Highlights:

- The stablecoin market has recorded significant declines with possible crypto market implications.

- Santiment noted that the new trend suggests that investors are pushing their funds to safer assets.

- Altcoins seem to suffer more serious negative impacts from the stablecoin market downturn.

On-chain cryptocurrency analytics firm Santiment reported that the stablecoin market saw significant declines over the past ten days. According to the platform’s X post on January 26, the total value of the top 12 stablecoins dropped by $2.24 billion. At the same time, Bitcoin’s (BTC) price declined by about 8%. Santiment noted that when scenarios like this play out, it often tells a deeper story about investors’ behaviour.

🚨 NOW: Stablecoin market cap drops $2.24B in 10 days as capital rotates into gold and silver, per Santiment. pic.twitter.com/sz3WhVPgCe

— Rex (@Rexmetax) January 27, 2026

Safer Assets Attract Investors’ Interest

Gold and Silver have seen remarkable price spikes that coincided with declines in the cryptocurrency and stablecoin markets. For context, Google Finance’s data showed that Gold is priced at approximately $5,100 after a 7.66% upswing in the past five days. Within the same period, Silver climbed to about $107.91, following a 14.67% spike. Santiment stated that this current trend suggests many investors are moving away from risky assets to safer options.

The analytics firm stated:

“When uncertainty rises, money often flows into assets that are seen as stores of value during economic stress, rather than volatile markets like crypto.”

Another deduction from the market declines is that money is leaving crypto entirely. During market downturns, traders sell Bitcoin or altcoins and convert the proceeds to stablecoins. However, it was not the case this time as the stablecoin market also experienced significant declines, which shows that investors are exploring other non-crypto options.

Santiment explained:

“A falling stablecoin market cap shows that many investors are cashing out to fiat instead of preparing to buy dips.”

📉 The combined marketcap of the top 12 stablecoins in crypto has declined by $2.24B in the past 10 days alone. This drop has coincided with a -8% drop in Bitcoin's price. A few things to interpret from this:

🥇🥈 Capital is rotating into traditional safe havens like gold and… pic.twitter.com/jfk1NSGygA

— Santiment (@santimentfeed) January 26, 2026

Altcoins to Suffer More Negative Impacts from the Stablecoin Market Declines

In its X post, Santiment noted that when available money in the market drops significantly, altcoins usually take the hardest hit, while Bitcoin tends to perform better. History shows that the crypto market usually starts recovering once the stablecoin supply stabilizes. “That would signal fresh capital entering the ecosystem and renewed confidence from investors,” Santiment added.

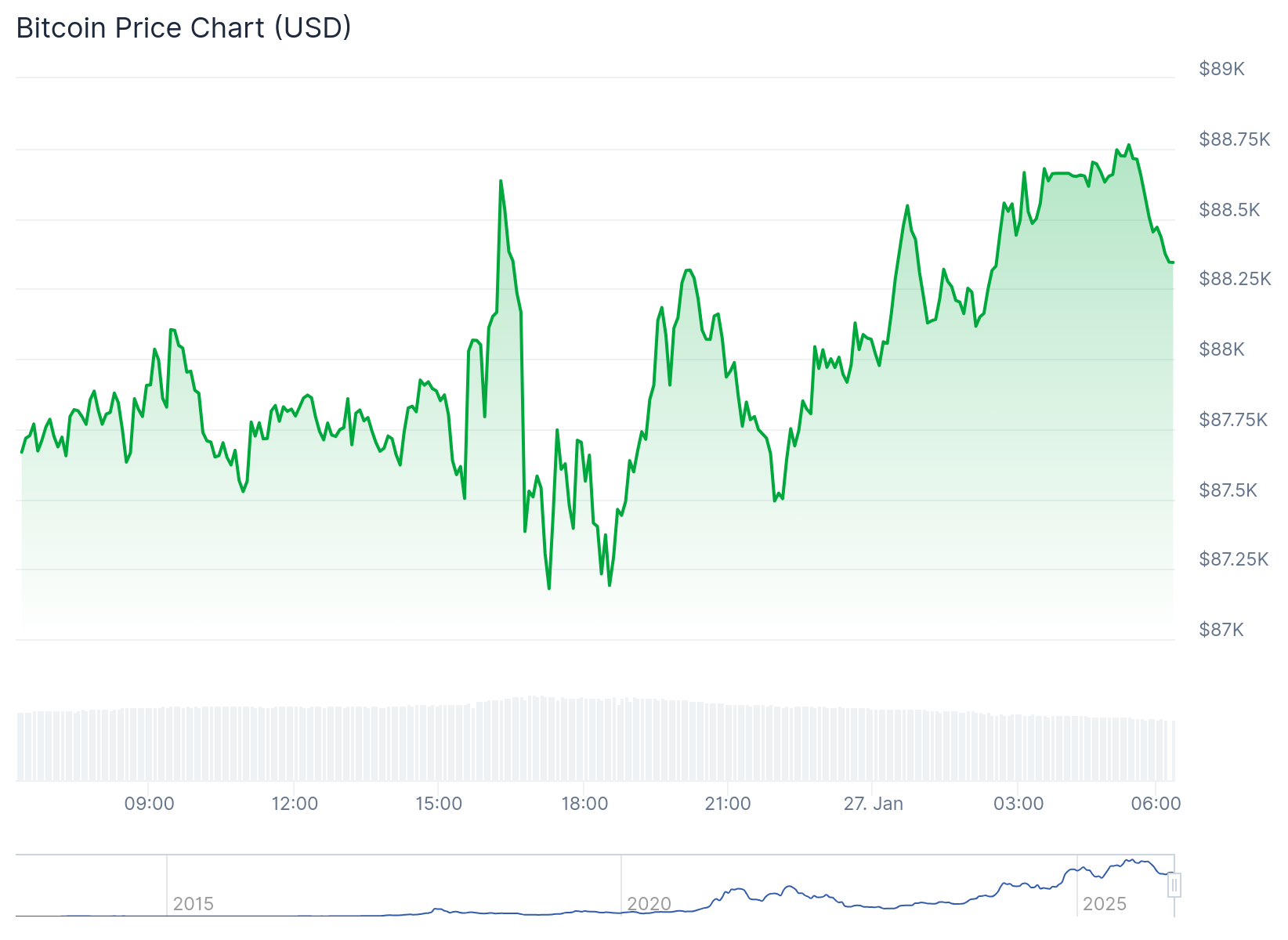

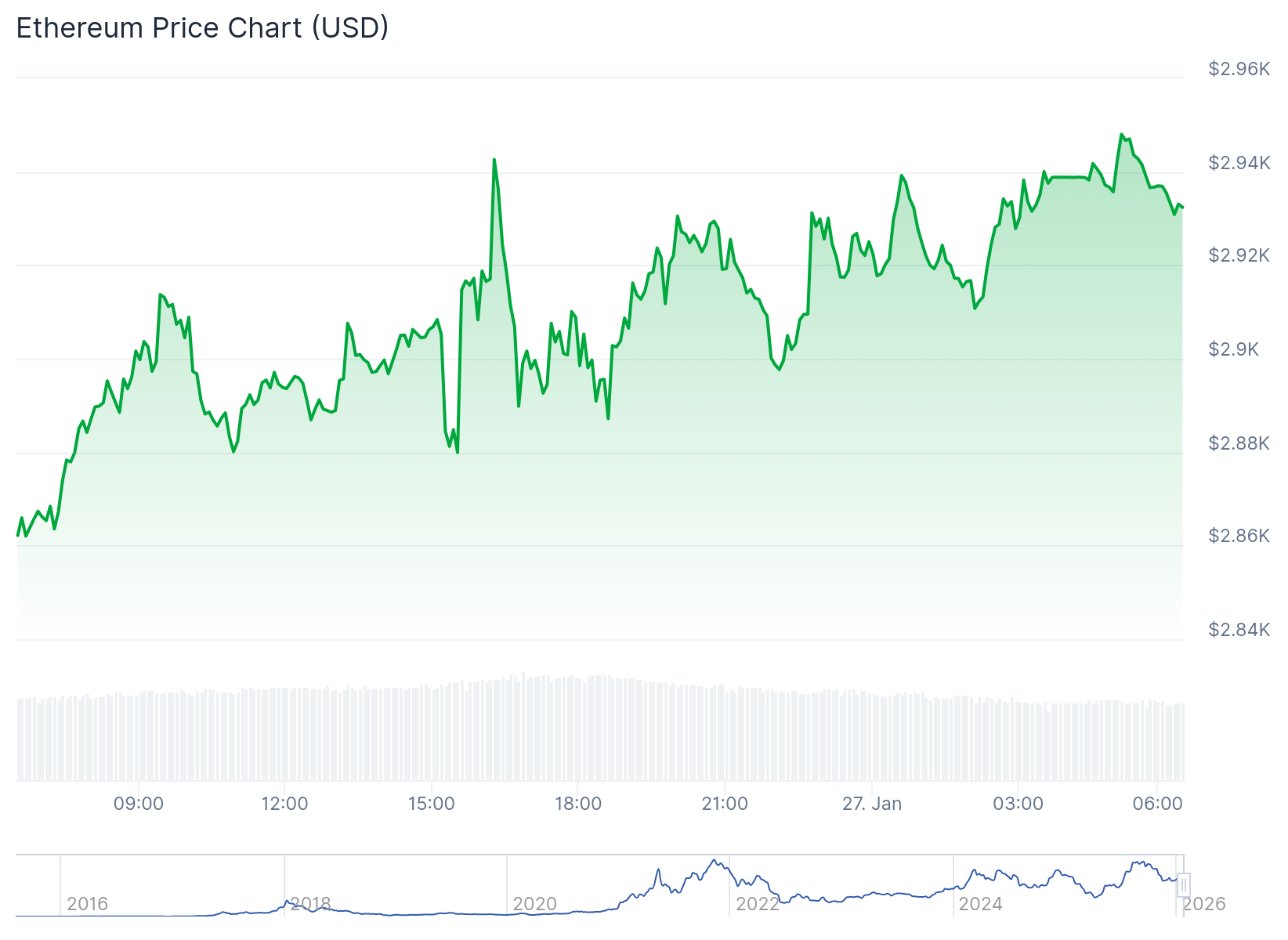

At the time of press, the cryptocurrency market has surged 0.9% in the past 24 hours, with a market cap of $3.074 trillion and a trading volume of $118.268 billion. BTC maintains a dominance of 57.4%, while Ethereum sits at 11.5%. On its part, Bitcoin is up 0.8% and changing hands at approximately $88,310. It has a market cap of roughly $1.76 trillion and a trading volume of $43.64 billion.

On January 26, Japan’s Bitcoin investment firm, Metaplanet, reported that it lost about $680 to $700 million on its BTC holdings. This is a non-operating loss, which suggests that daily operations and cash flow were intact. The Japanese firm is expecting an ordinary loss of about $632 million and a net loss of $491 million for fiscal 2025.

Despite BTC’s price declines, Strategy announced yet another purchase on January 26. The American-based company acquired 2,932 BTC for $264.1 million between January 20 and January 25, 2025. The company now holds 712,647 BTC worth $54.19 billion at an average cost of $76,037 per token. Unlike Bitcoin, Ethereum is up 2.5% in the past 24 hours, trading at $2,932 with a market cap of $353.9 billion and a trading volume of $27.6 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.