Highlights:

- Ethereum ETFs initially saw strong inflows but faced significant outflows on day two.

- Grayscale’s ETHE alone experienced $327 million in outflows, reducing its AUM to $8.3 billion.

- Despite the higher trading volume on the second day, Ethereum’s price dropped by 8.27%.

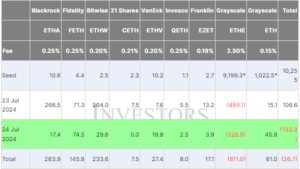

The nine US-based spot Ether exchange-traded funds (ETFs) have seen a significant decline in net inflows after a strong start with almost $107 million. According to Farside data, investors withdrew about $133 million from these products on July 24, their second day of trading.

The Grayscale Ether Trust (ETHE) recorded $326.86 million in net outflows — the only one logging outflows among the ETH ETF. In contrast, the Grayscale Ethereum Mini Trust (ETH), a spinoff of Grayscale’s ETHE, saw around $46 million in inflows. It is one of the lowest-cost spot Ethereum products in the US market.

The Fidelity Ethereum Fund (FETH) and the Bitwise Ethereum ETF (BITW) topped the list with the largest net inflows, reporting $74.5 million and $29.6 million, respectively. BlackRock’s iShares Ethereum Trust (ETHA), which saw the highest inflows of $266.5 million on July 23, attracted just $17.4 million on July 24. VanEck’s Ethereum ETF (ETHV) reported $20 million in inflows. Franklin’s EZET and Invesco/Galaxy’s QETH also saw gains. Meanwhile, 21Shares’s Core Ethereum ETF (CETH) recorded no inflows.

Ethereum ETFs’ Strong Start Offsets ETHE’s Debut Outflows

On the first day of trading, ETHA led with over $266 million in inflows. ETHA’s strong performance and additional inflows from seven other Ethereum ETFs helped counterbalance significant outflows from Grayscale’s Ethereum ETF (ETHE) on its debut. The nine funds logged about $107 million in net inflows on July 23.

However, this balance shifted on the second day. Grayscale’s ETHE faced nearly $327 million in outflows, bringing the total to $811 million since the fund’s conversion. After the second trading day, ETHE’s assets under management dropped to $8.3 billion, down from $9 billion before the launch of spot Ethereum ETFs.

Launched by Grayscale in 2017, ETHE allowed institutional investors to purchase ETH with a six-month lock-up period on investments. Since the switch to Spot Ether Fund on July 22, investors have been able to sell their ETH more easily.

Spot Ethereum ETFs Trade $951 Million on Second Day

According to data, the spot Ether ETFs generated approximately $951 million in cumulative trading volume on Wednesday. They traded $1.06 billion on their first day, Tuesday. ETHE again led with around $492 million, making up about 52% of the total volume. BlackRock’s ETHA followed with $256 million, while the Fidelity Ethereum Fund (FETH) recorded $113 million.

Despite the influx of ETF investments, Ethereum’s price is under downward pressure. Some analysts attribute recent declines to broader market dynamics and traders’ profit-taking.

ETH Down Over 8% as ETHE Outflows Ramp Up

Following the substantial net outflows from Ethereum ETFs, the price of Ethereum dropped by 8.27% in the past 24 hours. As of writing, the second-largest cryptocurrency is trading at $3,174.

ETH’s market cap is currently around $381 billion, with a daily trading volume of $21.9 billion. The decline aligns with Kaiko analyst Will Cai’s prediction that ETH’s price could be highly “sensitive” to inflows after the ETF launches.

ETH Price Poised for Volatility with ETF Inflows

Kaiko warns ETH's price could be highly "sensitive" to ETF inflows.

Despite last year’s lukewarm response to ETH futures ETFs, anticipation is high for spot ETFs.

Kaiko’s Will Cai points to Grayscale’s Ethereum Trust outflows as… pic.twitter.com/rMemmwIIFt

— Crypto Town Hall (@Crypto_TownHall) July 23, 2024

It’s important to note that the broader crypto market is also in a bearish phase. According to CoinMarketCap, the global cryptocurrency market capitalization dropped by 4.16% in the past day, now standing at $2.31 trillion.