year. Right now, Bitcoin is trading near $65,782, reflecting a 3% decrease in the past 24 hours.

ETF Outflows Raise Concerns as Selling Pressure Grows

ETF flows are becoming a bigger worry for the market. Standard Chartered estimates that Bitcoin ETF holdings have fallen by about 100,000 BTC since their peak in October. Since many of these investors bought near $90,000, they are now holding unrealized losses. Because of this, Kendrick said more selling could happen, which may push prices down in the short term. On top of that, demand from corporate treasuries has weakened. So now, ETF inflows are one of the main forces moving the market.

Fed Uncertainty and Rate Delays Weigh on Investor Confidence

Meanwhile, interest rate conditions are not helping. Investors have delayed expectations for Federal Reserve rate cuts and now think the first cut may come later this year. Kendrick also said uncertainty about future Fed leadership is making investors more careful. As a result, confidence has dropped, and this shift in mood has weighed on crypto prices.

Bitcoin has already gone through a strong correction. At its lowest close on February 5, the price was down almost 50% from its record high in October last year. Standard Chartered says only about half of Bitcoin’s total supply remains profitable. This is a sharp drop, but it is still not as bad as earlier bear markets. The bank also pointed out an important difference. This time, the decline has not caused major platform crashes like the ones seen in the 2022 cycle, such as Terra Luna and FTX. Meanwhile, on-chain activity keeps improving, and that gives some confidence to long-term investors.

Even so, the bank still has a positive view of the future. Earlier in December, it reduced its forecasts and predicted Bitcoin would reach $100,000 by the end of 2025 and $150,000 by the end of 2026. It also kept its long-range target of $500,000 for 2030. However, Bitcoin did not hit $100,000 by the end of 2025. Because of that, the latest outlook shows that the market still faces clear challenges.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.