Highlights:

- Stacks price spikes 19% to $0.90 in the past 24 hours, as trading volume soars.

- Stacks technical indicators signal a slight retracement to sweep through liquidity.

- Stacks open interest and volume spike 39% and 97% respectively, indicating surging investor confidence in the token.

The Stacks price has spiked 19% to trade at the $0.90 mark, as the bulls show immense strength in the market. Accompanying the upward trajectory in the market is its daily trading volume, which has rallied over 117%, indicating intense market activity. With the strong upward trend, can the Stacks bulls break through $1?

What’s Driving Stacks’ Price Surge?

Despite Bitcoin side chains not being a new idea, Stacks and other chains in the ecosystem have observed impressive performances recently. The underlying diagnostics all point to an accumulation dominance increase outpacing broader bullishness across the rest of the crypto market. STX price has bottomed out from its lows at $0.47, up about 80% to $0.90.

liquidity in the stacks defi ecosystem is accelerating:

– 3k sbtc already on stacks – on track to become the #1 bitcoin l2 by btc supply

– stablecoin market cap surged 400% in q1, crossing $12M+

– new tvl record for stx being liquid stacked unlocking more stx capital pic.twitter.com/0mj3CWL9I4— stacks.btc (@Stacks) April 24, 2025

According to the Stacks team, intense investor interest in Defi products and other key factors have caused the recent surge in Stacks. According to the team’s highlight via X, Stacks’ stablecoin market cap has soared about 437%, positioning STX among the top 3 with $5.93M. Other leading coins with soaring stablecoin market caps include Morph and Cronos, with about 756% and 686%, respectively.

Following the recent launch of the Grayscale STX Trust fund, and crypto exchanges such as Crypto.com offering stacking for STX, it builds investor confidence in the market. These recent developments position Stacks among the fast-growing tokens that could soon spark a rally in the market.

institutions recognize that stacks is the leading bitcoin l2:

– jump, utxo, snz, and others invested in sbtc

– grayscale launched the stx trust fund

– exchanges like crypto(.)com offer stx stacking

– enterprise-grade validators with billions in aum support stacks as signers pic.twitter.com/K5v0MZDui3— stacks.btc (@Stacks) April 23, 2025

Stacks Derivative Market and Market Outlook

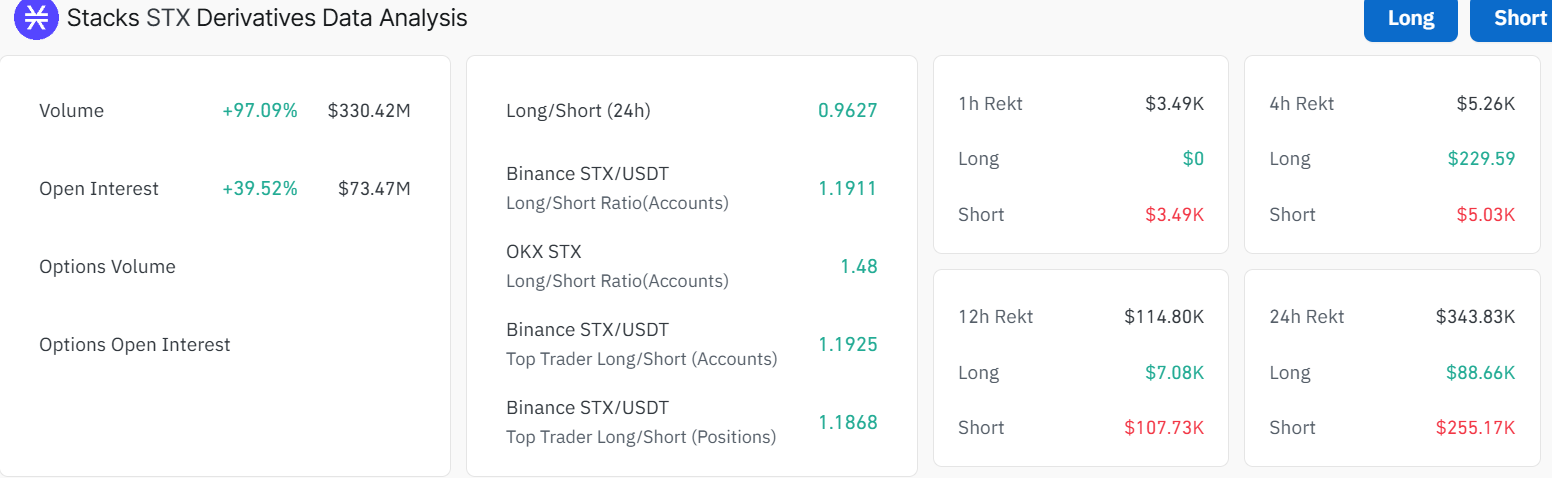

The Stacks derivatives data analysis indicates intense trading activities, signaling potential future growth. Stacks Open interest (OI) has increased by 39% to $73.47m in the last 24 hours, indicating a strong bullish outlook. The surge in volume by 97.09%, making it around $330.42 million, could well show an uptick in the market’s activity and the trader’s confidence in the token.

Stacks is trying to hold on to $0.90 firm at press time, with bulls showing immense strength, breaking out of an ascending parallel channel. The Relative Strength Index has, however, hit the 70-overbought territory, at 73.89. However, STX’s potential to rise above the next critical resistance of $1.00 is still grounded upon this bullish outlook and increasing trading volume.

As the crypto market as a whole displays a bullish picture, if the Bitcoin price continues with the upward movement above the $94K, other altcoins, including Stacks, could keep dominating the bullish sentiment. Although the STX price looks quite overbought, the uptrend may end and lead to a reversal before the weekend starts.

Therefore, in the event of a bigger retracement, traders may look to support at $0.75, which may act as a safety net. If earlier profiteering commences, a deeper correction will cause the Stacks price to drop toward the $0.64 support area, which aligns with the 50-day MA.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.